Will Twitter Ever Pay A Dividend?

Since its IPO in late 2013, Twitter (TWTR) has pronouncedly underperformed the market. During this period, the stock has slumped 29% whereas the S&P 500 Index has rallied 75%.

Twitter has been one of the more disappointing stocks in the S&P 500 Index since it went public. You can see the full list of S&P 500 stocks by downloading the sheet below:

The underperformance of Twitter stock has been even greater when dividends are considered, as the S&P has been offering a nearly 2% dividend yield year after year whereas Twitter has never paid a dividend.

Therefore, it is only natural that some Twitter shareholders might wonder whether the company will ever initiate a dividend. Such a move might make it easier for those investors to remain patient and wait for a rebound in the stock.

Business Overview & Recent Events

Twitter is a social networking giant, which provides a platform to million people to discuss about everything that happens in the world, including breaking news, politics, sports, and everyday interests.

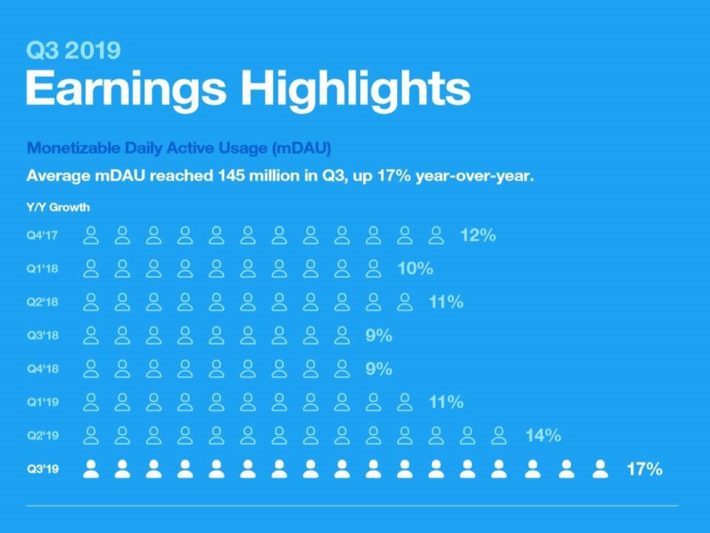

Despite its popularity, the company is still in its early phases of expansion, which are typically characterized by high growth. In the last two years, Twitter has grown its average monetizable daily usage at a double-digit rate, with growth having accelerated in the last three quarters.

Source: Investor Presentation

Twitter does not rest on its laurels–it is continuously trying to make it easier for people to find content relevant to the topics of their interest and follow new conversations. To this end, the company is trying to improve its machine-learning models in order to provide more relevant content in everyone’s timelines and notifications.

Twitter is also trying to make progress in the “health” of its conversations by removing automatically abusive content and enabling authors to hide some of the responses, which derail the trajectory of the conversation. As there is ample room for improvement and expansion of the platform, Twitter has promising growth potential ahead.

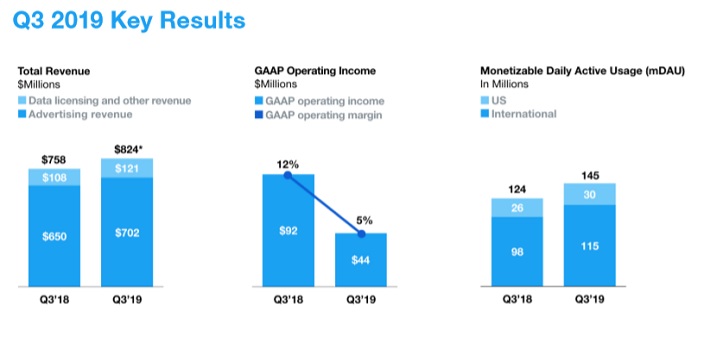

In the third quarter, Twitter grew its average monetizable daily use 17% and its revenue 9% over last year’s quarter, from $758 million to $824 million. Total U.S. revenue grew 10% while Japan remained the second-largest market, contributing 16% of the total revenue. However, the company was negatively affected by greater than expected advertising seasonality in July and August and thus its operating margin fell from 12% to 5% and its earnings per share collapsed, from $1.02 to $0.05.

Management expects the subdued advertising revenues to remain the main theme in the fourth quarter but expects improvement from next year. Due to the negative results, the stock plunged 21% on the day of its earnings release. While the collapse of the stock can be somewhat justified by the rich valuation it enjoyed before the report, we expect management to resolve the troubling issues and the current headwinds to ease in the long run.

Cash Flow & Balance Sheet Analysis

Twitter posted material losses in 2016 and 2017 but became profitable last year, and is expected to earn $2.28 per share this year. Twitter has generated positive free cash flows in every quarter over the last three years. This is a striking difference of Twitter from other high-tech stocks, such as Netflix, Uber, and Lyft, which have been growing their revenues at tremendous rates but still have a long way to go to achieve positive free cash flows. As dividends are funded directly from free cash flows, this is an important factor for income-oriented investors to consider.

Moreover, Twitter has a rock-solid balance sheet. It has a strong net cash position. More precisely, its cash and receivables exceed its total debt by $3.2 billion. This net cash position comprises 13% of the current market capitalization of the stock. The strong financial position of Twitter is certainly exceptional, as the vast majority of companies carry significant amounts of debt thanks to the suppressed interest rates that have prevailed over the last decade.

On the other hand, it is critical to note that interest expense consumed 53% of Twitter’s operating income over the first three quarters of 2019. This level of interest expense is excessive and renders the earnings of the company highly vulnerable to any unexpected headwind.

Overall, Twitter has much stronger free cash flows and a much healthier balance sheet than most high-tech stocks but its operating margin is still too low and thus its interest expense consumes a great part of its operating income. As a result, the earnings of the company are highly volatile and may continue to be volatile in the years to come, which could reduce the likelihood of a dividend.

Will Twitter Ever Pay A Dividend?

As mentioned above, Twitter has become profitable in the last two years and has posted strong free cash flows in every single quarter in the last three years. This means that the social networking giant has the capacity to initiate a dividend.

However, it is critical to note that the earnings of the company are highly volatile while interest expense remains at a high level. At this point, it is important to realize that the initiation of a dividend is a long-term commitment for any company. Once the shareholders begin to receive a dividend, they expect to receive it quarter after quarter. In fact, they expect to receive a growing dividend every year. Due to its volatile results, Twitter cannot enter such a long-term commitment right now.

Moreover, when a company is in its-high growth phase, it makes much more economic sense to reinvest the profits in the business than to return them to the shareholders. That’s why most high-growth stocks do not distribute a dividend. Twitter borrowed funds from the market via its IPO six years ago and the company is still very far from reaching a plateau, as it has ample room to grow by improving its platform and by expanding to new markets.

In the most recent quarter, Twitter reported a headcount of more than 4,600 employees, which was 21% higher than last year’s figure. The company also reported that its research and development expenses grew 18%, its sales and marketing expenses grew 17% and its general and administrative expenses jumped 20% over last year’s quarter.

As a result, while Twitter’s users and revenue increased last quarter, operating income declined significantly.

Source: Investor Presentation

It is thus rational for Twitter’s management to choose to preserve as much cash as possible in order to fund its growth strategy. In fact, if the company ever initiates a dividend, the stock could drop on the news, as it may be taken as a signal that the high-growth era of the stock is coming to an end.

Multiple technology companies have initiated dividends in the past decade, as their businesses matured and opportunities for future growth were reduced. As long as Twitter management continues to believe the best use of cash flow is reinvestment in growth, it is unlikely the company will pay a dividend, even if its fundamentals technically justify a dividend payout.

Final Thoughts

Twitter has been growing its revenues at a fast pace and is doing its best to further improve its platform in order to attract more people and lead its current users to use the platform more often. As the company is already profitable and generates strong free cash flows, it has the capacity to initiate a dividend.

However, its earnings are still volatile for such a long-term commitment. In addition, as Twitter has ample room to grow for many more years, it is much more profitable for the company to reinvest its profits in its business than to return funds to its shareholders. As a result, we do not expect Twitter to pay a dividend for the next several years.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more