Wirecard’s Chronically Low ESG Scores Reflected Governance Challenges

On June 25, 2020, the German digital payment company Wirecard AG filed for insolvency following reports that over USD 2 billion in cash assets went missing. Wirecard’s stock has gone down 90% since the initial announcement, and the company’s lenders now face deep losses.

While the S&P ESG Index Series does not include Wirecard, the case sheds light on how governance factors are incorporated and controversies are monitored in screening companies included in many ESG indices and benchmarks.

The primary driver of constituent eligibility and selection into the S&P ESG Index Series is a company’s S&P DJI ESG Score, which is derived from the annual SAM Corporate Sustainability Assessment (CSA). The CSA is an industry-specific questionnaire based on financial materiality and is designed to source corporate sustainability information directly from companies and used to assign ESG scores. Insights gathered from the CSA form the backbone of the ESG score that is incorporated in the index constituent selection process.

In each S&P ESG Index, companies are removed from eligibility due to involvement in controversial weapons or tobacco (in line with specific revenue thresholds) or for having a low United Nations Global Compact score. In addition, companies with an S&P DJI ESG score in the bottom 25% by Global Industry Classification Standard® (GICS®) industry group on a global basis are also ineligible.[1] At the most recent annual rebalance, effective at the end of April 2020, Wirecard had an ESG score of 10 (out of a possible 100),[2] which is firmly within the range of excluded ESG scores. As a result, Wirecard was not eligible to be selected for any of the indices in the S&P ESG Index Series.

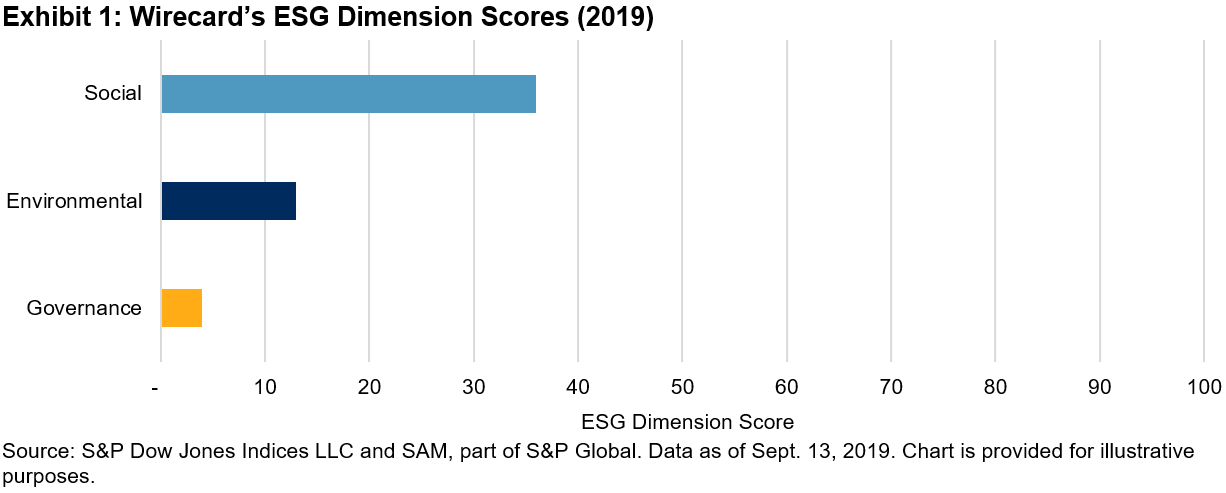

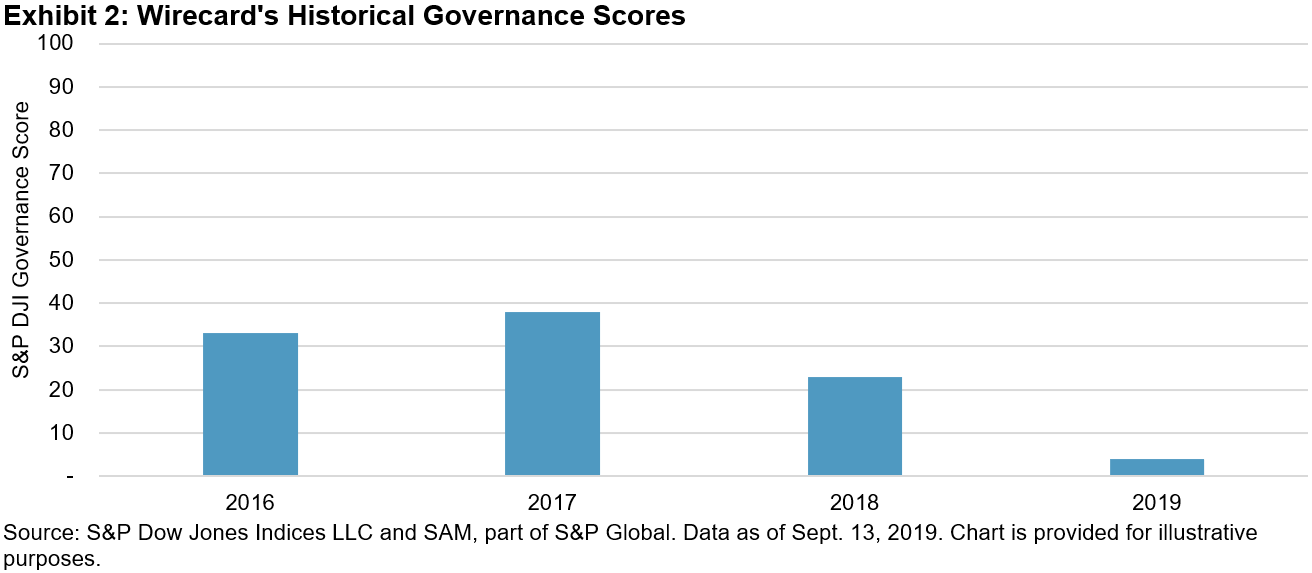

What stands out in Wirecard’s ESG score is its poor governance performance. The company received a score of 4 (out of 100) in the governance dimension in the most recent review cycle for the CSA. This low score is primarily driven by poor performance in the areas of privacy protection, risk and crisis management, and codes of business conduct. Given Wirecard’s recent public struggles, its already low governance score reflected this weakness.

Wirecard, in fact, has never been part of any S&P ESG Index. At each historical rebalance period dating back to 2018 (the first rebalancing when Wirecard was in a universe index for the S&P ESG Index Series), the company never broke the 25% score threshold for eligibility.

It is worth mentioning that in the vast majority of S&P DJI’s ESG benchmarks, including the S&P ESG Index Series, corporate controversies are monitored on an ongoing basis through a Media & Stakeholder Analysis (MSA).[3] When controversies occur between index rebalances, they are factored into the decision of whether or not a company’s ESG score should be reduced. An S&P DJI Index Committee, which oversees the index, assesses the revised ESG score to determine whether the company continues to meet the eligibility criteria and therefore should remain in or be removed from an index. Even though Wirecard was not in any S&P ESG Index and thus could not trigger this process, the S&P ESG Index Series does have measures in place to account for controversies affecting current constituents.

Wirecard’s struggles with governance are well documented by now. The financial-materiality-driven CSA framework was designed to identify a company’s sustainability performance from an ESG perspective. The combination of Wirecard’s ESG score plus the S&P ESG Index Series methodology appears to be fulfilling its intended design.

[1] For more information, please refer to the S&P ESG Index Series methodology.

[2] S&P DJI ESG Scores are designed to be read as percentiles; in the case of Wirecard, a score of 10 means that the company is in the bottom 10th percentile globally within its industry.

[3] For more information on the MSA, please refer to the MSA Methodology Guidebook.

Disclaimer: For more information on the risk-adjusted performance of actively managed funds compared with their benchmarks in 2018, read our latest more