Without Acquisition, Acadia Healthcare Shares Remain Overvalued

The high-low fallacy makes certain investments appear much more attractive on the surface. When one peers below the surface, the fundamentals of the business are often revealed to be in much worse shape. For those that care about profits, the increasing losses and declining ROIC earn Acadia Healthcare (ACHC: $55/share) a spot on July’s Most Dangerous Stocks list.

GAAP Growth Masks Cash Costs of Acquisitions

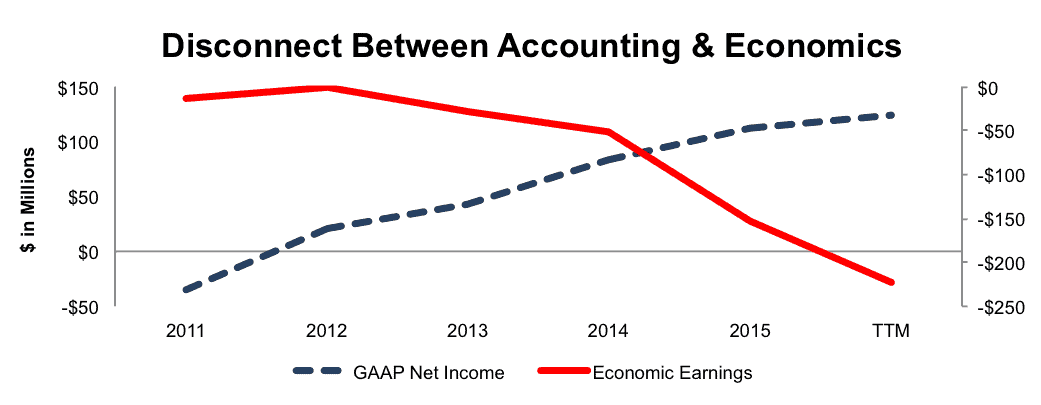

Acadia’s economic earnings, the true cash flows of the business, have declined from -$13 million in 2012 to -$223 million over the trailing twelve months. These losses come despite GAAP net income growing from -$35 million in 2011 to $124 million over the last twelve months. See Figure 1. See the reconciliation of Acadia’s GAAP net income to economic earnings here.

Figure 1: Disconnect Between Revenue and Economic Earnings

Sources: New Constructs, LLC and company filings

The acquisition approach to growth accounts for the large discrepancy between the accounting earnings and economic earnings of ACHC. Since 2011, ACHC has undergone over 25 separate acquisitions, which have cost upwards of $5.3 billion. While these acquisitions are “accretive” to EPS, they are highly dilutive to cash flows and ACHC’s balance sheet. From 2011-2015, Acadia’s debt grew 66% compounded annually to $2.3 billion. Over the last twelve months, debt has ballooned to nearly $3.8 billion, or 77% of the current market cap.

Smart acquisitions improve ROIC. ACHC’s acquisitions have not been smart. Since earning a 9% return on invested capital (ROIC) in 2012, the company’s ROIC has declined to a bottom-quintile 5% over the last twelve months. Similarly, ACHC has burned through cumulative -$3.4 billion in free cash flow from 2011-2015, and over the last twelve months, FCF sits at -$2.8 billion. No matter which way you slice it, ACHC’s acquisitions have drastically deteriorated the economics of the business.

Misaligned Executive Incentives Mean More Value Destruction To Come

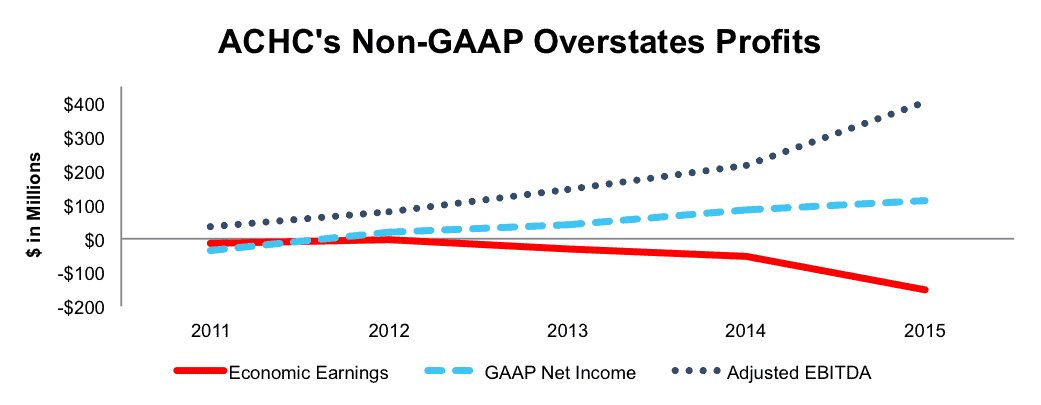

Apart from base salaries, executives at Acadia receive annual cash bonuses and long-term stock-based awards. The cash bonuses are paid out for meeting adjusted EBITDA and adjusted EPS goals. As seen in Figure 2, these two metrics paint a much rosier picture than the economics of the business and have significant costs of business removed. Additionally, stock-based awards are given based upon meeting adjusted EPS goals and also have a time based vesting requirement. At the end of the day, the metrics chosen to incent executives do very little to create true shareholder value. By removing costs such as compensation expense or acquisition costs, executives can grow the top line and adjusted metrics with little or no attention paid to the economics of their actions. The best way to create shareholder value, and align executives with the best interest of shareholders, is to tie performance bonuses to ROIC because there is a clear correlation between ROIC and shareholder value.

Misleading Adjusted EBITDA Rises While Profits Decline

While the decline in economic earnings is clear, investors following non-GAAP metrics would have a vastly different view of the firm. Companies routinely remove normal operating costs to create a more positive picture of business operations and ACHC is a poster child for the dangers of non-GAAP earnings. Here are expenses ACHC has removed when calculating its non-GAAP metrics, including adjusted EBITDA and adjusted EPS:

- Equity-based compensation expense

- Transaction expenses related to acquisition

- Sponsor management fees

- Debt extinguishment costs

- Loss/gain on foreign currency derivatives purchased in relation to acquisitions

These costs can be significant, particularly equity-based compensation expense and transaction expenses. In 2015, ACHC removed $20 million (18% of GAAP net income) in equity-based compensation expense and $36 million in transaction costs (32% of GAAP net income) to calculate its adjusted EBITDA. By removing these costs, along with the others, ACHC is able to report non-GAAP results that are much improved from economic earnings. Adjusted EBITDA grew from $215 million in 2014 to $405 million in 2015, 88% year-over year (YoY). GAAP net income grew “only” 36% YoY while economic earnings declined from -$52 million to -$153 million, or -194% YoY. This discrepancy, dating back to 2011, can be seen in Figure 2.

Figure 2: Misleading Non-GAAP Metrics

Sources: New Constructs, LLC and company filings

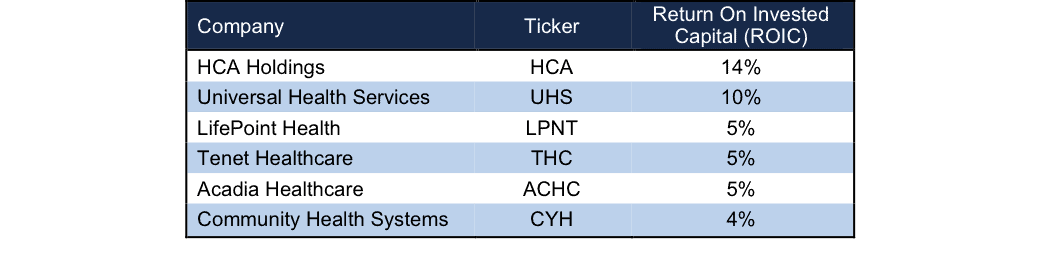

Lower Profitability Than Main Competitor: Acquisitions Not Adding Competitive Advantage

The behavioral healthcare industry is a specialized subset of the larger healthcare industry, and therefore has fewer true competitors. Acadia Healthcare competes primarily with Universal Health Services (UHS) and also hospitals and that may offer mental health services. By comparing ROIC, we can get a true measure across these specialized sectors to identify which firms are allocating their capital most efficiently. Per Figure 3, ACHC’s ROIC ranks below UHS and general hospital operators such as HCA Holdings (HCA).

When comparing margins its more apt to compare between UHS’s behavioral health segment alone, rather than hospitals in general where margins are impacted due to traditional hospital services. UHS’s behavioral health operating margin has topped 20% each year since 2011, and was 23% in 2015. Meanwhile, ACHC’s operating margin maxed out at 13% in 2014, and was 9% in 2015. Either way, ACHC has lower margins and ROIC than its direct competitor, which gives it less operational flexibility and pricing power.

Figure 3: ACHC’s Profitability Hardly Matches Competition

Sources: New Constructs, LLC and company filings

Bull Hopes Rest On Roll-Up Continuing

The bull case with all roll-up strategies revolves around the company continually finding new acquisition targets, purchasing them, and growing revenue and non-GAAP metrics.

With this in mind, ACHC has executed this strategy to perfection. However, the bull case unravels with each acquisition, as the ability to “move the needle” shrinks. An acquisition when a firm generates $200 million in revenue is much more impactful than when the firm generates $2 billion in revenue. Without revenue growth, roll-up strategies lose momentum, and the underlying economics of business are revealed for what they truly are.

Additionally, the current bull case would imply that the past acquisitions have been a quality use of capital, which as shown above, is simply not true. The market ultimately rewards firms that generate the highest return for each dollar of capital invested. In the short-term. ACHC can report non-GAAP metrics that stoke investor interest, but long-term, the economics of the business are trending in the wrong direction.

The largest risk to the bear case is simply time. As we know, the market can stay irrational longer than investors can stay solvent. There is no specific timeframe for roll-up strategies to slow down and the market wake up to the growing economic losses. In the meantime, another risk is that a hospital or other healthcare provider acquires ACHC. However, as we’ll show below, only in the event a firm is willing to destroy shareholder value is ACHC worth more than its current share price.

Roll Up Scheme Worth Acquiring? Not If One Cares About Capital Allocation

The biggest risk to our thesis would be if a competitor were to acquire ACHC at a value at or above today’s price. With the low to no growth environment in which many firms find themselves, large companies will overpay to create good optics or superficial EPS growth, regardless of the true economics of the deals. Unfortunately for those hoping for a buyout, we’ll show below that Acadia Healthcare is not an attractive acquisition target because unless a competitor is willing to destroy shareholder value, an acquisition at current prices would be unwise.

To begin, ACHC has liabilities that investors may not be aware of that make it more expensive than the accounting numbers suggest.

- $123 million in off-balance-sheet operating leases (3% of market cap)

- $53 million in net deferred tax liabilities (1% of market cap)

- $12 million in outstanding employee stock options (<1% of market cap)

After adjusting for these liabilities we can model multiple purchase price scenarios. Even in the most optimistic of scenarios ACHC is worth less than the current share price.

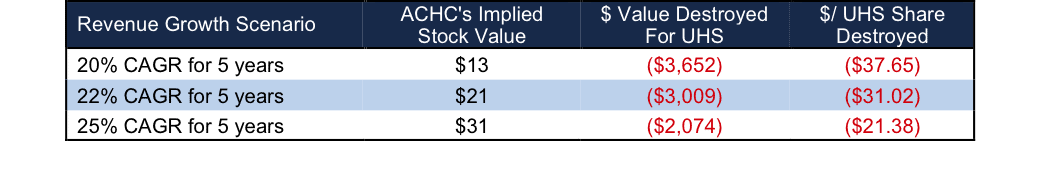

Figure 4 shows what we think United Health Services (UHS) should pay for ACHC, given different growth scenarios that account for the capital outlay required to achieve such a scenario. UHS acquiring ACHC would increase its existing behavioral health segment while providing additional cross-treatment opportunities between its hospital care segment. However, there are limits on how much UHS would pay for ACHC given the cash flows being acquired.

Each implied price is based on a DCF scenario (linked below) assuming different levels of future revenue growth:

- Scenario 1: 62% in (estimated) year one, 14% in (estimated) year two, and 11% in (estimated) year 3 and beyond.

- Scenario 2: 62% in (estimated) year one, 14% in (estimated) year two, and 14% in (estimated) year 3 and beyond.

- Scenario 3: 62% in (estimated) year one, 14% in (estimated) year two, and 18% in (estimated) year 3 and beyond

In each scenario, the estimated revenue growth rates in year one and two are equal to the consensus estimates for 2016 (62%) and 2017 (14%). For the subsequent years, we use 11% in scenario one because it represents the 5-year average revenue growth rate at UHS. We use 14% in scenario two because it represents a continuation of 2017 expectations. We use 18% in scenario three because it represents the average 2017 expected revenue growth rate of all mid to large cap health care firms under coverage.

Additionally, in each scenario, we assume ACHC’s invested capital increases $2.37 billion in year 1, which is equivalent to the change in fixed assets after the acquisition of Priory. This acquisition accounts for much of the revenue growth expected in 2016. We, then, conservatively assume that UHS can grow ACHC’s revenue and NOPAT/free cash flow without any incremental capital outlays after year 1, an unlikely assumption, but nonetheless. We also assume ACHC achieves a 14% NOPAT/free cash flow margin. This margin is above UHS’s NOPAT margin (9%), which is dragged down by its hospital care segment and above ACHC’s current NOPAT margin of 12%.

The resulting implied values for ACHC in each scenario represent the maximum amount UHS should pay for ACHC, given the expected cash flows and the costs to achieve those cash flows.

Figure 4: Implied Acquisition Prices For UHS To Not Overpay For ACHC

Sources: New Constructs, LLC and company filings. $ values in millions except per share amounts. $ value destroyed equals the difference between implied price and acquisition at current market price plus net assets/liabilities.

Figure 4 shows that even If Acadia Healthcare can grow revenue 25% compounded annually, achieve 14% NOPAT margins, and require no excess capital spending (beyond year 1) for the next five years, the most UHS should pay for the firm is $31/share – a 43% downside from current price. Note in even the most optimistic scenario that the average ROIC over five years only equals 9%, which is slightly below UHS’s 10% ROIC. In order to achieve an ROIC equal to its current ROIC, UHS would either need to pay below $31/share, or grow ACHC’s revenue greater than 25% compounded annually while spending $0 in incremental invested capital.

Without Acquisition, Shares Remain Overvalued

Without acquisition hopes, the expectations baked into the current stock price remain unrealistically high. Specifically, to justify the current price of $55/share, ACHC must grow NOPAT (and free cash flow) by 14% compounded annually for the next 12 years. In this scenario, ACHC would be generating over $9 billion in revenue 12 years from now, which is greater than UHS’s 2015 revenue and nearly double LPNT’s 2015 revenue.

Even if we assume ACHC can grow NOPAT (and free cash flow) by 12% compounded annually for the next decade, the stock is only worth $30/share today – a 45% downside. Each of these scenarios also assumes the company is able to grow revenue and NOPAT without spending on working capital or fixed assets, an assumption that is unlikely, even if the firm ceased destructive acquisitions. However, this assumption allows us to create a very optimistic scenario. For reference, ACHC’s invested capital has grown on average $968 million (54% of 2015 revenue) each year since 2012.

Catalyst: Acquisitions Run Out Coupled With Regulation Roadblocks

While roll-up strategies can carry on for quite sometime but the downside when they run out has been well documented. We’ve previously analyzed firms engaging in a roll-up strategy, such as InnerWorkings (INWK), which fell 50% at its worst, and Valeant (VRX), which still trades down 65% from when we originally published these reports. The roll-up strategy either runs out of acquisition targets, or is no longer able to keep up the illusion of non-GAAP profits. As we saw with Valeant, non-GAAP earnings do not pay cash costs, and with ACHC’s climbing debt, it could only be a matter of time before the roll-up runs out of steam. In this case, investors would be forced to measure the firm on its fundamental merits, which as shown above, do not warrant a valuation anywhere near the current price.

Secondly, as with all acquisitions, each must be approved and upheld by the regulating body, whether in the U.S. or abroad. On July 14, 2016 it was announced that the U.K.’s Competition and Markets Authority referred Acadia’s $2.2 billion acquisition of Priory Group for investigation, as it could lower competition within the market. This acquisition is expected to more than triple ACHC’s bed count in the U.K. and a finding that it stifles competition and cannot be completed could bring shares back to a more realistic valuation.

Lastly, the upcoming presidential election could provide a large negative catalyst for ACHC and many other healthcare providers. Under the current Affordable Care Act, mental health and substance abuse saw one of the largest coverage expansions. However, Republicans have made repeated, while unsuccessful, attempts to revoke much of the Affordable Care Act. Depending upon the winner of the 2016 election, these attempts could see a large increase. In 2015, 41% of U.S. revenue came from Medicaid, which Republicans have repeatedly proposed reduced funding, and 29% from commercial insurers. Changes to the ACA that in any way lower the coverage of mental health and substance abuse could have a material negative effect on ACHC’s business.

Insider Are Selling While and Short Interest Grows

Over the past 12 months 12.6 million shares have been sold and 355 thousand have been purchased for a net effect of ~12.2 million insider shares sold. These purchases represent 14% of shares outstanding. As ACHC has fallen, selling has declined too, signaling insiders cashing in while ACHC’s price was on the downturn. Additionally, there are 9.6 million shares sold short, or just over 11% of shares outstanding.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Acadia’s 2015 10-K:

Income Statement: we made $225 million of adjustments with a net effect of removing $105 million in non-operating expenses (6% of revenue). We removed $165 million related to non-operating expenses and $60 million related to non-operating income. See all adjustments made to ACHC’s income statement here.

Balance Sheet: we made $1.2 billion of adjustments to calculate invested capital with a net decrease of $36 million. The most notable adjustment was $579 million (15% of net assets) related to midyear acquisitions. See all adjustments to ACHC’s balance sheet here.

Valuation: we made $3.8 billion of adjustments with a net effect of decreasing shareholder value by $3.8 billion. There were no adjustments that increased shareholder value. One of the largest adjustments was the removal of $3.7 billion (77% of market cap) due to total debt, which includes $123 million in off-balance sheet debt.

Dangerous Funds That Hold

The following funds receive our Dangerous-or-worse rating and allocate significantly to Acadia Healthcare.

Disclosure: New Construct Staff receive no compensation to write about any specific stock, sector or theme.