Will Shopify Ever Pay A Dividend?

At Sure Dividend, we believe investors can generate superior returns over the long run, by investing in high-quality dividend growth stocks such as the Dividend Aristocrats. These are a group of 65 stocks in the S&P 500, with 25+ consecutive years of dividend increases.

At the same time, growth stocks should not be ignored, and one of the most prominent growth themes of the past few years is e-commerce.

The rise of e-commerce has created many winners and losers in the stock market. Physical, old-style retailers, for example, have struggled to adapt in some cases. Those that have embraced the shift to digital have been able to keep pace with a rapidly-changing environment, while those that haven’t embraced it have struggled.

Then there are those that are driving the change to digital shopping, such as Shopify (SHOP). While Shopify has proven extremely successful and has produced eye-popping returns for shareholders in 2020, the company doesn’t pay a dividend. The question for income-focused investors then becomes whether or not Shopify will ever pay a dividend. In this article, we will attempt to answer that question.

Business Overview

Shopify is a cloud-based multi-channel commerce platform for any size business, ranging from self-employed entrepreneurs to huge multinational corporations. Shopify operates in Canada – where it was founded – as well as the United States, United Kingdom, Australia, and other parts of the developed world.

Shopify provides merchants with a single place for all of their needs, including digital storefronts, social media storefronts, product and inventory management, order processing and payments, order fulfillment and shipping, customer relationship management, analytics and reporting, and financing.

Shopify should produce about $2.9 billion in revenue this year, and trades with a market capitalization of $112 billion.

Growth Prospects

As you’d probably expect from a software company with a market cap of $112 billion, Shopify has huge growth expectations in front of it. However, that is because it has managed to produce strong growth in past years, which has driven estimates steadily higher.

The company’s model that has a plan for every kind of business, has created strong revenue tailwinds.

Source: Investor presentation

Its core service draws in customers and then Shopify sells the merchant value adds that drive additional spending, as we can see above. The core product is still the biggest revenue producer, but additional growth is coming from the company’s Plus and other platform add-ons. This story has been unfolding for years and it is simply gaining steam as the company adds more and more offerings to its suite of products. Higher revenue allows the company to continue to invest in new offerings, creating a virtuous cycle of higher revenue.

Shopify isn’t just producing revenue for the sake of revenue, however; its profitability is increasing nicely as well as the top line moves higher.

Source: Investor presentation

Gross profit has exploded higher in recent years, with 2015 coming in at $114 million, and last year coming in at almost $900 million. That sort of growth is extraordinarily difficult to find, and it is why Shopify’s share price has ballooned to more than $900.

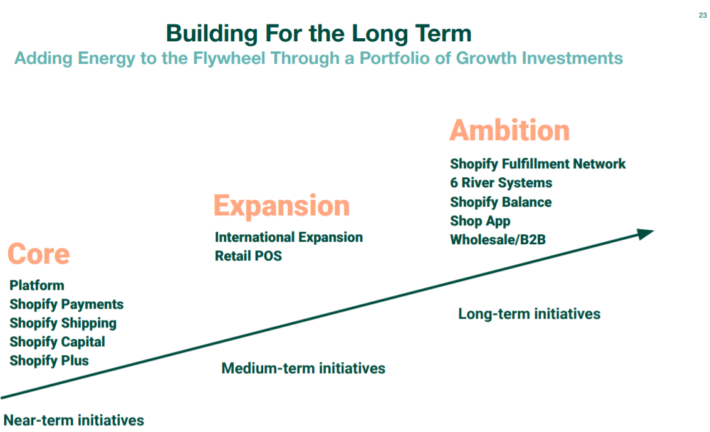

Shopify’s focus on investing for the long-term has driven this growth over the years, and it continues to focus on the long run, rather than chasing profitability as quickly as possible. This model of investing for growth rather than ramping to profitability as quickly as possible has worked with numerous other tech companies over the years, and Shopify is replicating that model.

Source: Investor presentation

Shopify has robust long-term growth plans that include not only the impressive suite of offerings it has today but extensions of those product lines, as well as entirely new offerings.

Shopify is still in the early stages of its growth despite the fact that it is hugely dominant in its field. We see Shopify producing 20%+ revenue growth for many years to come because of its relentless focus on investing for the future.

Source: Investor presentation

Shopify’s flywheel – a concept that states investing in platforms creates more upside momentum, which allows for more investment and more upside – is well underway. Given that the company benefits from higher e-commerce spending, more people selling online, and international expansion, we see the company’s future as very bright.

Shopify’s third-quarter earnings were released on October 29th. Revenue nearly doubled, rising 96% year-over-year to $767 million. Subscription revenue was up 48%, Merchant Solutions revenue soared 132% higher, and Monthly Recurring Revenue was up 47% year-over-year. Gross merchandise volume, which is a measure of merchant success, more than doubled to $31 billion in Q3.

Gross profit dollars were up 87% year-over-year to $405 million, while adjusted gross profits were up 88% to $413 million. Adjusted operating income came to 17% of revenue, or $131 million, up from just 3% of revenue and $10.5 million, respectively, in the year-ago period. Shopify produced a net profit of $1.13 per share on an adjusted basis, up from a net loss of $0.29 per share in the year-ago period.

The company’s balance sheet remains pristine as well, with more than $6 billion in cash and equivalents as of quarter-end, up from less than $2.5 billion a year ago.

Competitive Advantages

While there are certainly other platforms with similar offerings as Shopify, its competitive advantage is in its one-stop-shop setup for merchants.

The company offers merchants an integrated back office setup that takes the guesswork out of piecing together numerous vendors to run their business; Shopify offers virtually everything a business owner needs to operate online.

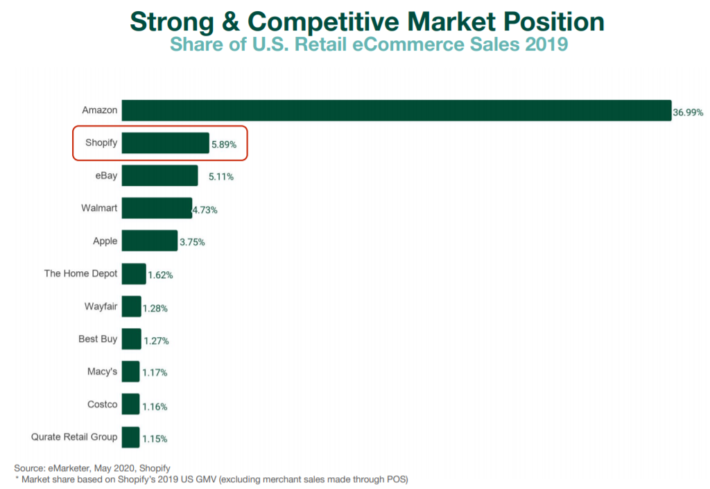

That has led to a very strong competitive position in the sector, as we can see below.

Source: Investor presentation

Shopify trails only Amazon (AMZN) in terms of retail digital sales and has managed to outpace eBay (EBAY), Walmart (WMT), Apple (AAPL), and other big names. Getting to the point where Shopify is today in terms of market competitiveness would take enormous investment and expertise, so we see the company as very well-positioned given its leadership position.

Will Shopify Ever Pay A Dividend?

Shopify has a dominant market position, very strong growth prospects, and improving profitability. However, that doesn’t mean the company is necessarily willing to pay a dividend. While all of the pieces are in place for Shopify to return capital to shareholders over time, we see it as far too early on in its growth cycle to do so.

The company’s cash position that has been built very quickly shows Shopify has the potential to return capital to shareholders over time. We see rising revenue and gross margins as supporting this as well, as Shopify should eventually produce high levels of earnings.

However, the company’s stated growth strategy will require billions of dollars of investments in the years to come to execute, meaning the potential for any sort of capital returns is likely a decade or more away.

Given that Shopify has such a long runway for growth, we believe a dividend is unlikely in the next decade. The company has far too much to play for when it comes to growth investments, and with so much at stake, the idea that Shopify will run out of places to invest its cash seems quite unlikely.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more