Will DoorDash Ever Pay A Dividend?

DoorDash (DASH) has attracted the focus of the investing community, fresh off its initial public offering at $102 per share on December 9th, 2020. The stock has already rallied over 50%, just one week after its IPO.

As a result, DoorDash is already a large-cap stock with a market capitalization above $50 billion. We have compiled a list of over 400 large-cap stocks in the S&P 500 Index, with market caps of $10 billion or more.

The impressive rally of the stock has resulted from rising enthusiasm about the growth potential of the company, which is in the very early stages of a multi-year growth trajectory.

Income investors may have missed DoorDash’s rally as the company just performed its IPO and it does not pay a dividend. The absence of a dividend is fairly common among growth stocks, particularly those in the technology sector.

Income-focused investors who are attracted by the impressive return potential of DoorDash probably wonder whether the company will pay a dividend anytime soon.

Business Overview

DoorDash was founded in 2013, when it launched a website displaying menus from local restaurants in Palo Alto, California. Since then, the company has grown to a huge marketplace, which connects more than 390,000 merchants, more than 18 million consumers, and one million users who use its logistics platform. Its platform enables local brick-and-mortar businesses to thrive in the current demanding business landscape, in which consumers focus on ease and convenience.

Technological advances have dramatically changed the behavior of consumers, who have become remarkably demanding with regard to convenience. Consumers now demand products and services inexpensively and quickly, at the touch of a button.

This shift, which has greatly accelerated this year due to the coronavirus crisis, has completely changed the business landscape for local businesses, which were used to offer personalized experience only at their stores. DoorDash has filled this gap with its platform, which helps merchants satisfy the needs of consumers and thus increase the number of their customers.

There are more than 30 million small businesses in the U.S., which play a major role in the economies of suburban areas. Those small businesses, along with the franchisees of large national or international chains, have created approximately two-thirds of the net new jobs in the U.S. over the last two decades. They thus represent a gigantic market for DoorDash.

Thanks to the value that DoorDash offers to its merchants, it has become the largest and fastest-growing business in the category of U.S. local food delivery logistics.

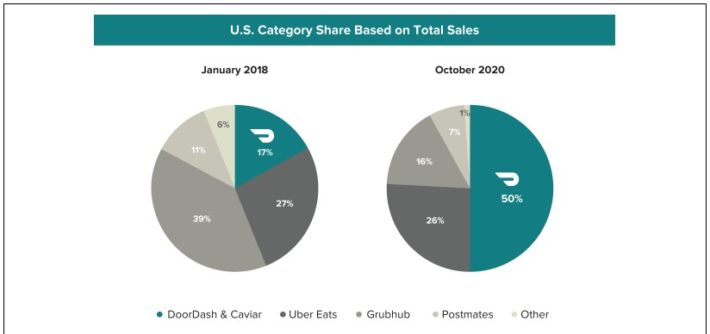

Source: Annual Report

As shown in the above chart, DoorDash has nearly tripled its market share in its business in less than three years, from 17% in early 2018 to 50% in late 2020. This is undoubtedly one of the reasons behind the impressive rally of the stock on the first day of its IPO.

Growth Prospects

The steep increase in the market share of DoorDash may lead some investors to think that the company has limited growth potential ahead. However, this is far from true.

The number of U.S. consumers who use the platform of DoorDash is less than 6% of the U.S. population. In addition, in 2019, the marketplace of DoorDash generated gross order value of $8.0 billion. That value was only 2.7% of the gross order value of $303 billion spent off-premise at restaurants in the country. It is evident that DoorDash has ample room for future growth, even if it focuses exclusively on the food delivery business. However, the company has stated that it will expand to many other areas apart from food delivery.

The growth potential of DoorDash is evident from the trend in its revenues in the last two years. The company more than tripled its revenues, from $291 million in 2018 to $885 million in 2019. In the first nine months of 2020, DoorDash has more than tripled its revenues over last year’s period and there are no signs of fatigue in its growth trajectory. Instead, the pandemic has actually provided a strong tailwind to its business, as it has accelerated the shift to online shopping and food delivery at home.

Competitive Advantages

The logistics platform of DoorDash gathers a broad range of information, which is analyzed by machine learning algorithms and thus improves the performance of the platform. This is a significant competitive advantage.

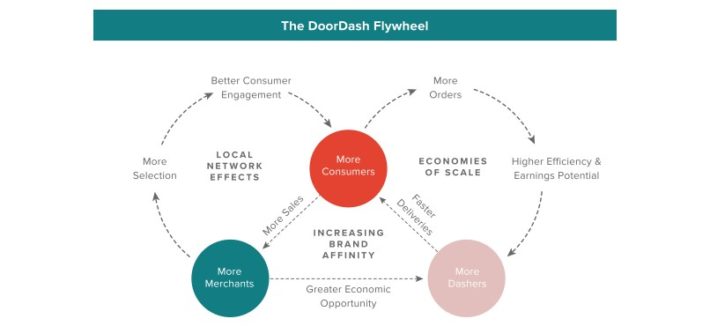

Moreover, there are some virtuous cycles generated from the growing number of merchants and customers in the platform and the interaction among them.

Source: Annual Report

The increasing number of customers enhances the market size and the efficiency of merchants while the increasing number of merchants offers more options to consumers, who thus become more engaged to the platform. In addition, the tremendous growth in the sales generated in the platform create great economies of scale for merchants at the logistics front. This is another competitive advantage.

On the other hand, investors should always keep in mind that technology companies rarely enjoy a strong competitive advantage, as the industry is highly competitive. This is certainly the case for DoorDash. In addition, there is usually cut-throat competition in the tech sector and hence many companies run the risk of incurring business deterioration if their competitors achieve major technological breakthroughs. Overall, DoorDash enjoys a relatively narrow business moat.

Will DoorDash Ever Pay A Dividend?

In order to pay a dividend, companies need to generate positive free cash flows. In other words, their business should generate cash flows that exceed the capital expenses by a wide margin. Some popular tech stocks cannot pay dividends to their shareholders due to their negative free cash flows. For instance, Uber (UBER), Lyft (LYFT), and Netflix (NFLX) have not managed to generate positive free cash flows yet.

DoorDash spends a great portion of its revenues on sales and marketing expenses in order to attract and engage new customers. As a result, the company has not managed to make a profit yet while its free cash flows are negative.

Even its EBITDA margin is extremely low. It was in deep negative territory in the last two years and has just become positive this year, at 5%. All the above confirm that there are no funds available for the initiation of a dividend.

Analysts expect DoorDash to switch from a loss per share of -$0.68 this year to a profit per share of $0.21 in 2022. Even better, they expect high earnings growth going forward, and thus they expect DoorDash to earn $0.81 per share in 2023 and $2.68 per share in 2025.

However, investors should not expect a dividend from DoorDash even when it becomes profitable, at least as long as the company remains in high growth mode. The company is growing its business at such a high rate that it makes much more sense to invest in the business instead of initiating a dividend.

DoorDash recently stated that it will continue investing heavily in its business in order to grow the number of merchants and consumers who use its platform. Therefore, the company will continue spending a great portion of its revenues on sales and marketing for the foreseeable future.

As DoorDash has many years of double-digit revenue growth ahead, it is not likely to initiate a dividend anytime soon. Instead, its management is likely to remain focused on its growth initiatives. Therefore, shareholders should be completely satisfied as long as the company keeps growing at a fast pace, without initiating a dividend.

High-growth companies do not offer a dividend for another reason as well. Their stocks usually enjoy such a rich valuation that a dividend is meaningless for the shareholders. To provide a perspective, DoorDash is currently trading at 195 times its expected earnings in 2023. Therefore, even if the company distributes 50% of its future earnings in the form of dividends, it will offer just a 0.3% dividend yield. Such a yield will be negligible for its shareholders and hence there is no incentive for the company to initiate a dividend.

Final Thoughts

To sum it up, DoorDash is in the very early stages of its growth trajectory, with exciting growth prospects ahead thanks to the immense size of its addressable market. As a result, the company will remain focused on its growth strategy and will continue investing a great portion of its revenues in its business. It is thus not likely to initiate a dividend for the next several years.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more