Williams-Sonoma: Solid Quality And Attractive Valuation

Williams-Sonoma (WSM) is one of the top players in the home furnishing industry, with impressive financial performance and plenty of growth opportunities in the long term. The industry is cyclical and competitive, but Williams-Sonoma stock is attractively priced at current levels.

A Solid Business

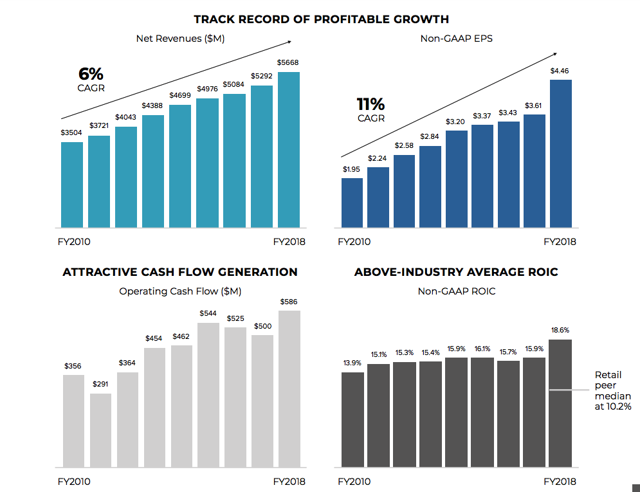

Brand differentiation and superior designs are key sources of competitive advantage for Williams-Sonoma. Management has proven an ability to generate consistent growth in revenue, cash flows, and earnings over the long term.

(Click on image to enlarge)

Source: Williams-Sonoma

Profitability levels are well above the industry average, return on invested capital (Nasdaq: ROIC) amounts to 18.6% for the company versus an industry average of 10.2%.

Success attracts competition in the business world, and competitive pressure tends to reduce profitability. When a company can manage to sustain superior profitability over the long term, this signals that the business has solid competitive strengths and an effective management team.

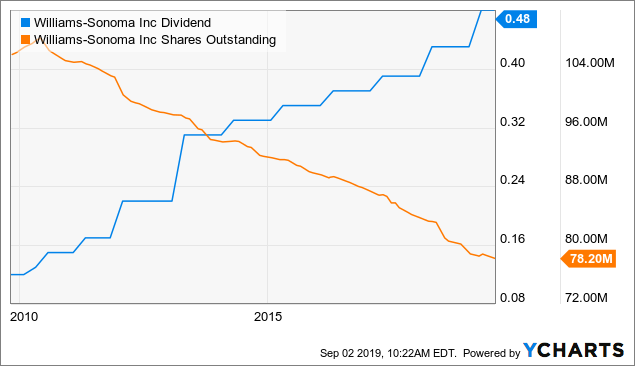

The company generates more cash than it needs to retain, and it has rewarded investors with generous dividends and buybacks over the years. The chart shows how dividends have increased and the number of shares outstanding has significantly declined over time.

(Click on image to enlarge)

Data by YCharts

The $130 billion US home-furnishing market is highly fragmented, with the top 50 companies producing 45% of total revenues and 25,000 companies generating 55% of sales. This should provide plenty of opportunities for Williams-Sonoma to continue growing through market share gains in its main markets.

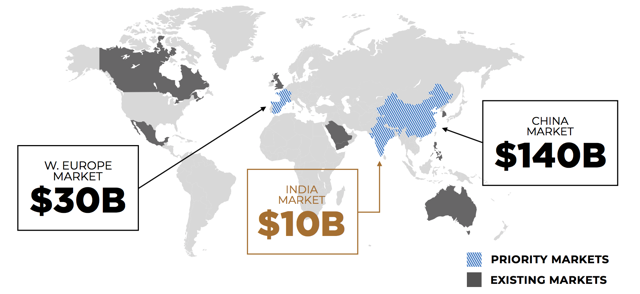

The company is barely giving the first steps in terms of international expansion, with only 10% of revenue coming from overseas. The global market opportunity is worth around $350 billion according to management, and this provides abundant room for sustained international growth.

(Click on image to enlarge)

Source: Williams-Sonoma

Williams-Sonoma is one of the most successful players in e-commerce. The company is in the top 25 retailers based on e-commerce in North America, and the top multi-channel retailer in home furnishings. Nearly 54% of total revenue is currently being generated online, and management intends to further accelerate online growth to increase market share gains in the years' ahead.

All in all, market share gains in North America, international expansion, and rapid online growth should be powerful growth drivers for Williams-Sonoma over the coming years.

Attractive Valuation

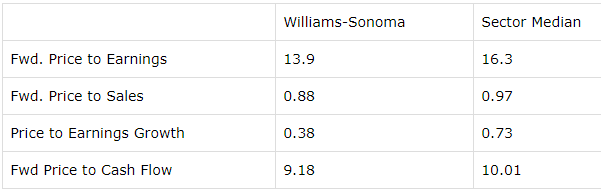

Williams-Sonoma is arguably one of the best companies in the consumer discretionary sector. However, the stock is priced in line with the average levels for the sector, and even at a slight discount. The table below compares some valuation metrics for Williams-Sonoma versus median stock in consumer discretionary, and valuation metrics for the company are more than reasonable.

(Click on image to enlarge)

Data Source: Seeking Alpha Essential

It is important to keep in mind that valuation is always dynamic. Ratios such as forward price to earnings are calculated on the basis of earnings expectations in the year ahead. If the company can consistently deliver numbers above expectations, and those expectations tend to increase over time, then the stock price needs to rise too in order for the valuation to remain stable.

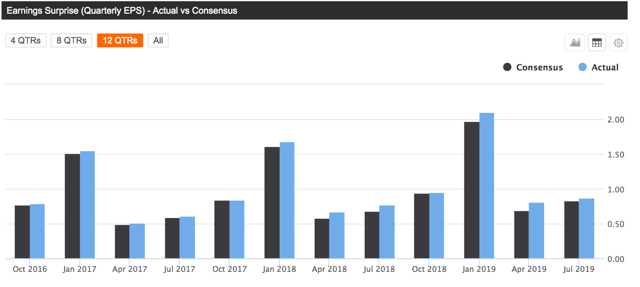

Williams-Sonoma has an impressive track record in that area, the company has delivered earnings above Wall Street estimates over the past 12 quarters, which is not easy to do in such a cyclical and competitive industry.

(Click on image to enlarge)

Source: Seeking Alpha Essential

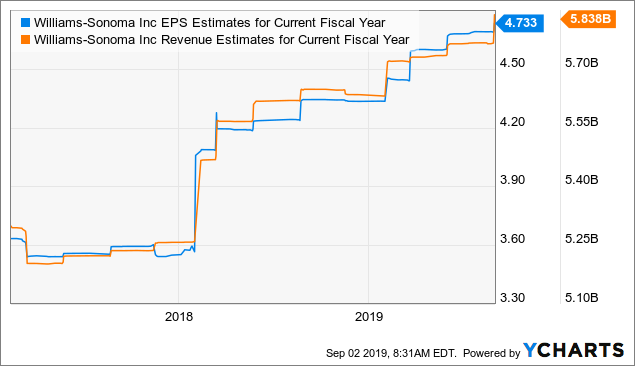

Wall Street analysts are typically running behind and raising their earnings and sales estimates for Williams Sonoma as the company outperforms expectations. The chart shows how both earnings and sales estimates for Williams-Sonoma in the current year have significantly increased over time.

(Click on image to enlarge)

Data by YCharts

Past performance is no guarantee of future returns. However, winners tend to keep on winning, and companies that consistently deliver earnings numbers above expectations tend to continue doing so in the future more often than not. As long as this trend remains in place, rising earnings estimates for Williams-Sonoma would mean that the stock is actually cheaper than what current ratios are indicating.

Valuation needs to be analyzed in the context of other return drivers. A company producing strong growth rates and consistently delivering earnings above expectations deserves a higher valuation than a business producing mediocre financial performance and underperforming expectations.

But sometimes it can be challenging to incorporate the multiple factors into the analysis in order to see the complete picture from a quantitative perspective. The PowerFactors system is a quantitative system that ranks companies in a particular universe according to a combination of factors, such as financial quality, valuation, fundamental momentum, and relative strength.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and this bodes well for investors in Williams-Sonoma.

The company has a PowerFactors ranking of 92.5 as of the time of this writing, meaning that Williams-Sonoma is comfortably above the best 10% of companies in the US stock market based on financial quality, valuation, fundamental momentum, and relative strength combined.

Moving Forward

Williams-Sonoma operates in a cyclical industry with considerable exposure to the ups and downs in the housing market, and this can always be a source of volatility for the stock. Besides, the increased competitive pressure from e-commerce and mass-merchant competitors is always an important factor to watch.

Those risks being acknowledged, Williams-Sonoma is a well-managed company with a differentiated brand that provides a solid competitive advantage for the business. The company is not only adapting well but even thriving in e-commerce and omnichannel, so new industry trends are being transformed into growth opportunities as opposed to competitive risks for Williams-Sonoma.

At current prices, the stock is very reasonably priced for such a high-quality business. As long as management keeps leading the company in the right direction, Williams-Sonoma should be able to deliver attractive returns for investors.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in WSM over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more