By

Jonathan Baird CFA

of

Global Investment Letter

Wednesday, February 17, 2021 4:44 AM EDT

Regular readers of my social media posts will be aware of my concerns prompted by the widespread evidence that “irrational exuberance” has gripped global capital markets.

|

Examples of historically high levels of investor confidence can be found in the generally used measures of sentiment as well as in the proprietary indicators I have developed over my career.

Additional evidence of the speculative mania that is so concerning is supplied by companies like Tesla (TSLA). Tesla would not be profitable were it not for government subsidies for the purchase of electric vehicles, yet its value is greater than the nine largest auto companies combined. A cult of personality has developed around Tesla founder Elon Musk that has certainly played a role in the stock’s astronomic valuation. As a student of history, I cast a skeptical eye on such cults of personality. Indeed, the events of January 6th in Washington provide a recent example that such uncritical belief in a personality ultimately ends in tears.

In addition to Tesla, we can add record levels of margin debt and call option buying by retail investors, as well as failed short squeeze attempts on GameStop (GME) and other issues. Professional investors, who should know better, are not immune from the current speculative mania. Cash levels for both mutual and pension funds are at historically low levels, and hedge funds are maintaining high levels of leverage.

The amount of leverage exposed to capital markets is at an all-time high, which is exacerbated by the truly gigantic debt burden borne by all levels of the world economy.

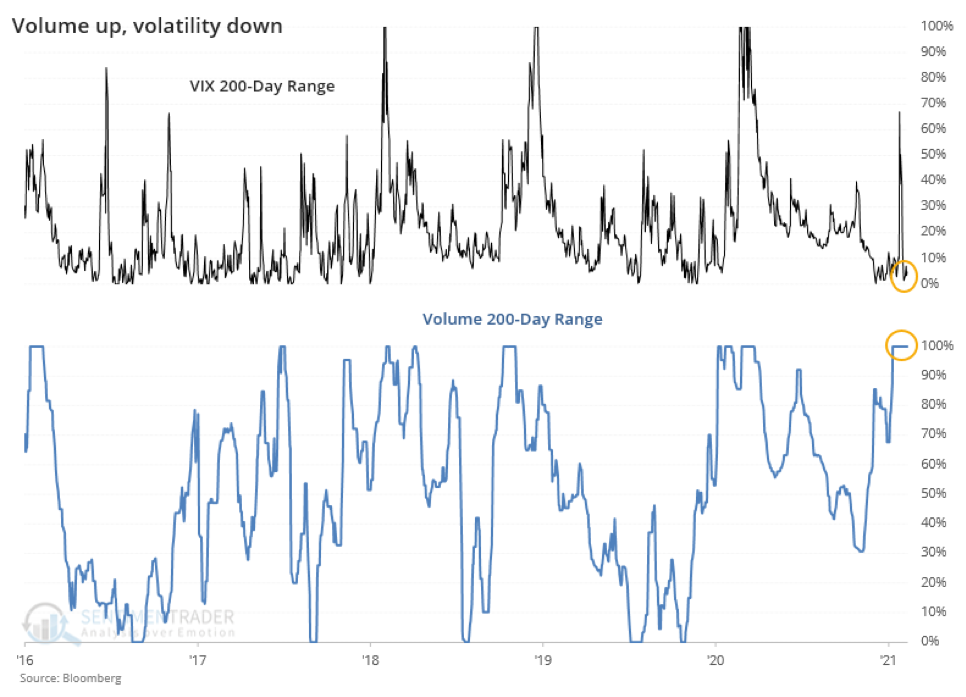

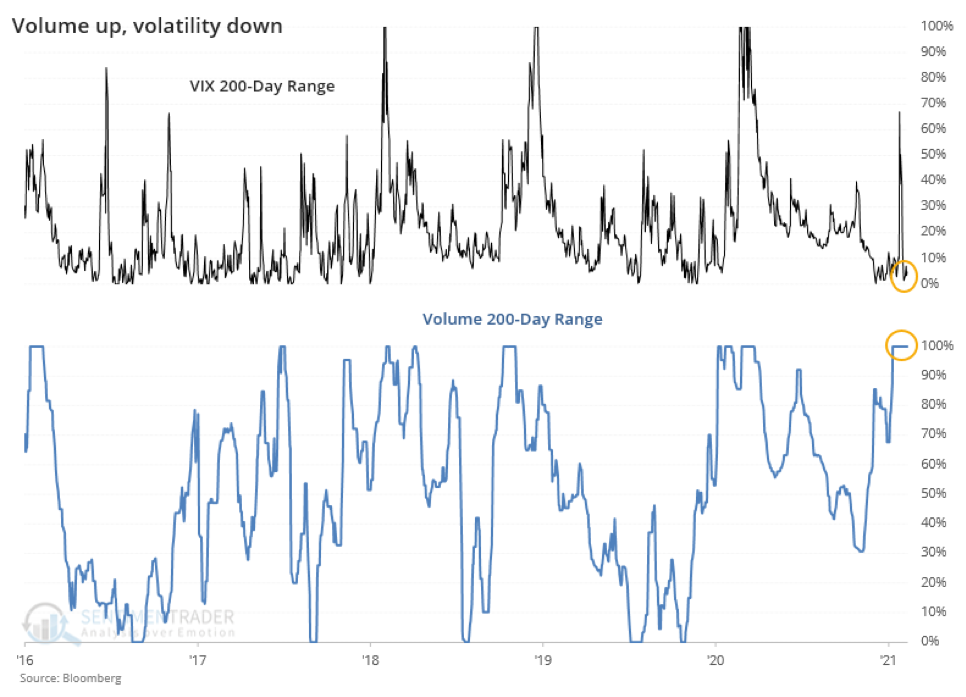

Capital markets are beginning to show the strain under which they labour by behaving in unusual ways. Decades and centuries-old market correlations are breaking down. An example is provided in the chart below.

|

|

|

|

|

Volume and volatility are usually correlated, with divergences usually pointing to significant market moves. We are currently at an extreme divergence with the volatility index (VIX) resting at the bottom of its 200-day moving average range while volume is at the top of the same range. Except for 2017 (which saw a modest market increase), such divergences as we are now seeing have resulted in significant market retracements. These market pullbacks can be attributed to the low level of volatility indicating investor complacency while a surge in volume suggests speculative buying.

Will the market crash in 2021?

It remains uncertain, but market conditions make the chances higher than average. Major market declines occur far more often than probability would suggest. I started managing money in early 1987, and since that time I have witnessed the 1987 crash, the Nasdaq crash at the turn of the century, and the 2008 Financial Crisis. That was three major events in 21 years! To those dramatic events can be added smaller events and the pandemic induced crash of 2020. Extreme market moves occur because markets are a product of human psychology, which is prone to extremes of fear and greed. A study of history will attest to the extreme behaviour that can result from crowd psychology, most of it bad. A key element of successful investing is to do the reverse of extremes of sentiment while managing our own psychology so that we don’t get swept up in extremes of optimism or pessimism.

If a market crash is uncertain, what is more certain?

While a market crash may be more likely, it is not guaranteed. What is more likely is that we will experience a very sharp market pullback at some point in 2021 that will produce attractive risk/reward opportunities. I can also say with a good deal of confidence that the next bear market will be very severe, even sharper than that seen in 2008.

It is our view that the 2020s will prove to be an unusually volatile decade for investors. The current speculative mania we are witnessing will surely produce volatility that will support this view.

If we are correct in our thesis, the coming volatility will produce considerable risk but also great investment opportunities. The risks can be mitigated, and the opportunities can be taken advantage of by prepared investors.

|

|

If you found this post of interest, you’ll find the Global Investment Letter of value. To view free sample issues and to receive our weekly investment comment please click

more

If you found this post of interest, you’ll find the Global Investment Letter of value. To view free sample issues and to receive our weekly investment comment please click here.

Disclaimer: This material is sourced from the Globalinvestmentletter.com website and is subject to the terms of use and privacy policy of that site. The comments are for informational purposes only and represent the opinions of the writer, which can change at any time as additional information becomes available. They do not constitute an offer to buy or sell a security at any price. The information contained is believed to be reliable at time of writing but cannot be guaranteed. No liability is accepted for any loss or damage arising from the use of the material presented.

All rights reserved. This material is strictly for viewing by specified recipients and may not be reproduced, distributed or forwarded in any manner without the permission of the publisher.

less

How did you like this article? Let us know so we can better customize your reading experience.