Will This 9% Yielder Continue To Pay Its Dividend?

MPLX (NYSE: MPLX) is a master limited partnership (MLP) formed by Marathon Petroleum Corp. (NYSE: MPC). Like many MLPs, its main business is operating oil and gas pipelines.

The stock yields a juicy 9% based on the last dividend (it has raised its dividend for the past 10 quarters and every year since it started paying one in 2012).

Can the company continue to pay that healthy of a dividend yield?

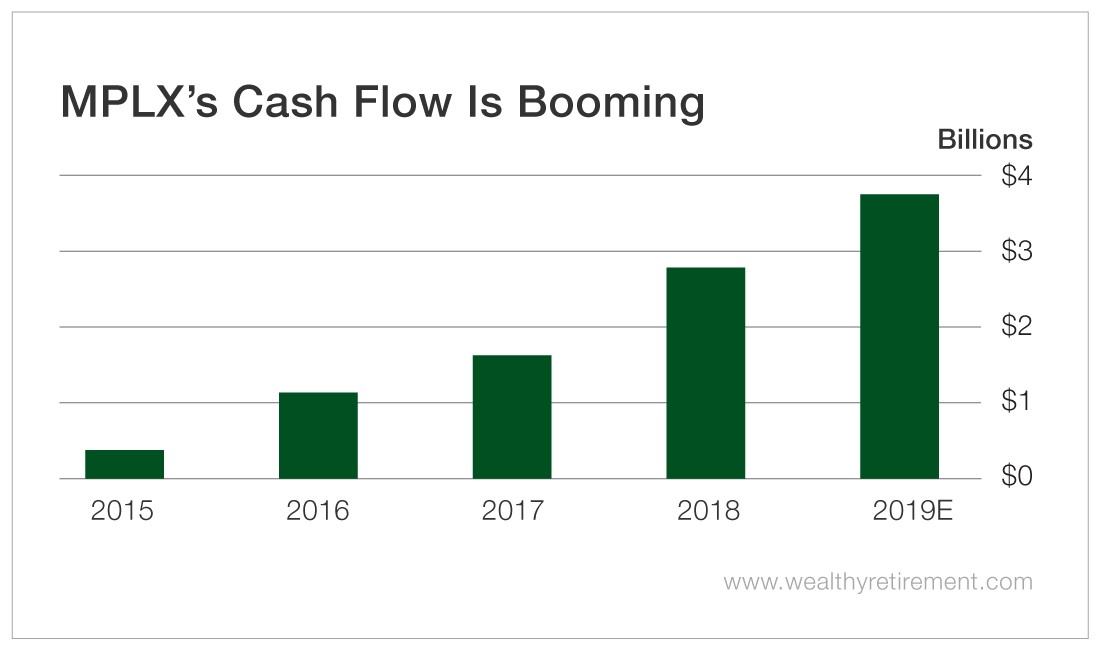

Last year, cash available for distribution (CAD), a measure of cash flow for MLPs, was $2.78 billion. It has been climbing steadily over the years, and in 2019, it is expected to surge to $3.75 billion.

In 2018, the company paid out $1.9 billion in distributions or 68% of the total CAD. That’s a payout ratio well within my comfort zone.

This year, the company is forecast to pay investors $2.8 billion, or 75% of CAD. That’s still low enough not to be worried that the company can’t afford what it’s paying out to shareholders.

I like the fact that although its history of distributions to shareholders is short, it is impressive with yearly and now quarterly increases.

The only blemish on MPLX’s record is that its debt is a bit high.

Its debt-to-EBITDA (earnings before interest, taxes, depreciation and amortization) ratio, which is a common measure of leverage, is 4.05 and is expected to rise to 4.57 by the end of the year.

That’s considerably more than the 3.29 of just three years ago.

Because the company can easily afford its distribution, the high debt level isn’t something that is too concerning, but it definitely should be watched.

There could be a point in the future where CAD is declining and the debt could become a problem. But for now, the dividend looks safe.

Dividend Safety Rating: B

Disclaimer: Nothing published by Wealthy Retirement should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not ...

more