Will Intuitive Surgical Ever Pay A Dividend?

Advances in technology have been enormous in recent years, to say the least. That is certainly true in medicine as well, with innovation in medications as well as equipment driving better outcomes for patients, and profits for the companies that innovate more quickly than competitors.

One such company is Intuitive Surgical (ISRG), a medical device maker that has seen its stock soar nearly 900% in the past ten years. It is a large-cap stock with a market capitalization now at a very impressive $88 billion after another strong run in 2020.

Intuitive Surgical’s profit base is quite significant and growing. But for income-focused investors, Intuitive Surgical may not be the right choice.

After all, the company has never paid a dividend. However, as it matures in its growth cycle and generates excess cash, the potential for a dividend rises. In this article, we’ll examine Intuitive Surgical’s business, growth potential, and whether it might ever pay a dividend.

Business Overview

Intuitive Surgical was founded in 1995, and in just 25 years, has gone from a startup with essentially no revenue to a giant in the field of medical devices. The company designs manufactures, and markets its da Vinci surgical systems and related accessories and instruments, primarily in the U.S.

The da Vinci machine is an all-in-one solution for performing a variety of surgical procedures as the surgeon is aided by technology, rather than relying upon a human to perform the surgery alone. Da Vinci’s applications are numerous, including gynecology, urology, cardiothoracic, head and neck procedures, and more. The uptake in da Vinci has been extraordinary over the years, and this single product has turned Intuitive Surgical into the global leader in medical devices that it is today.

The da Vinci machines performed more than 7.2 million procedures worldwide last year, and without the disruption of COVID-19, would have performed significantly more this year. However, the company’s installed base of nearly six thousand machines, as well as its ever-growing customer list mean that the backlog for postponed surgeries is robust.

Intuitive is on pace for $4.3 billion in revenue this year, which would be down from $4.5 billion in 2019. However, investors shouldn’t take this as anything other than an indication that COVID-19 disrupted procedures around the world, and beginning in 2021, we believe the company will be right back on track.

Growth Prospects

Despite its large size, Intuitive Surgical has an immense amount of growth potential in front of it. The installed base of da Vinci machines has grown at double-digit rates for years, including a 12% gain in 2019. In addition, the number of procedures the machine can do is expanding, meaning that customers are finding greater utility in the machine.

This has led to more procedures per machine, as well as existing customers purchasing additional machines.

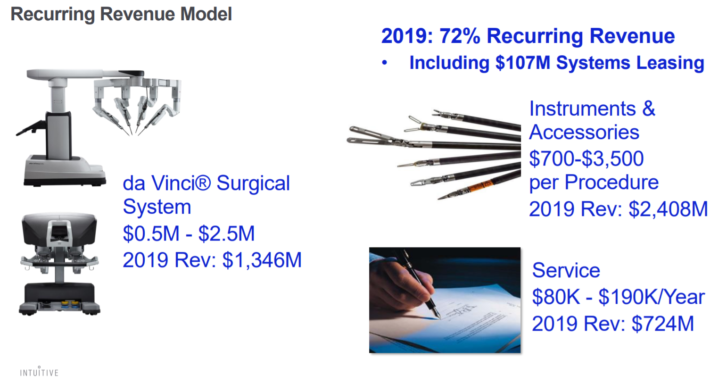

Source: Investor presentation

Da Vinci machines cost between $0.5 million and $2.5 million to purchase, depending upon configuration, which generated about $1.3 billion in total revenue last year. Those are one-time purchases for the customer, but it opens the door to significant recurring revenue for Intuitive Surgical as the machine is used in procedures subsequent to purchase.

The lucrative recurring revenue is what is helping to drive Intuitive Surgical’s growth, as a higher installed base of machines means a higher level of recurring revenue, which comes from servicing revenue, as well as accessories and peripherals that are used up during a procedure. Indeed, recurring revenue was 72% in 2019, which is extremely attractive from an investor’s perspective.

Source: Investor presentation

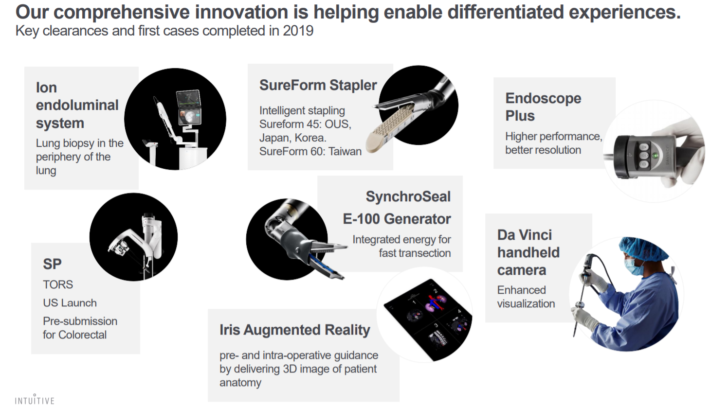

Intuitive Surgical isn’t resting on its laurels, however. The company continues to use the cash it generates to invest in future growth, including improving its core da Vinci system, but also in creating new products that serve related needs.

Above is just a sampling of the growth initiatives the company is working on, and while none of these is likely to ever reach anything like the success of da Vinci, diversifying away from a core product is always a good idea. We believe that Intuitive Surgical’s growth runway in the coming years is enormous, and project revenue growth in the low-double-digits annually, with earnings-per-share growth closer to 20%.

The company’s most recent earnings report showed a slowdown compared to prior quarters, but again, this was due to COVID-19-related disruption, and not a fundamental deterioration in the company’s prospects. Worldwide da Vinci procedures rose 7% year-over-year, reflecting what the company called a partial recovery from COVID-19.

It also shipped 195 da Vinci systems, a decline of 29% from the 275 systems it shipped in the same period a year ago. However, the installed base grew 8% year-over-year to 5,865 systems as of the end of the quarter.

Revenue was $1.078 billion, a decline of 4% year-over-year, driven by fewer new system placements in 2020, as well as a slight decline in revenue from the company’s customer relief program, which is a direct result of COVID-19.

Instruments and accessories revenue was up 4% year-over-year to $631 million, which was driven by the growth in procedure volume. Systems revenue was down 21% to $268 million, attributable to fewer new machines being shipped.

Net income came to $334 million, or $2.77 per share on an adjusted basis, down from $409 million and $3.43 per share in the same period a year ago. Intuitive Surgical built its cash position by a further $287 million in Q3, and it now stands at $6.4 billion.

Competitive Advantages

Intuitive Surgical’s competitive advantage is obvious in that it is the only company in the world that makes a machine that is as versatile and well-accepted among medical practitioners as da Vinci. Its unparalleled growth in the past two decades is a testament to its durable advantage.

Source: Investor presentation

The company is still heavily reliant upon the US for its revenue, but as the above picture shows, Intuitive Surgical has been busy expanding globally as well.

With a huge market opportunity for thousands of new da Vinci placements in the developed and developing markets of the world, we see this advantage as durable for the long-term. There simply is not a viable competitor to da Vinci at this point.

Will Intuitive Surgical Ever Pay a Dividend?

Given all of this good news about the company’s prospects and indeed its current position of strength, will it ever return cash to shareholders via dividends? Intuitive Surgical certainly has the ability to do so, which can’t always be said regarding growth stocks. It has a cash position of more than $6 billion and generates hundreds of millions of dollars of additional cash each quarter.

Intuitive Surgical, however, has been investing that cash to fund future growth, as it has since its founding 25 years ago. The company makes small acquisitions to buy technology it can scale for future growth, and it has been buying back a relatively small amount of stock, mostly to offset dilution from employee stock awards.

We believe the company will continue this practice for the foreseeable future, meaning it is very unlikely to pay a dividend soon. However, given that the company is obviously generating much more cash than it needs to invest in the business, we believe the potential is there for Intuitive Surgical to pay a dividend.

We think this is likely many years away. But once the installed da Vinci base reaches maturity, and barring a massive strategic shift, we believe the company will have much more cash than it can profitably invest, and may therefore consider paying a dividend.

Final Thoughts

Intuitive Surgical has been one of the best medical equipment stocks to own for years. The company’s growth has been enormous, and shareholders have reaped the rewards. However, income investors would have no reason to own the stock given it has never paid a dividend.

While we don’t think that will change soon, we do believe the company will reach a point where it generates more cash than it can invest in the business. The company has proven it will return cash to shareholders via share repurchases, so a dividend isn’t a big stretch from there.

With a durable competitive advantage, a very long runway for growth, and strong free cash flow generation, we believe we will see Intuitive Surgical mature in the years ahead, and potentially begin paying a dividend to shareholders.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more