Yesterday's Gains Reversed For S&P And Nasdaq, As Russell 2000 Gains

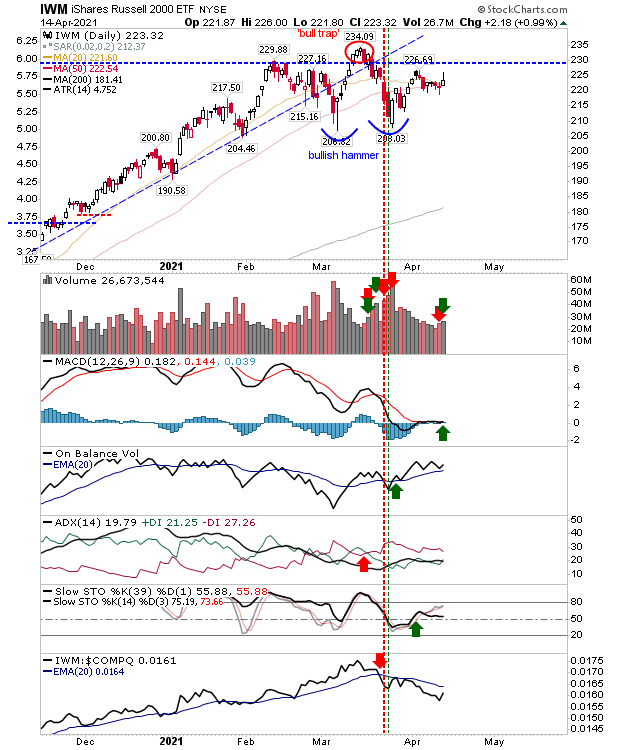

The headlines may have made it look worse than it was for the S&P and Nasdaq, but the gain in the Russell 2000 was important after a week of indecisive action. Volume climbed to register an accumulation day for the Russell 2000, along with a new MACD trigger 'buy' in support of the earlier 'buy' signals in Stochastics and On-Balance-Volume.

The Nasdaq gave up nearly a percentage point, but it remains well above its breakout level. It also continues to outperform relative to the Russell 2000.

The S&P didn't give up as much ground and it remains well ahead of the last peak (resistance). Technicals are in good shape. The index is 14.7% above it 200-day MA, which keeps it in the 5% zone of historic extremes and at a place where a top may emerge.

Look for the Russell 2000 to push its advantage as it looks to reassert its leadership role. It will be important for the S&P and Nasdaq to hold their existing gains so as to prevent unwanted profit taking.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary basis ...

more