Workday's Q1 Print Strengthens The Long-Term Thesis, Says Bullish Bank Of America

Workday Inc (WDAY) reported robust first-quarter results Tuesday, beating Street expectations on almost all fronts. Despite this, the stock traded down after hours, mainly due to concerns around net new annual contract values being backend-loaded, according to Bank of America Merrill Lynch.

This seems to be a “non-issue,” as subs billings growth is expected to be broadly in-line with subs revenue growth in 2020.

The Analyst

Kash Rangan reiterated a Buy rating on Workday and raised the price target from $234 to $260.

The Thesis

Workday reported quarterly billings growth of 42 percent year-on-year, beating the consensus estimate of 33 percent, while bookings growth came in at 46 percent, Rangan said in a Tuesday note. (See his track record here.)

BofA estimates 2020 subs billings growth of 29 percent year-on-year and subs revenue growth of 28 percent. There is no cause for concern, the analyst said.

While the total addressable market for human capital management could expand from $12-14 billion to $26 billion, Workday’s HCM revenue suggests merely 8-10-percent penetration, Rangan said, adding the company has a long runway.

Workday added larger HCM customers toward the end of 2017, and these will be coming up for renewal, Rangan said.

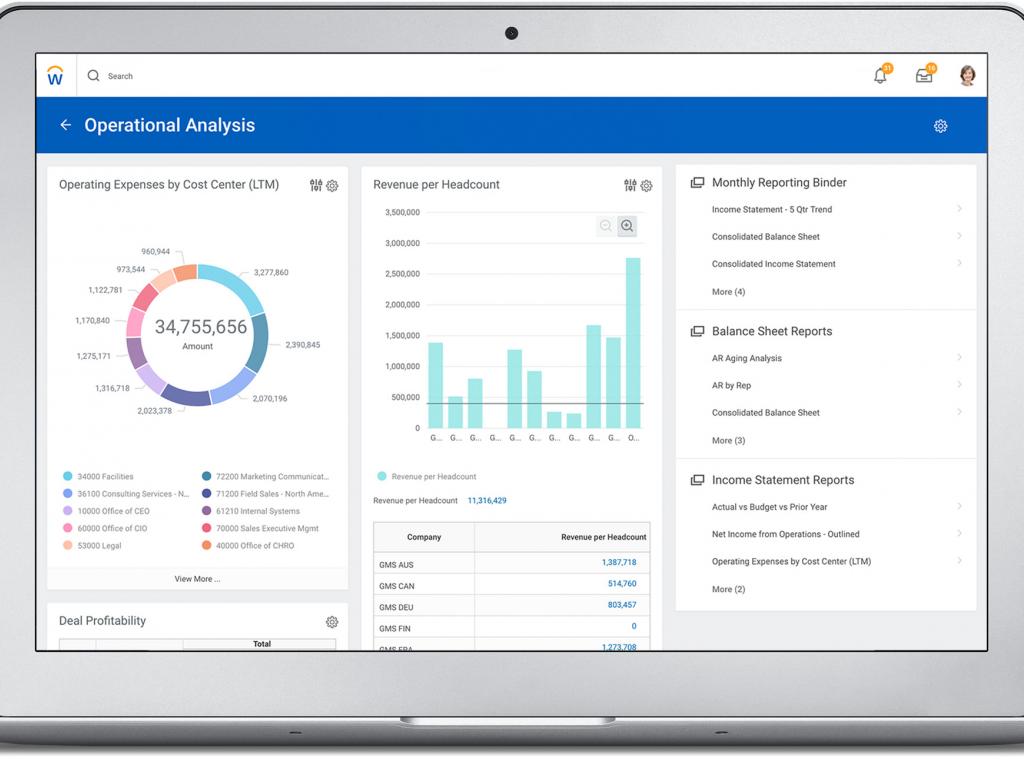

This creates an upselling opportunity not just for HCM modules, but also for planning, analytics, and financials, enabling the company to sustain 30-percent growth in the near term, the analyst said.

The long-term thesis for Workday has strengthened in light of its first-quarter report, he said.

This was the first full quarter of Workday’s sales team driving Adaptive’s planning solution, and there is strong adoption, Rangan said. Net new ACVs in financials could continue to grow at a 50-percent-plus rate, driven by strength in HCM and planning, he said.

Price Action

Workday shares were down more than 5 percent at $202.09 at the time of publication Wednesday.