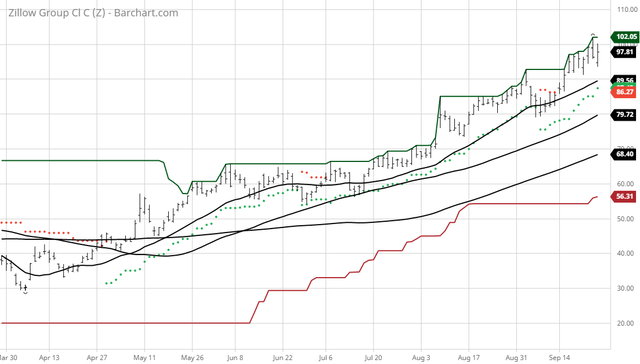

Zillow Group - Chart Of The Day

Summary

- 100% technical buy signals.

- 11 new highs and up 17.68% in the last month.

- 234.97% gain in the last year.

The Barchart Chart of the Day belongs to the Real Estate services company Zillow Group (Nasdaq: Z). I found the stock by using Barchart's powerful screening tools to find the stock with both the highest technical buy signals and highest Weighted Alpha, then sorted the list by the most frequent number of new highs in the last month. Next, I used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 9/14 the stock gained 12.30%.

Zillow Group, Inc. offers real estate and home-related brands on mobile and web. The company's brands focus on home lifecycle consists of renting, buying, selling, financing, and home improvement. Its real estate and rental marketplaces of consumer brands includes Zillow, Trulia, StreetEasy, and HotPads. The company also works with real estate agents, lenders, and rental professionals. Its business brands for real estate, rental, and mortgage professionals, including Postlets, Mortech, Diverse Solutions, Market Leader, and Retsly. Zillow Group, Inc. is headquartered in Seattle.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart technical indicators:

- 100% technical buy signals

- 192.10+ Weighted Alpha

- 234.97% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 11 new highs and up 17.68% in the last month

- Relative Strength Index 69.98%

- Technical support level at 94.12

- Recently traded 97.75 with a 50 day moving average of 79.73

Fundamental factors:

- Market Cap $21.86 billion

- Revenue expected to grow 15.60% this year and another 45.40% next year

- Earnings estimated to increase 25.90% this year and an additional 77.50% next year

- Wall Street analysts issued 1 strong buy and 3 hold recommendations on the stock

- The individual investors following the stock on Motley Fool voted 199 to 10 that the stock will beat the market

- 37,330 investors are monitoring the stock on Seeking Alpha

Disclosure: None.