Will Oil Or Interest Rates Rebound First?

MLPs?

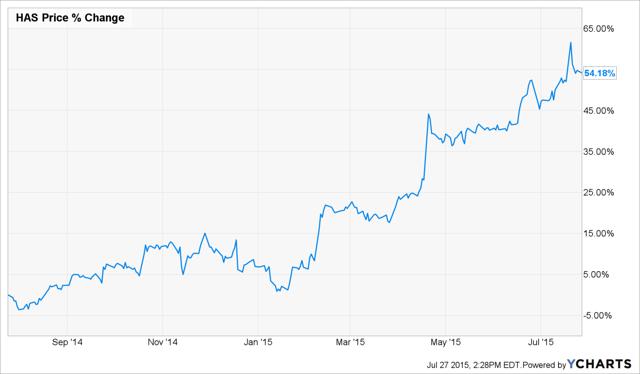

Over the past year, investors have been contending with a collapse in energy prices along with fears of a rate hike. Eventually, it is likely that both oil and rates will rebound. Which will come first? It is not clear. However, one asset class that has been destroyed by the confluence of these events has been MLPs - that's master limited partnerships, an asset that is so hated that it is now listed beneath Hasbro (NASDAQ:HAS) in the Google search engine. Incidentally, while master limited partnerships languish, My Little Ponies are apparently just killing it; HAS is up over 50% this past year.

Back to the grimmer picture of the energy market.

There. That's what I mean by MLP.

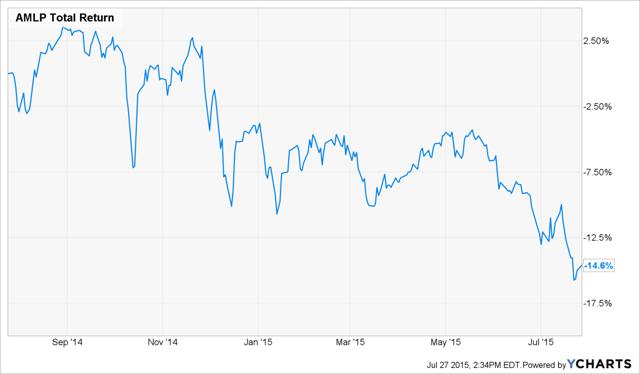

MLPs have been hit by their exposure to oil and gas and hit again by their exposure to interest rate concerns. Alerian MLP (NYSEARCA:AMLP) which tracks energy infrastructure MLPs, is down double digits over the past year.

If you are interested in exposure to an energy rebound or a rate hike delay, then you might consider some MLP exposure. Two caveats are worth considering. First of all, these generate Schedule K-1 tax forms, which can be an inconvenience. Secondly, their investor rolls tend to be dominated by retail investors who can be extremely pro-cyclical in downturns. But I submit that MLPs are worth owning, especially considering that we can avoid the first caveat and exploit the second.

The Cushing MLP Total Return Fund (NYSE:SRV) has been a catastrophe for its owners to date.

Over the past year, it has lost over a third of its NAV. However, prospectively this may be an attractive long idea. SRV does not generate K-1s, so that problem is out of the way. As far as jittery investors, they have driven the discount to over 22%. Therein lies the price opportunity. This discount to mostly large, liquid energy names is not justified by the adverse macro backdrop, poor performance, high turnover (137%) or indefensible expense ratio (2.9%). I paid 78% of the market price for this diversified basket:

|

Top Holdings (as of 3/31/2015) |

||||

|

Energy Transfer Partners LP (NYSE:ETP) |

6.76% |

|||

|

Enable Midstream Partners LP (NYSE:ENBL) |

5.33% |

|||

|

Kinder Morgan Inc ORD (NYSE:KMI) |

4.98% |

|||

|

Enterprise Products Partners LP (EPD) |

4.90% |

|||

|

Regency Energy Partners LP (NYSE:RGP) |

4.62% |

|||

|

Williams Partners LP (NYSE:WPZ) |

4.59% |

|||

|

Blueknight Energy Partners LP PFD (NASDAQ:BKEP) |

4.34% |

|||

|

Targa Resources Partners LP (NYSE:NGLS) |

4.34% |

|||

|

Plains All American Pipeline LP (NYSE:PAA) |

4.19% |

|||

|

Enbridge Energy Management LLC ORD (NYSE:EEQ) |

4.09% |

|||

The fund combines a large discount to NAV with a distribution yield.

The combination partially self-liquidates the fund over time, capturing some of the NAV discount with each distribution.

Disclosure: I am/we are long SRV.

Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by ...

more