Will JD.com Ever Pay A Dividend?

Focusing on dividend-paying companies – preferably those that increase their payouts each and every year – is a tried-and-true strategy to weather all sorts of economic storms. The consistently of receiving a cash payment every single quarter helps alleviate the volatility that inevitably shows up in business performance and certainly with day-to-day fluctuations in stock prices.

More importantly, a long record of paying and increasing dividends is a signal of a mature and enduring business that generates more cash than it requires.

Of course, the counterpoint to this notion is that an income investor misses out on all sorts of fast-growing companies that have not yet decided to start paying a dividend. A good example of this would be JD.com (JD), which has returned nearly 25% per year for the last five years.

With such strong returns, income investors might wonder if JD.com will ever pay a dividend. This article will attempt to answer that question.

Business Overview

Founded in 1998 and headquartered in China, JD.com Inc. is China’s largest online retailer and its biggest overall retailer. The company is a one-stop e-commerce platform providing over 440 million active customers access to products. Through the company’s logistics network and data-driven technologies, customers enjoy same- and next-day delivery as a standard service.

JD Worldwide allows brands from around the world to sell directly to Chinese customers, even those that do not have a physical presence in the country. U.S. investors can initiate an ownership stake via American Depository Shares (ADS), representing two ordinary shares, traded on the Nasdaq exchange with the “JD” ticker.

Last year the company generated $82.9 billion in sales and earnings-per-ADS of $1.18. For the nine months ending September 30th, 2020 JD.com has generated $76.8 billion in sales and earnings-per-ADS of $2.36. Roughly 88% of the sales of the $138 billion market capitalization company’s revenues are derived from products, with the remainder from services.

Growth Prospects

Source: Financial and Operational Highlights, JD.com, November 2020

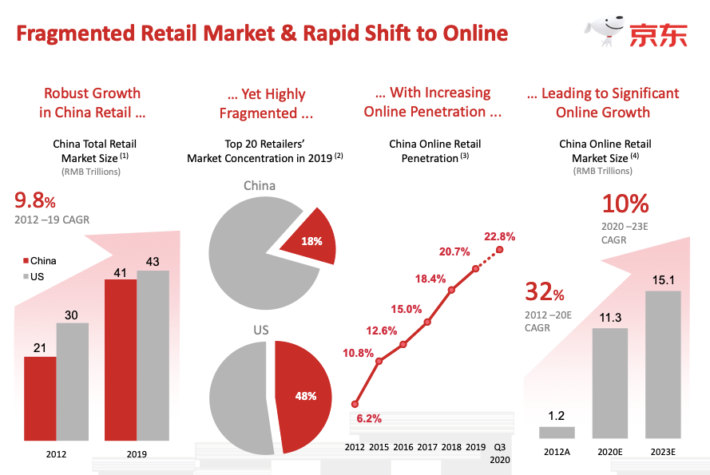

JD.com has a variety of tailwinds at its back. Perhaps the largest of which is being located in China, which has exhibited strong growth trends for quite some time. The total Chinese retail market has grown by nearly 10% per year dating back to 2012. Even so, the market is much more fragmented than the U.S., with the top 20 retailers holding less than 20% of the market, compared to almost half of the market for the top 20 U.S. retailers.

Not only is China in general growing very quickly, but the online segment is increasing rapidly as well. Penetration is increasing significantly, and the size of the Chinese online retail market is become larger and larger. In 2012 the online space made up roughly 6% of the market. This year it’s approaching a fourth of the overall market.

This has allowed for significant growth at JD.com as it stands squarely in the middle of this tailwind:

Source: Financial and Operational Highlights, JD.com, November 2020

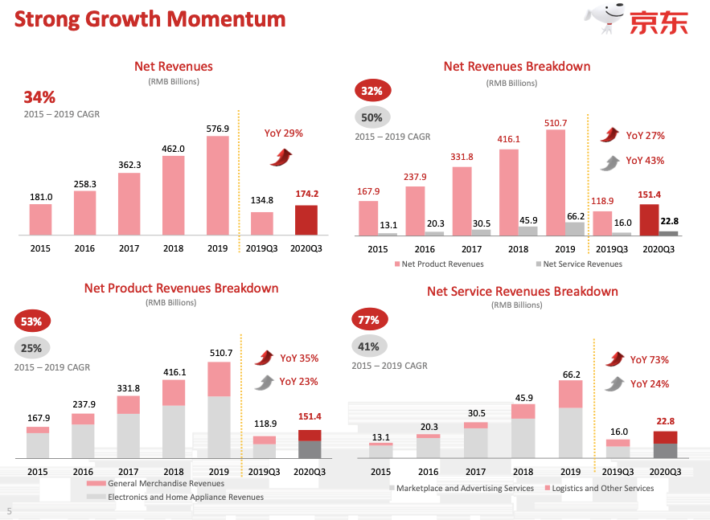

Net revenues have increased by a 34% annualized rate in the home currency during the 2015 to 2019 period. Service revenue in particular is quite impressive, but it is clear that growth has been across the board. Given that the company’s tailwinds are still very much in place, it appears JD.com’s growth runway is far from over.

Competitive Advantages

Source: Financial and Operational Highlights, JD.com, November 2020

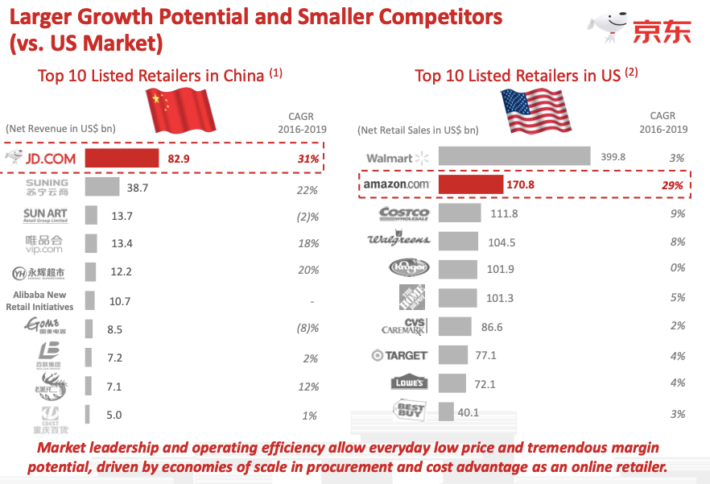

An interesting aspect of JD.com’s market compared to the U.S. is that the potential market is much larger, but the competition is smaller. This is beneficial for two reasons.

First, as the leader in the market, JD.com stands to collect its “fair share” of growth over time. Second, and just as importantly, there is enough growth to go around, meaning that one company’s gain is not necessarily another company’s loss.

Source: Financial and Operational Highlights, JD.com, November 2020

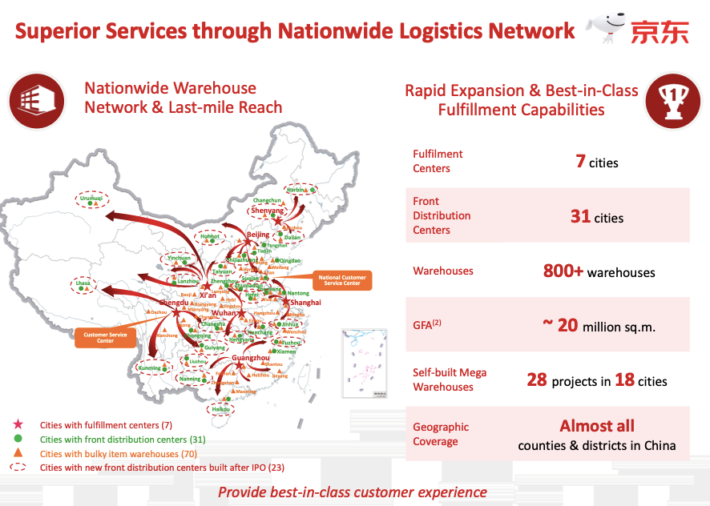

JD.com also has an immense nationwide network that serves as a lasting competitive advantage. It would be very difficult for an upstart to match the scale and reach of JD.com. This advantage provides three noticeable benefits: 1) keeping would-be competitors at bay, 2) allowing for an improved cost structure through scale, and 3) keeping the customer happy with quick and dependable service.

As of the most recent report, JD.com held $10.8 billion in cash, $30.6 billion in current assets, and $55.1 billion in total assets against $25.4 billion in current liabilities and $29.3 billion in total liabilities. Long-term borrowings were under $500 million which is quite impressive for such a large company that is growing as fast as it is.

Will JD.com Ever Pay A Dividend?

Any successful business works through different phases of needing and allocating capital. In the beginning, companies are usually capital-intensive, requiring significant funds. Equity is issued and debt is sought, while cash flows have not yet materialized.

In the growth phase profitability is possible, but the focus is often on reinvestment instead. This usually means reinvesting all cash flows and continuing to seek more capital via debt or equity.

Once a company begins to mature, the cycle starts to unwind itself. Debt and equity can still be used, but often the profits being generated are more than enough to service, sustain, and even grow (albeit at a slower rate) the now much larger business. Further, debt is reduced to a manageable level and a company may begin repurchasing shares. Finally, a dividend may be considered, indicating that the company is sustainable and generating excess funds.

When thinking about JD.com in that framework, JD.com is still very much in the growth phase. The revenue growth rate of JD.com has been fantastic – growing from $27 billion in 2015 to an expectation of over $100 billion this year – but that has not yet translated into terrific bottom-line results. JD.com lost money in 2015, 2016, and 2018 and barely broke even in 2017. Last year the company did post $1.18 in earnings-per-ADS and this year the number is already above $2 per ADS. However, a consistency in results has not yet been established.

If JD.com began paying out a $0.50 annual dividend – a sizable amount of recent earnings – this would imply a current dividend yield of 0.6%. However, this would interrupt the growth trajectory of the company. In the short to intermediate-term JD.com is not expected to pay a dividend. The focus will continue to be on strong top-line growth and reinvesting in the business, much like Amazon.com (AMZN).

However, this does not mean that the company will never pay a dividend. In general, there are three things to look for to provide some insight into when this may occur: a manageable debt load, a stabilizing share count, and maturing growth.

The debt load is already manageable, as JD.com has done a nice job of growing quickly without putting undue pressure on the balance sheet. Indeed, the balance sheet appears quite healthy.

The share count shows some signs of being leaned on. JD.com’s ADS share count stood at ~1.36 billion in 2015, compared to ~1.60 billion as of the most recent report. This is not excessive, but it does give you an idea of where additional funds are being sourced. When the share count starts stabilizing, without the company taking on excess debt, this could indicate a turning point in capital allocation.

Finally, when the top-line growth starts to slow, or more importantly when the bottom-line starts to show consistency, this could also be an inflection point in capital allocation.

Final Thoughts

JD.com has been a very successful investment as of late, compounding shareholder money at nearly 25% per year for the past five years. This success is driven by very strong top-line improvement, but the bottom-line has not yet demonstrated the same consistency.

The company is still very much focused on growth and reinvestment. In that vein, a dividend is not likely in the short or intermediate-term.

Over the long-term, if JD.com is able to convert is robust top-line growth into consistent bottom-line results, there may come a time when the company has excess funds available. At this point, the company could focus on the balance sheet, acquisitions, retiring shares or sending cash to shareholders.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more