Will Pinduoduo Ever Pay A Dividend?

Pinduoduo (PDD) operates an e-commerce platform in China. This platform offers a wide range of consumer products, such as apparel, shoes, bags, childcare products, food and beverage, agricultural products, and electronic appliances.

Pinduoduo benefits from the strong growth of the Chinese economy, whose GDP has grown more than 6% per year for more than a decade. The company also benefits from a secular trend, namely the shift of consumers from conventional shopping to online shopping.

Pinduoduo has greatly rewarded its shareholders since its IPO, in mid-2018. Since then, the stock has rallied more than 5-fold and is now a large-cap stock with a market cap above $150 billion.

We have compiled a list of over 400 large-cap stocks in the S&P 500 Index, with market caps of $10 billion or more.

Income investors may have missed the exceptional returns of Pinduoduo, as the company does not pay a dividend. This is fairly common among growth stocks, particularly those in the technology sector.

Income-oriented investors who are attracted by the massive returns of Pinduoduo probably wonder whether the company will pay a dividend anytime soon.

Business Overview

Pinduoduo operates a mobile e-commerce platform in China, with a wide range of products. This platform has become a mainstream online shopping application.

Pinduoduo benefits from the secular shift of consumers from brick-and-mortar shopping to online shopping. This trend has accelerated this year thanks to the coronavirus crisis and the resultant social distancing lifestyle. It is also worth noting that Pinduoduo has become the largest online platform for agricultural products in China by enabling direct selling from farms to the dining table.

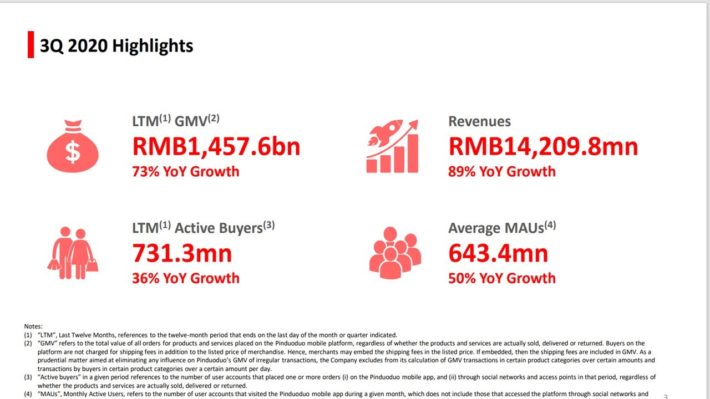

Thanks to its impressive growth, Pinduoduo has attracted 731.3 million active buyers in the last 12 months, after just a few years of operation.

Source: Investor Presentation

Pinduoduo also has 643.4 million monthly active users and is still growing its customer base at a tremendous pace.

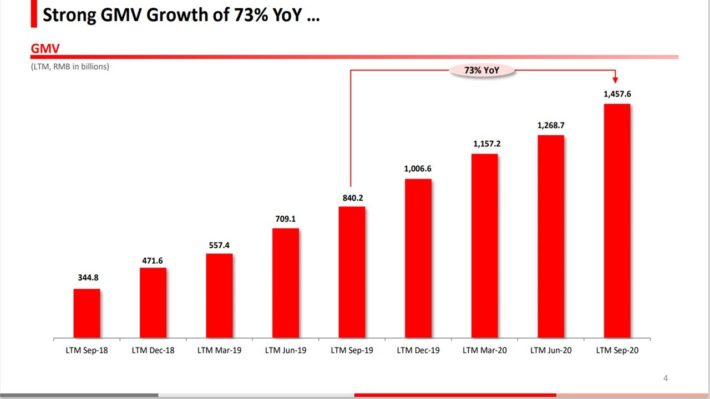

In the most recent quarter, the gross merchandise volume of the mobile platform of Pinduoduo grew 73% over the prior year’s quarter. As shown in the chart below, the growth of the gross merchandise volume is both impressive and consistent.

Source: Investor Presentation

The consistency is paramount, as it is a testament to the strength of the business model of Pinduoduo and the absence of any signs of fatigue.

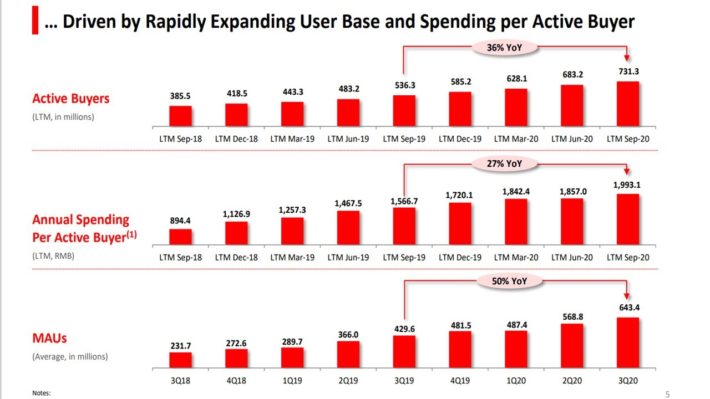

The impressive growth in the gross merchandise volume has been achieved thanks to high growth in the number of monthly active users and a steep increase in the annual spending per active buyer.

Source: Investor Presentation

The rising revenue per active customer indicates that the platform of Pinduoduo achieves strong customer engagement and thus leads consumers to use the platform more and more often. This is also evident from the first slide, which shows that nearly 90% of the annual active users of the platform have made at least one purchase during the last month.

Growth Prospects

Pinduoduo is growing its revenues at a breathtaking pace and still has ample growth potential, as the secular shift of consumers from traditional shopping to online shopping is in its early stages. The company will also grow thanks to the continuous addition of new products into its platform. It will also continue to benefit from the strong growth of the Chinese economy, which results in increased consumption power of its individuals.

In the first nine months of 2020, online sales in China grew 16% over last year’s period. It is also worth noting that the annual online sales in China are nearly $2.0 trillion. As the annual gross merchandise value of Pinduoduo is approximately $219 billion, it is evident that the company has ample room to keep growing its revenues.

It is also remarkable that China has managed to contain the pandemic more efficiently than nearly all the other countries in the world thanks to its drastic measures and the strict compliance to these measures. As a result, the Chinese economy has returned to strong expansion in the third quarter, much sooner than most developed countries.

Overall, Pinduoduo is still in the early phases of its growth trajectory and thus it has exciting growth prospects ahead. Analysts agree on this view, as they expect Pinduoduo to switch from a loss per share of -$0.35 this year to a profit per share of $0.56 in 2021 and grow that profit essentially 6-fold in just two years, to $3.32 per share in 2023.

Competitive Advantages

Technology companies rarely enjoy a strong competitive advantage, as it is usually inexpensive to imitate their business model. In addition, there is usually cut-throat competition in the tech sector and hence many companies run the risk of incurring business deterioration if their competitors achieve major technological breakthroughs.

On the other hand, Pinduoduo has a significant competitive advantage, namely its great scale, which has resulted from the popularity of its e-commerce platform. Its attractive, user-friendly platform, which has attracted hundreds of millions of users, is likely to keep most of these users engaged for years, as consumers are much more likely to keep using a familiar platform than switch to a new one.

Will Pinduoduo Ever Pay A Dividend?

In order to pay a dividend, companies need to generate positive free cash flows. In other words, their business should generate cash flows that exceed the capital expenses by a wide margin. Some popular tech stocks cannot pay dividends to their shareholders due to their negative free cash flows. For instance, Uber (UBER), Lyft (LYFT), and Netflix (NFLX) have not managed to generate positive free cash flows yet.

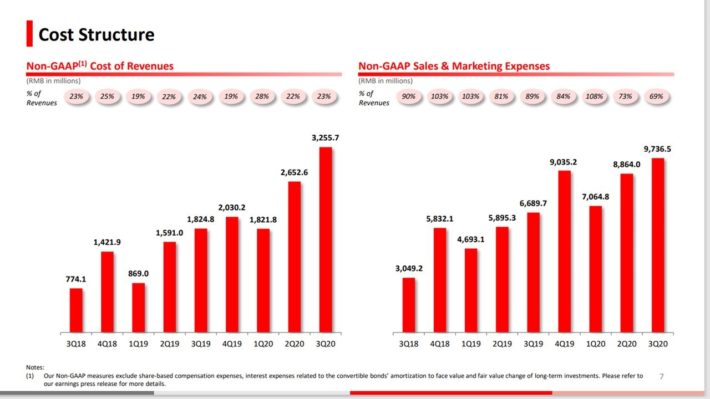

Pinduoduo spends a great portion of its revenues on sales and marketing expenses.

Source: Investor Presentation

As shown in the above chart, Pinduoduo has spent nearly all its revenues on sales and marketing expenses in every single quarter in the last two years. The company also pays approximately 10% of its revenues on R&D expenses every quarter. As a result, there are no funds available for the initiation of a dividend.

However, investors should not be dissatisfied with the capital management of Pinduoduo. The company is growing its business at such a high rate that it is much more profitable to invest the earnings in the business instead of distributing them to the shareholders.

Pinduoduo recently reaffirmed that it will continue investing heavily in its business in order to improve user engagement and gain more mind share with consumers. Therefore, the company will continue spending a great portion of its revenues on sales and marketing for the foreseeable future.

As Pinduoduo has many years of double-digit earnings growth ahead, it is not likely to initiate a dividend anytime soon. Instead, its management is likely to remain focused on its growth initiatives. Therefore, the shareholders of Pinduoduo should be completely satisfied as long as the company keeps growing at a fast pace, without initiating a dividend.

High-growth companies do not offer a dividend for another reason as well. Their stocks usually enjoy such a rich valuation that a dividend is meaningless for the shareholders. To provide a perspective, Pinduoduo is currently trading at 252 times its expected earnings in 2021. Therefore, even if the company distributes 50% of its earnings in the form of dividends, it will offer just a 0.2% dividend yield. Such a yield will be negligible for its shareholders and hence there is no incentive for the company to initiate a dividend.

Final Thoughts

To sum it up, Pinduoduo is in the early stages of its growth trajectory, with exciting growth prospects ahead thanks to various drivers. As a result, the company will remain focused on its growth initiatives and will continue investing a great portion of its earnings in its business. It is thus not likely to initiate a dividend for the next several years.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more