Will Major Pot Stock Tax-Loss Selling Happen Again This Year?

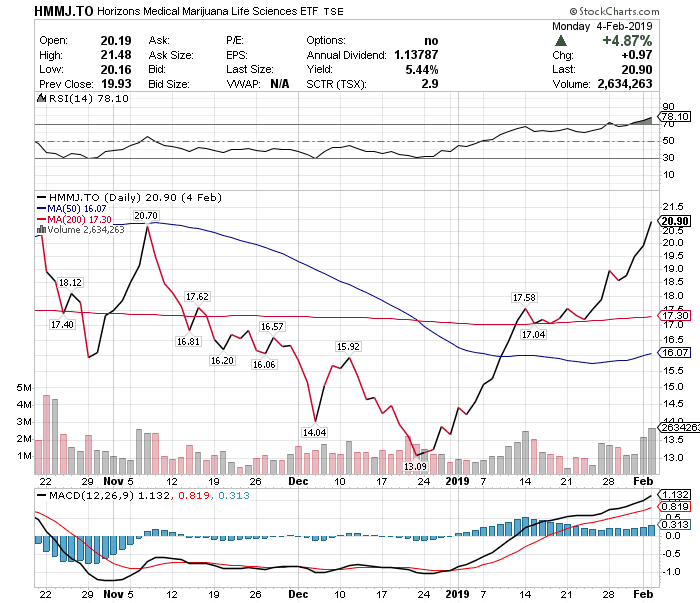

Tax-loss selling last year began in earnest on November 7th in 2018 with the various marijuana indices dropping 40%, on average, by the end of 2018 before increasing by 50% by the end of January, 2019. This article examines the prospect for such a swing in pot stock prices this year.

What Is Tax-Loss Selling?

- Tax-loss selling is when investors sell shares that have incurred huge losses during the year - but are deemed to have decent prospects going forward - to reduce the capital gain taxes earned on investments.

- Since the investor cannot repurchase the shares for a minimum of 30 days to be able to claim the tax deduction, most tax-loss selling occurs in November and December.

- As such, a good strategy for investors to take advantage of tax-loss selling is to:

- buy during the tax-selling period and sell after the tax loss has been established for a quick profit

- or, if the investor is interested in establishing a long position, the investor could use tax-loss selling as a good entry point.

Latest Pot Stock Performance

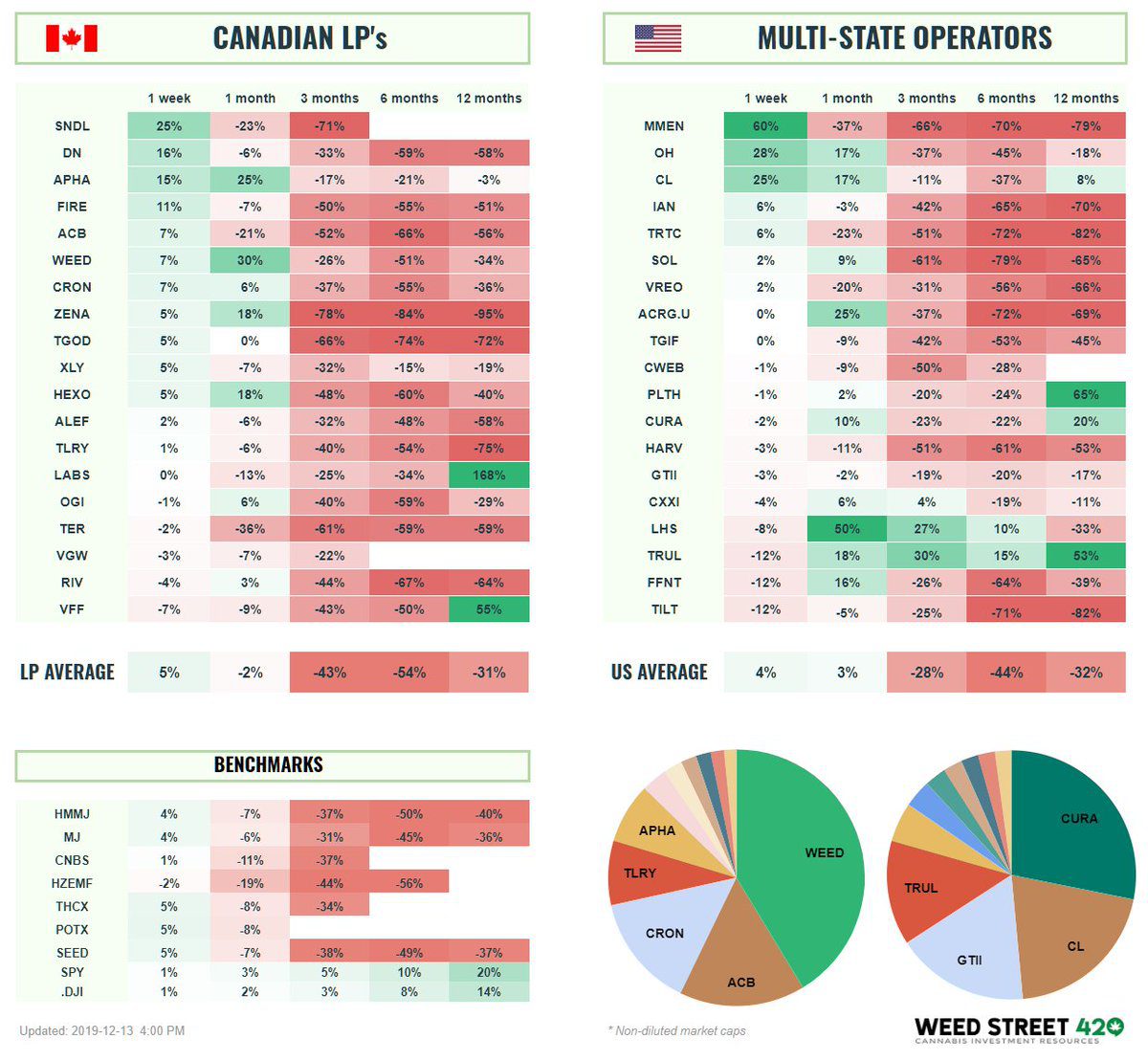

As noted in the table below the Canadian LPs were only down 2% and the American MSOs were actually up 3% in the past month (and up 5% and 4%, respectively, in the past week) suggesting that investors are not undertaking much tax-loss selling in the marijuana market this year.

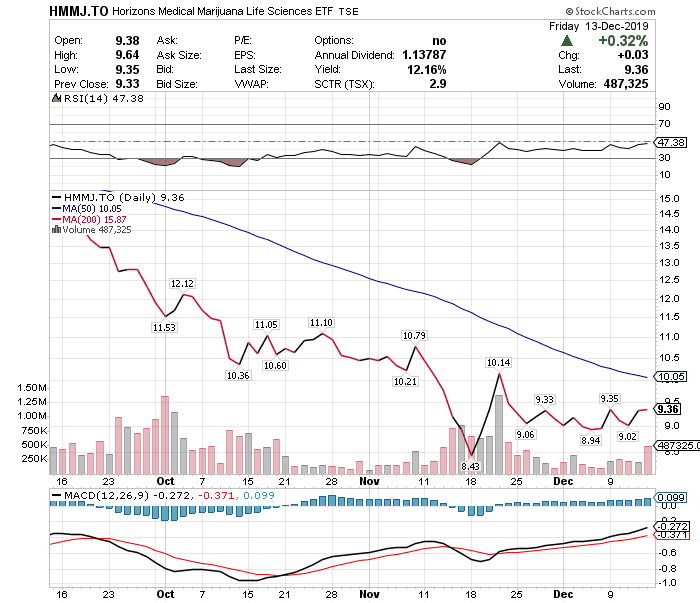

Of course, every investor's situation is different and there certainly will be some tax-loss selling in some accounts but it is evident from the chart below that it is not a major factor like it was last year.