Yin And Yang; Russell 2000 Manages Small Gain

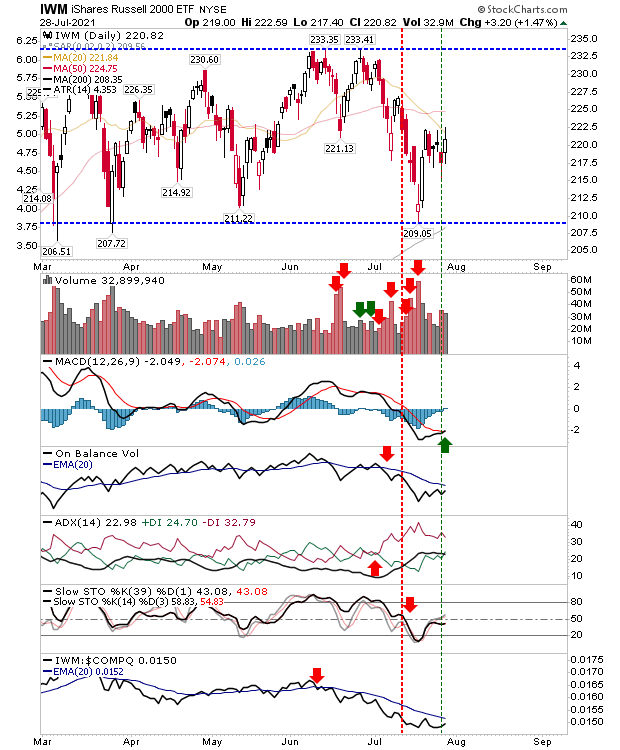

The Russell 2000 was one of the better performing indices on the day, but it didn't change the larger picture of an index caught in a trading range. Today's gain was enough to see a new 'buy' trigger in the MACD as it closed on its 20-day MA. However, until it makes its way back to trading range resistance it's hard to be optimistic - or pessimistic - as to its potential outcome. Near-term traders could trade from here for a move to channel resistance, but the whipsaw risk is high because of the trading range.

The Nasdaq recovered some of its losses as it made it bounced off its 20-day MA. The rally is a mix of bullish technicals for On-Balance-Volume, and a bearish one for the MACD. However, while it's easy to be pessimistic we have yet to see concerted selling in the index. The index continues to outperform the Russell 2000.

The S&P finished with a small, indecisive doji above all lead-moving averages. Technicals are bullish, although trading volume over the last couple of days has ranked as confirmed distribution. The trend remains positive, so, until this changes (with an undercut of an earlier swing low), this can be considered bullish.

Indices remain unchanged on prior action; the Russell 2000 still has to catch up, while the S&P and Nasdaq maintain their rallies.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more