Will Salesforce Ever Pay A Dividend?

A singular focus on quality dividend stocks and income generation can help investors endure the worst economic storms. When times get tough, it’s comforting to know that a dividend check is on the way, in good times or bad.

However, there is a downside which is missing out on fast-growing companies that do not yet pay a dividend. A prime example of this is Salesforce (CRM) which has generated annualized returns north of 20% per annum for the last decade. Salesforce stock has soared to a market cap of $225 billion.

As a result, Salesforce is now a mega-cap stock, defined as those with market caps above $200 billion. The total number of mega cap stocks varies depending upon market conditions, but there are generally 25 to 30 in the US, so there are plenty to choose from for investors.

An investment in Salesforce stock made back in 2010 would now be worth more than 7 times your initial capital. Now that Salesforce is a mega-cap stock and profitable, investors might be wondering whether the company will ever pay a dividend.

Business Overview

Founded in 1999, Salesforce.com Inc. is the world’s #1 customer relationship management platform, and a tool that helps companies stay connected to customers. Salesforce helps over 150,000 businesses run their companies more effectively by enabling them to take advantage of the cloud, mobile, social, internet of things, artificial intelligence, voice, and blockchain to create a 360-degree view of their customers.

Last year the company generated $17.1 billion in sales and earnings-per-share of $0.15. This year Salesforce anticipates $20.7 billion to $20.8 billion in sales and earnings-per-share in the $3.12 to $3.14 range on a reported basis and $3.72 to $3.74 on an adjusted basis. Roughly 94% of the $235 billion market capitalization company’s revenue is derived from subscriptions and support.

Source: Dreamforce 2019, Company Presentation

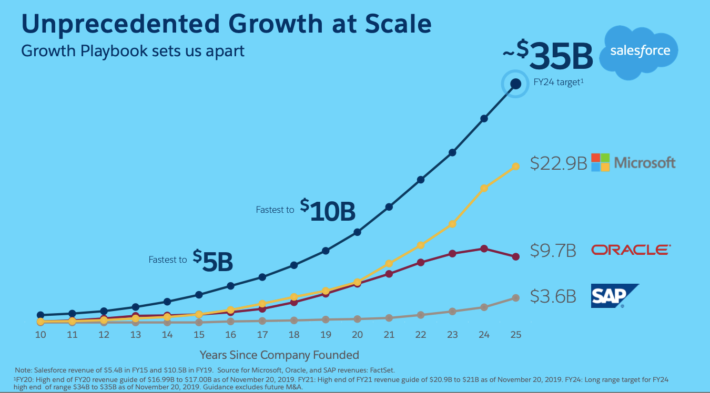

Salesforce has put together an enviable growth record, having increased its sales from $1.7 billion in fiscal year 2011 to $17 billion in fiscal year 2020, representing an annualized compound growth rate of nearly 30% per annum.

Moreover, the company anticipates this strong growth trajectory will continue, forecasting that sales will hit $35 billion by fiscal year 2024. This would mean growth would slow to 20% annually, but this still exceptionally impressive coming off a larger and larger base.

Growth Prospects

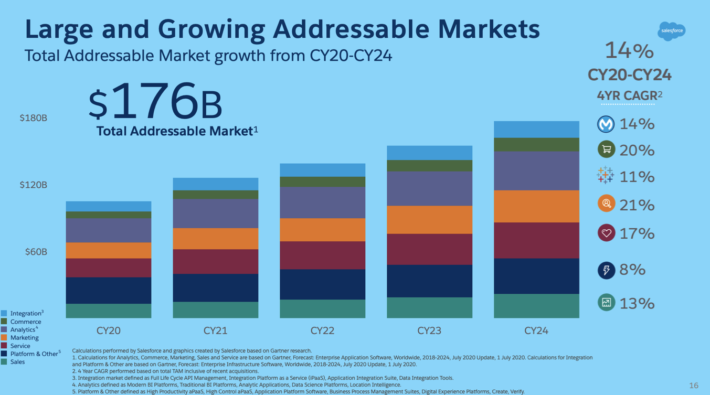

To achieve this growth, Salesforce has a variety of large and growing markets:

Source: Q2 FY2021 Presentation

Not only is there a large addressable market to go after, but a variety of opportunities offer the potential for double-digit growth rates. This means that even if Salesforce keeps its share of the market constant, it could still have a long growth tailwind.

Here’s how Salesforce thinks about its growth in different stages:

Source: Dreamforce 2019, Company Presentation

In the beginning, growth was exceptional, but the numbers were quite a bit smaller. As the company became much larger, growth remained robust – an important aspect for the company and one of the reasons shareholder returns have been so exceptional.

Today we’re in the phase that management calls “Solidifying our Leadership,” with the expectation of $20+ billion in sales this year. As the company gets larger and larger, the rate of growth will slow, but it’s clear that there remains a significant tailwind at the company’s back.

Competitive Advantages

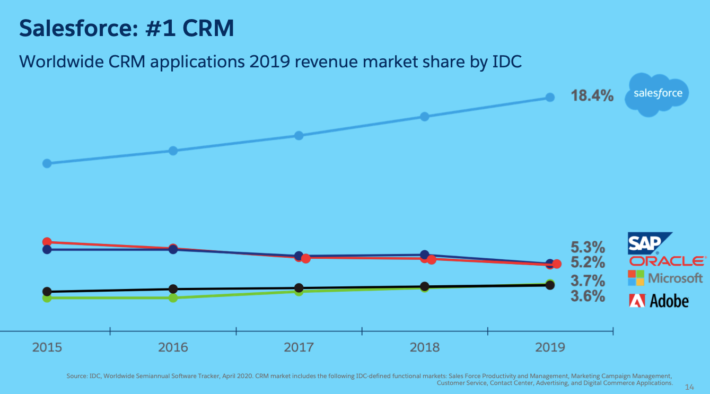

Source: Q2 FY2021 Presentation

Put simply, Salesforce is the dominant customer relationship management platform and has earned the CRM ticker. Moreover, the company’s share of the market has been growing, as the company solidifies its leadership and continues to outpace some of the most respected companies in the technology space.

This has allowed the company to generate an unmatched growth rate:

Source: Dreamforce 2019, Company Presentation

In conjunction with its impressive growth story over the last two decades, Salesforce also derives competitive advantages from its first-mover advantage, cementing itself as the “gold standard” in the industry and its financial position.

As of the most recent report, Salesforce held $4.1 billion in cash, $5.2 billion in marketable securities, $14.8 billion in current assets, and $57.8 billion in total assets against $13.0 billion in current liabilities and $19.3 billion in total liabilities. Long-term debt stood at just $2.7 billion.

It’s important to note that $26.3 billion of the company’s total assets are comprised of goodwill. This results in a slightly less impressive financial stance, but it also captures the idea that Salesforce is growing both organically and through acquisitions. Keeping a sound financial footing and being able to acquire companies will continue to be important as Salesforce matures.

Will Salesforce Ever Pay A Dividend?

Speaking of maturing, the question as to whether or not Salesforce will pay a dividend can be thought about along a “maturity scale.” Any successful business works through different phases of needing and allocating capital. In the beginning, companies are usually capital-intensive, requiring significant funds for growth investment. Equity and debt are issued to raise funds, while cash flows have not yet materialized.

In the growth phase profitability is possible, but the focus is often on reinvestment instead. This usually means reinvesting all cash flows and continuing to seek more capital via debt or equity.

Once a company begins to mature, the cycle starts to unwind itself. Debt and equity can still be used, but often the profits being generated are more than enough to service, sustain and even grow (albeit at a slower rate) the now much larger business. Further, debt is reduced to a manageable level and a company may begin repurchasing shares. Finally, a dividend is considered, indicating that the company is sustainable and generating excess funds.

When we think about those three stages, Salesforce is still very much in the growth phase.

While the history of revenue growth detailed above is exceptional, the bottom line does not tell the same story. In the 2012 through 2016 period, Salesforce posted a loss each year. In the 2017 through 2020 period, earnings-per-share totaled $0.26, $0.17, $1.44 and $0.15. And while earnings-per-share are expected to top $3+ this year, a trend has not yet developed.

Even if Salesforce began paying a $1.50 annual dividend – lofty based on recent earnings – this would only imply a current dividend yield of about 0.6%. More importantly, it would interrupt the company’s growth thesis. In the short to intermediate-term Salesforce is not expected to pay a dividend. The focus will be on continued growth, reinvestment, and acquisitions.

Of course, that does not mean that the company will never pay a dividend. There are three things to look out for, which might give us a clue as to when this could occur:

- Manageable debt load

- Stabilizing share count

- Maturing growth

The debt load is already manageable, a product of the relatively capital-light business model paired with a preference for issuing equity.

The share count, on the other hand, has gone from 509 million in fiscal year 2010 to 893 million at the end of fiscal year 2020 – equating to a 5.8% annualized growth rate. Moreover, as of the last financial report, the share count stood at 922 million. When the share count starts stabilizing, without the company taking on excess debt, this could indicate a turning point in capital allocation.

Finally, when management indicates or the company’s financials begin to show maturing growth, this could likewise be an inflection point. This is not expected in the short or medium-term, but it is something to watch over time.

Final Thoughts

Salesforce has been an exceptional investment over the past two decades, as a result of a phenomenal revenue growth record. Eventually, the value investors are placing on shares is predicated on the top line growth converting to bottom-line results. However, for the foreseeable future, the company is still very much focused on growth and reinvesting in the business. This means that excess funds will not be available and the likelihood of a dividend in the short-term appears remote.

Over the long-term, if Salesforce is successful in converting its strong top line to a consistent bottom-line result, there may come a day when the company has excess cash available. In particular, seeing a stabilizing share count and maturing growth trajectory could signal a turning point in capital allocation strategy. When this time comes, a dividend may not be that far off for this growth company.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more

I've often wondered about this myself.