Will Square Ever Pay A Dividend?

Square (SQ) has offered life-changing returns since its IPO, in 2015. During the last five years, the stock has rallied nearly 20-fold, from $12.50 to $242.

The surging stock is a result of the exceptional growth of the company and its still exciting growth potential.

Income investors have probably missed the breathtaking rally of Square, as the company does not pay a dividend. The absence of a dividend is fairly common among technology stocks, particularly in the early phases of their growth story.

Income-oriented investors who are attracted by the impressive return potential of Square probably wonder whether the company will pay a dividend anytime soon.

Continue reading this article to learn more about Square and the company’s future dividend prospects.

Business Overview

Square is a high-quality financial technology company. It offers payment and point-of-sale solutions in the U.S. and in foreign markets. It also provides hardware products such as the Magstripe reader, which enables transactions of magnetic stripe cards.

Square is an exceptional company. Most companies try to grow by expanding their core business but Square follows a different approach. It continuously tries to add new businesses to its portfolio by expanding the capabilities of its systems in order to grow its total addressable market as much as possible.

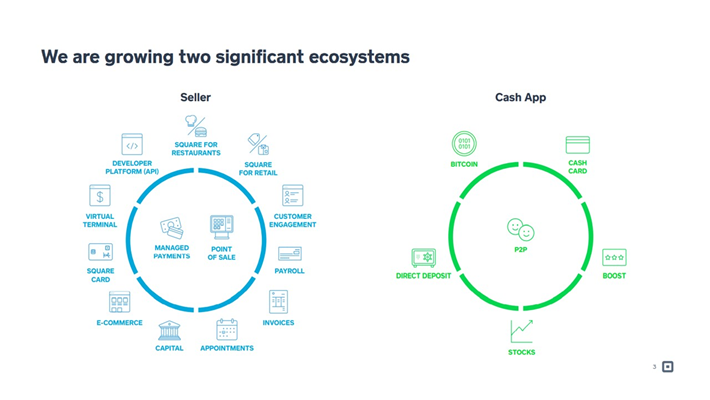

Source: Investor Presentation

Square has greatly expanded the capabilities of its two major ecosystems, Seller and Cash App.

Seller was much simpler in the beginning but it now enables merchants to keep track of their payments, invoices, payrolls, and inventory. In addition, Square launched a business debit card last year and provides sellers with immediate access to their funds without the need to set up a bank account. The adoption of this debit card has increased every quarter since the launch, with sellers spending more than $250 million on their cards in the latest quarter. This business card has rendered sellers much more dependent on Square.

Moreover, Square is continuously trying to expand the scope of its Cash App ecosystem. About a year ago, the company launched a stock brokerage product, which has enjoyed extremely fast adoption. More than 2.5 million customers have purchased stocks with the use of Cash App in less than a year.

It is also worth noting that Square has proved resilient to the coronavirus crisis, which rendered the online presence of merchants and their immediate access to cash and more important than ever.

In the most recent quarter, Cash App posted impressive gross profit growth of 212% over the prior year’s quarter and Square grew its gross profit 59%.

Growth Prospects

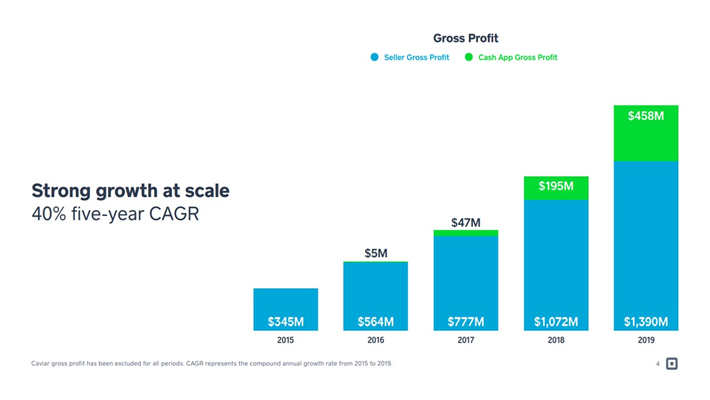

Square has an enviable performance record, as it has grown its gross profit at a 40% average annual rate over the last four years.

Source: Investor Presentation

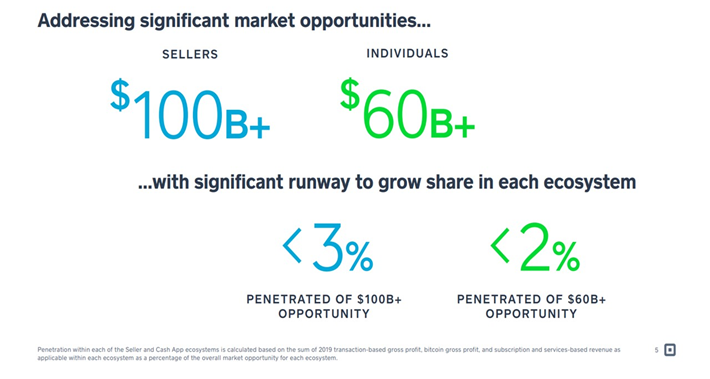

Square has ample room to continue growing at a double-digit rate for several more years. The company has penetrated less than 3% of its total addressable market of sellers, which is a market worth more than $100 billion.

Source: Investor Presentation

Square has penetrated less than 2% of the addressable market of individuals, which is worth more than $60 billion. It is evident that the company has room for future growth for many years, particularly if it continues to expand the capabilities of its ecosystems.

The primary growth driver for the company will be Cash App. This ecosystem represented only 25% of the business of Square last year but it is currently representing 50% of the business thanks to its impressive momentum.

Analysts seem to agree virtually unanimously that Square has exciting growth potential. They expect the company to grow its earnings per share by approximately 50% per year over the next three years, from $0.76 this year to $2.83 in 2023.

Competitive Advantages

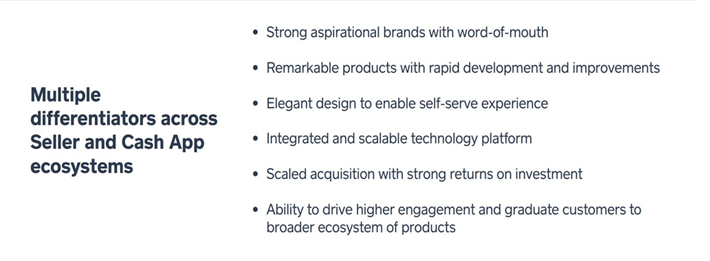

Square has greatly enhanced the capabilities of its two ecosystems in just a few years. Thanks to its sustained product improvement, it has significantly increased the engagement of its customers and their dependence on its products.

Source: Investor Presentation

It has also built a strong brand thanks to word-of-mouth. As a result, Square enjoys a material competitive advantage.

On the other hand, investors should never forget that technology companies rarely enjoy a strong competitive advantage, as it is usually inexpensive to imitate their business model. In addition, there is always cut-throat competition in the tech sector and hence many companies run the risk of incurring business deterioration if their competitors achieve major technological breakthroughs. This is certainly the case for Square.

On the bright side, as many customers of Square have engaged in more than one of the applications of its products, they are not likely to migrate to a competitor. Overall, Square enjoys a relatively narrow business moat but its moat is somewhat wider than that of most tech stocks.

Will Square Ever Pay A Dividend?

In order to pay a dividend, companies need to generate positive free cash flows. In other words, their business should generate cash flows that exceed the capital expenses by a wide margin. Some popular stocks cannot pay dividends to their shareholders due to their negative free cash flows. For instance, Uber (UBER), Lyft (LYFT), and Netflix (NFLX) have not managed to generate positive free cash flows yet.

Square spends a significant portion of its revenues on sales and marketing expenses in order to attract new customers and increase the engagement of existing customers. It also spends appreciable amounts in product development to enhance the value of its products.

Square recently stated that it intends to grow its operating expenses by 40% in 2021 to approximately $850 million. This amount is about one-third of the gross profit of the company in the last 12 months and hence it represents a significant amount. Due to the elevated amounts that Square spends on R&D and on sales and marketing expenses, its free cash flows are negative. As a result, there are no funds available for the initiation of a dividend.

As mentioned above, analysts expect Square to nearly quadruple its earnings per share over the next three years, from $0.76 in 2020 to $2.83 in 2023. However, investors should not expect a dividend from Square as long as the company remains in high growth mode. The company is growing its business at such a high rate that it makes much more economic sense to invest in the business instead of initiating a dividend.

As Square has several years of double-digit earnings growth ahead, it is not likely to initiate a dividend anytime soon. Instead, its management is likely to remain focused on enhancing the scope of its products, improving them, and promoting them in order to continue attracting new customers and keep the existing customers as engaged as possible. Therefore, the shareholders of Square should not expect a dividend anytime soon.

High-growth companies do not offer a dividend for another reason as well. Their stocks usually enjoy such a rich valuation that a dividend is meaningless for the shareholders. To provide a perspective, Square is currently trading at 213 times its expected earnings in 2021. Therefore, even if the company distributes 50% of its future earnings in the form of dividends, it will offer just a 0.2% dividend yield. Such a yield would be negligible for shareholders and hence there is no incentive for the company to initiate a dividend.

Final Thoughts

Square has exhibited an exceptional growth record since its IPO in 2015. Even better, it is still in the early stages of its growth trajectory, with promising growth prospects ahead thanks to the continuous expansion of the applications of its products.

However, the company will continue investing a great portion of its revenues in its business in order to keep growing its customer base and increase the engagement of its existing customers. As a result, Square is not likely to initiate a dividend for the next several years.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more