Will ServiceNow Ever Pay A Dividend?

ServiceNow (NOW) has offered life-changing returns since its IPO in 2012. During this period, the stock has rallied more than 30-fold, from $18 to $550. The impressive rally of the stock has resulted from the exceptional business performance of the company and its exciting growth prospects.

Income investors have probably missed the breathtaking rally of ServiceNow, as the company does not pay a dividend. The absence of a dividend is fairly common among technology stocks, particularly in the early phases of their growth history.

While ServiceNow has yet to pay a dividend, the 30 Dividend Kings have all increased their dividends for 50+ consecutive years. You download the Dividend Kings spreadsheet by clicking on the link below.

Click here to download my Dividend Kings Excel Spreadsheet now.

Income-oriented investors who are attracted by the impressive return potential of ServiceNow may wonder whether the company will pay a dividend anytime soon.

Business Overview

ServiceNow is a high-quality technology company, which transforms old, manual ways of working into modern digital workflows. It reduces the complexity of jobs and makes work more pleasant to employees which results in increased productivity.

ServiceNow currently has more than 6,200 enterprise customers, which include about 80% of the Fortune 500. All these customers use the Now Platform, which is an intelligent cloud platform that carries out their digital transformation.

Source: Investor Presentation

ServiceNow is a leader in the digital transformation of companies towards making work better for their employees. According to a research of IDC, more than $3 trillion has been invested in digital transformation initiatives but only 26% of the investments have delivered acceptable returns.

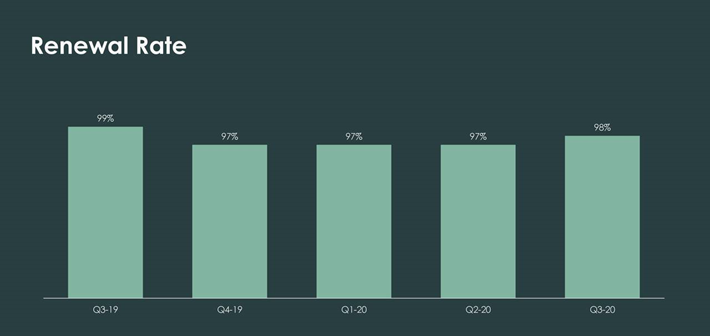

ServiceNow is a great choice for companies that seek digital transformation. The great results of its digital platform are clearly reflected in the exceptionally high renewal rates of its customers.

Source: Investor Presentation

Such high renewal rates confirm that the customers of ServiceNow experience great improvement in their productivity.

To provide a perspective of the power of the workflow platform of ServiceNow, the NBA and WNBA leagues were able to restart in time thanks to the workflows of ServiceNow. The company helped the league process more than 13,000 documents successfully in less than a week and thus prevented an extended delay.

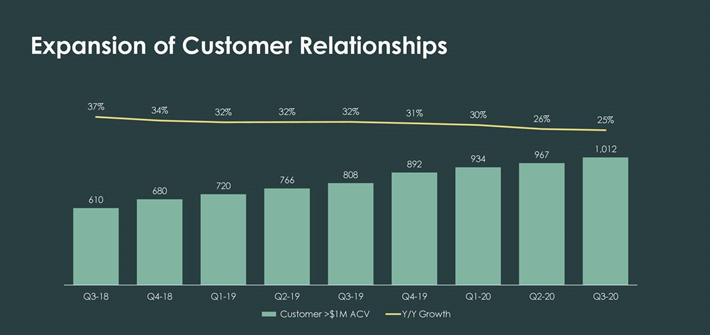

Thanks to its innovative business model and its effort to expand its customer relationships as much as possible, ServiceNow has grown the number of its large customers with more than $1 million in annual revenues at an impressive rate.

Source: Investor Presentation

In the most recent quarter, ServiceNow surpassed the milestone of 1,000 customers with annual revenue of more than $1 million for the first time in its history. It also signed the largest deal in its history, with its largest customer, who now exceeds $40 million in accumulated revenues.

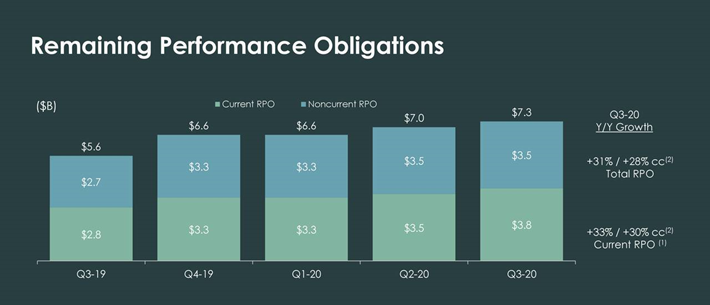

Despite the challenges posed by the pandemic, ServiceNow reported excellent results in the third quarter. The company grew its subscription revenues 29% over the prior year’s quarter. During the quarter, it closed 41 deals with annual contract value of more than $1 million and thus grew its remaining obligation performance (its backlog) 28%.

Source: Investor Presentation

The consistent growth of the backlog of the company bodes well for its future growth prospects. Thanks to its strong revenue growth, ServiceNow grew its adjusted earnings per share 21% and is on track to achieve 36% earnings-per-share growth this year.

In addition, ServiceNow exceeded analysts’ consensus estimates for an 11th consecutive quarter. This is a testament to the strong business momentum of the company and the great execution of its strategy.

Growth Prospects

ServiceNow has an enviable growth record, as it has grown its revenues at a 48% average annual rate over the last nine years, from $128 million in 2011 to $4.2 billion in the last 12 months.

Even better, management has repeatedly stated that it is just a question of time until ServiceNow exceeds $10 billion in annual revenues. As this amount is 2.4 times the current revenues of the company, it bodes very well for the growth potential of the company.

Moreover, as mentioned above, the company has a high customer retention rate and continues to rapidly add new customers. Its fast-growing backlog undoubtedly bodes well for the future growth prospects of the company.

As there are no signs of fatigue and the digital transformation of enterprises towards a better work environment is only in its early stages, it is evident that ServiceNow has ample room to keep growing at a fast pace for several more years.

Analysts seem to agree that ServiceNow has exciting growth potential. They expect the company to more than double its earnings-per-share in just three years, from $4.53 this year to $9.76 in 2023.

Competitive Advantage

ServiceNow is the leader in the digital transformation towards a better work environment and increased productivity. As its customers are overwhelmed by the impressive results of its workflows, the company has built a strong brand thanks to word-of-mouth. As a result, ServiceNow has built a material competitive advantage.

On the other hand, investors should always keep in mind that technology companies rarely enjoy a durable competitive advantage, as it is usually inexpensive to imitate their business model. The minimal amounts that ServiceNow invests in its business in order to grow (more on this below) confirm the low barriers to entry in this business.

In addition, there is always fierce competition in the tech sector and hence many companies run the risk of incurring business deterioration if their competitors achieve major technological breakthroughs. This is certainly the case for ServiceNow.

On the bright side, ServiceNow does its best to expand its business as much as possible and thus increase the dependence of its customers on its digital workflows which results in high switching costs. Overall, ServiceNow enjoys a narrow business moat but its moat is slightly wider than that of most tech stocks.

Will ServiceNow Ever Pay A Dividend?

In order to pay a dividend, companies need to generate positive free cash flows. In other words, their business should generate cash flows that exceed the capital expenses by a wide margin.

Some popular stocks cannot pay dividends to their shareholders due to their negative free cash flows. For instance, Uber (UBER), Lyft (LYFT), Netflix (NFLX) and Nikola (NKLA) have not managed to generate positive free cash flows yet.

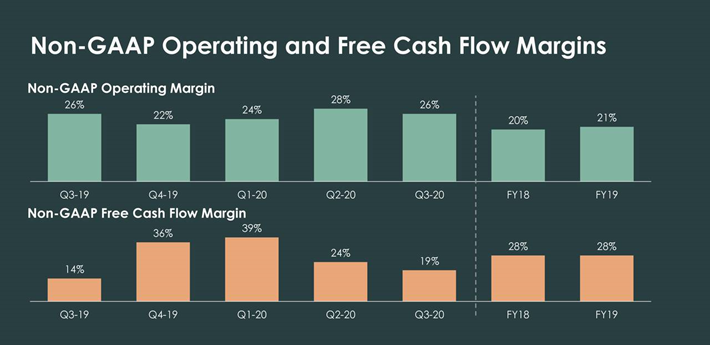

ServiceNow enjoys exceptionally high gross and operating margins in its business.

Source: Investor Presentation

The gross margin of ServiceNow has remained essentially flat, around 86%, in every quarter in the last two years while its operating margin has remained above 20%.

Even better, as shown in the above chart, ServiceNow has an impressive free cash flow margin, which has remained around 28% in each of the last three years. It is evident that the company needs to invest minimal amounts to grow its business. As a result, it enjoys strong free cash flows and has the financial power to initiate a dividend.

However, investors should not expect a dividend from ServiceNow as long as the company remains in high growth mode. The company is growing its business at such a high rate that it makes more economic sense to invest in the business instead of initiating a dividend.

It also makes sense to preserve funds for potential future investments to protect the business if large competitors attempt to enter this low-barrier business in the future.

As ServiceNow has several years of double-digit earnings growth ahead, it is not likely to initiate a dividend anytime soon. Instead, its management is likely to remain focused on improving the products of the company and promoting them in order to continue attracting new customers and keep the existing customers as engaged as possible. Therefore, the shareholders of ServiceNow should not expect a dividend anytime soon.

High-growth companies do not offer a dividend for another reason as well. Their stocks usually enjoy such a rich valuation that a dividend is meaningless for the shareholders.

ServiceNow is currently trading at 121 times its earnings. Even if the company distributes 50% of its future earnings in the form of dividends, it will offer just a 0.4% dividend yield. Such a yield will be negligible for its shareholders and hence there is no incentive for the company to initiate a dividend.

Final Thoughts

ServiceNow has exhibited exceptional growth since its IPO, in 2012. Even better, it is still in the early stages of its growth trajectory, with promising growth prospects ahead thanks to the continuous shift of enterprises towards automated workflows and increased productivity.

In contrast to most high-growth companies which do not generate meaningful free cash flows in the first phases of their high-growth period, ServiceNow enjoys strong free cash flows. As a result, the company has the financial power to initiate a dividend.

However, such a dividend would be negligible to the shareholders due to the sky-high valuation of the stock. In addition, it makes much more sense to invest funds in this high-growth business or preserve cash for future investments in the event of new competitors entering the market. Overall, ServiceNow is not likely to initiate a dividend for the next several years.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more