Wix Stock Down 20%: Buying Opportunity

Wix (WIX) is in the right place at the right time. The company has a proven track record of execution, generating consistent performance over the long term. Demand is now accelerating due to the pandemic, and Wix is aggressively investing in marketing and advertising to consolidate its market position and to build the foundations for sustained growth in the future.

These investments are taking a toll on accounting profits, but they are generating solid results and positioning the company for strong growth in the years ahead. The market seems to be skeptical, though, and Wix stock is down by nearly 20% from its highs of the year after the earnings report.

Prioritizing future growth above short-term earnings is exactly what management needs to do at this stage, and the fact that the market is being fearful and short-sighted could be creating a buying opportunity for long-term investors in Wix stock.

Wix Is Firing On All Cylinders

Having a strong online presence is crucially important for businesses of all sizes. This trend has been well in place for a long time, and it is now accelerating due to the pandemic.

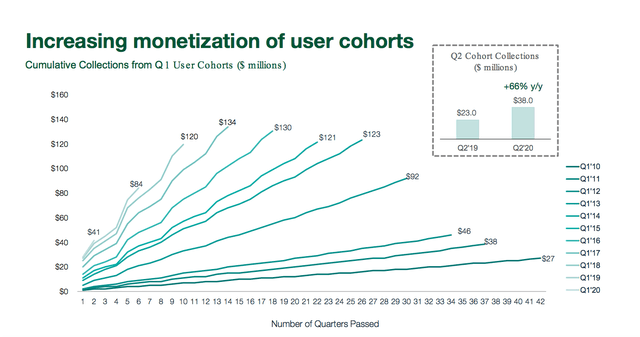

Wix offers a cloud-based set of solutions for companies to build their websites in a simple and cost-efficient way. The company has a freemium business model that drives monetization of user cohorts for many years after they are created. Acquiring large cohorts of users and monetizing them at higher levels with more and better products over the long term is a powerful growth strategy for Wix.

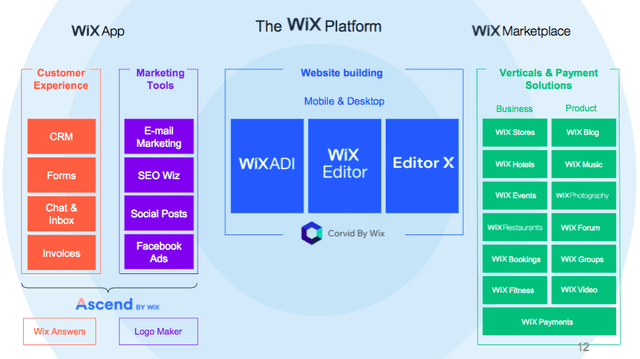

Around websites, Wix is building new growth engines in areas such as CRM, marketing, and payments. In June of this year, the company launched its new e-commerce capabilities, increasing its presence in a huge market with massive long-term potential.

Source: Wix

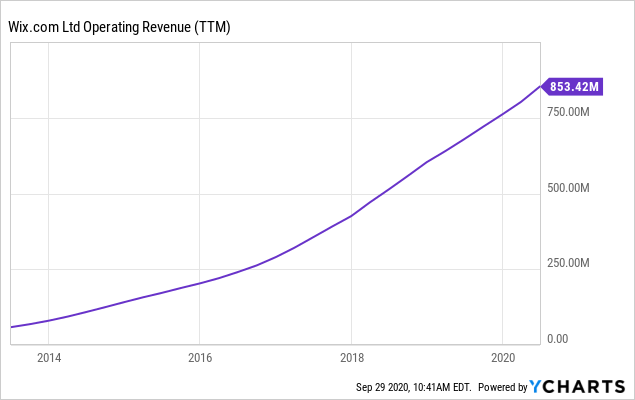

Well before the pandemic started, Wix was consistently growing at a strong rate. There was an acceleration in growth in the second quarter of 2020, but it is not like this is a transitory phenomenon due to the pandemic. Wix was already doing very well, and growth accelerated a few percentage points in the second quarter of 2020.

Data by YCharts

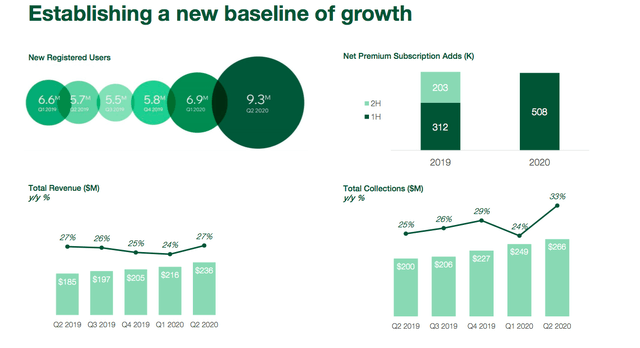

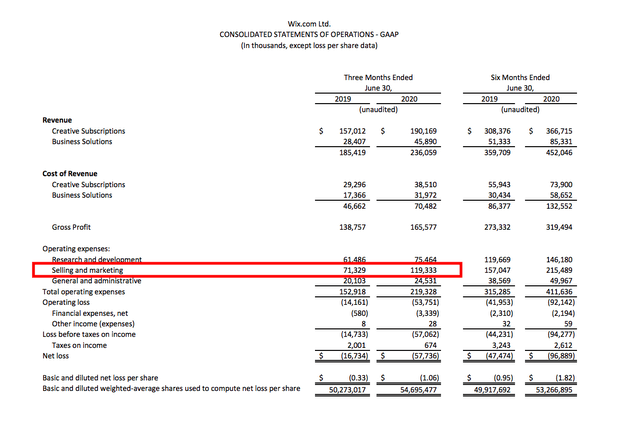

Revenue grew 27% during the second quarter. Creative Subscriptions revenue was $190.2 million in the period, an increase of 21%. Creative Subscriptions ARR was $790.9 million, an increase of 22%. Business Solutions revenue reached $45.9 million during the quarter, growing 62% year over year.

Source: Wix

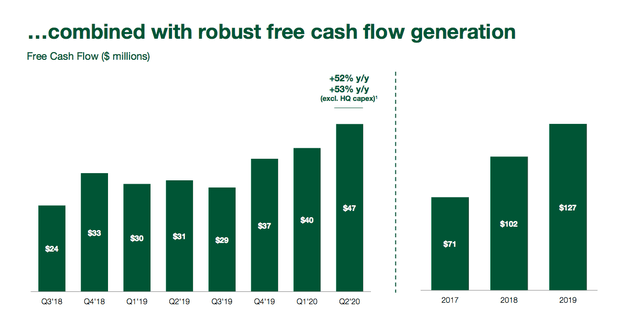

Free cash flow is evolving well, which is a major positive in terms of evaluating the company from a financial soundness perspective.

Source: Wix

On the other hand, sales and marketing investments grew by a staggering 67% year over year, reaching $119 million. Mostly because of this rapid increase in sales and marketing, the company reported an operating loss of $53.7 million during the quarter.

Source: SEC filings

Seeing The Big Picture

Wall Street is generally too short-sighted, the market is typically expecting an expansion in profit margins for a company that is growing rapidly and has a structurally profitable business model based on subscriptions to a good degree. This disappointment can arguably explain why Wix stock is almost 20% down from its highs of the year. However, for long-term investors, this could be creating a buying opportunity.

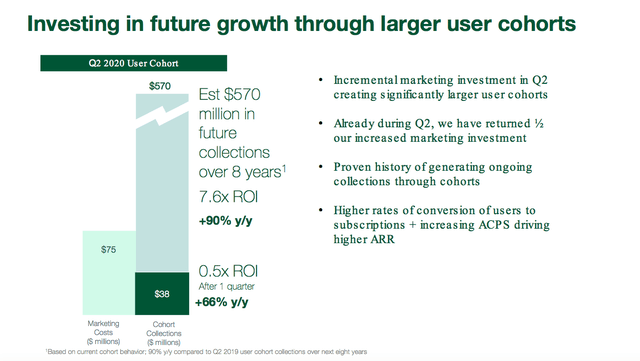

Management is seeing an increase in demand, and it is meeting this increase in demand with aggressive investing in marketing. In fact, marketing that is directly focused on the acquisition of users grew 90% year over year last quarter, reaching $75 million.

This created the largest customer cohort in the company's history with over 9.3 million users, and management calculates that based on current cohort behavior this will generate approximately $570 million in future collections over the next eight years.

Marketing efficiency is outstanding, management said during the conference call that 60% of marketing expenses that happened in Q2 have already been returned in cashback to Wix, so investments for growth are really paying off.

Source: Wix

Management also said that the newest user cohorts are monetizing at increasingly higher levels than past cohorts. A larger percentage of users are selecting higher-priced Business and eCommerce subscription packages, and the adoption of business solutions such as Ascend by Wix, Wix Payments, and paid third-party applications (TPAs) is also higher and continuing to increase. Users are also selecting longer-term packages, which reduces cancellations.

Wix has significantly increased its marketing investments, but those investments are rapidly coming back to the company via increased revenue, and Wix is better positioned than ever to monetize those new users at higher levels in the future.

The company also has over $1 billion in cash on its balance sheet and it has been generating positive free cash flows for a long time. Marketing investments are not only very profitable, but Wix can also afford these investments without jeopardizing the company's financial health.

Source: Wix

Timing and Valuation

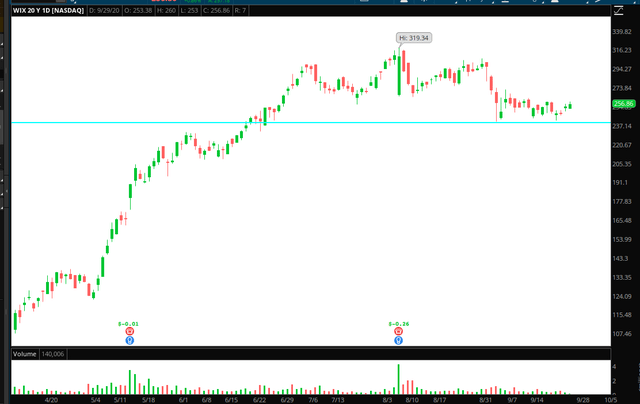

Wix stock reached new highs at almost $320 as the company was reporting earnings on August 6. Since then, the stock has pulled back by almost 20% from those levels, and now it seems to be finding support above $240.

Source: TOS

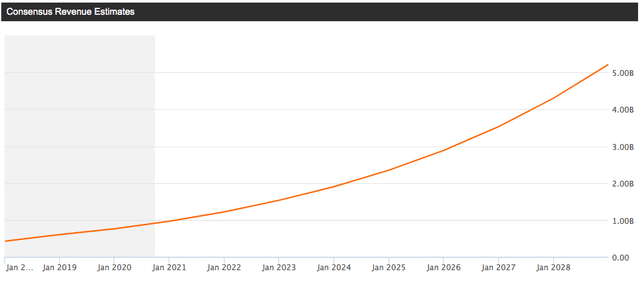

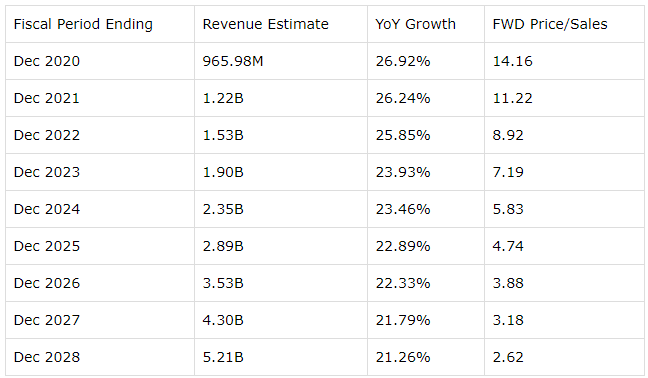

In terms of valuation, Wix is very reasonably priced by industry standards. The chart below shows revenue estimates for Wix in the years ahead. Wall Street analysts are on average expecting the company to grow from $966 million in revenue this year to $5.2 billion in 2028.

Source: Seeking Alpha

Looking at revenue estimates for each specific year and the implied price to sales ratio, Wix is trading at 11.2 times revenue estimates for 2021. This is not excessive at all for a company that can sustain revenue growth rates in the neighborhood of 25% or more over the coming years.

(Click on image to enlarge)

Source: Seeking Alpha

Wix has a compelling business model that can produce attractive growth rates over time. The company is adding more new services to premium users and driving increased monetization, while also expanding into promising areas such as e-commerce and online education. International expansion is another key growth engine for the company, as the business model should scale efficiently on the international front.

The industry is very competitive, and Wix needs to keep prices low in order to protect its market position and continue growing over time. But management has proven an ability to consistently execute, and there is no reason to expect the company to be derailed from its long-term growth trajectory as long as it keeps delivering solid products and investing as much as it needs to in sales and marketing.

The stock market has focused too much on the short-term effect of increased marketing investments on margins, but the long-term increase in growth prospects due to these investments could be far more important. From current price levels, Wix is offering attractive upside potential for long-term investors.

Disclosure: I/we have no positions in any stocks mentioned but may initiate a long position in WIX over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more