Will Datadog Ever Pay A Dividend?

Sure Dividend believes that the best way to build wealth over the long-term is by investing in companies with long track records of dividend growth. That is why we often highlight the Dividend Aristocrats, a group of 65 stocks in the S&P 500 with at least a quarter-century of dividend growth, as an excellent place for investors to find high-quality dividend stocks.

That said, we understand that investors might find growth stocks, especially in the technology sector, an attractive investment vehicle.

One name that has become popular among investors is Datadog, Inc. (DDOG). Datadog had its initial public offering on September 10, 2019. The stock opened up with an IPO price of $27 before climbing 39% at the end of its first trading day. Shares of Datadog has been riding an incredible hot streak as the stock is up more than 138% in 2020, which compares quite favorably to the 10.2% return of the S&P 500 index.

Datadog does not yet pay a dividend, but this isn’t unusual for young technology stocks. Many others didn’t pay a dividend for quite some time and others, like Alphabet (GOOGL), still do not distribute one to shareholders.

Income orientated investors interested in Datadog might want to know if Datadog will ever pay a dividend. This article will examine the company, its growth prospects, and whether or not investors can expect a dividend in the future.

Business Overview

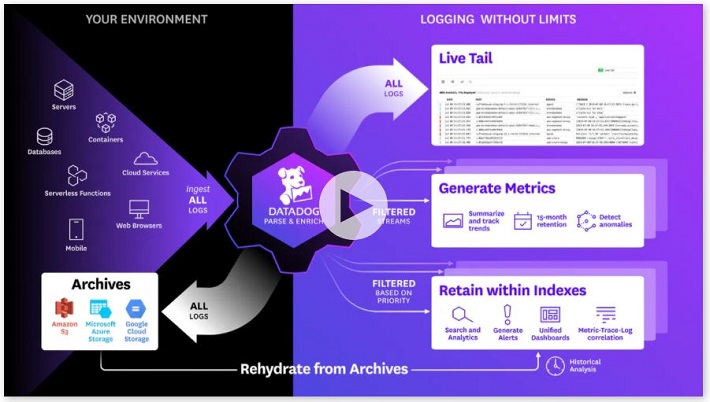

Datadog provides monitoring and analytics platforms for developers as well operations teams and business users in the cloud. The company’s software-as-a-subscription platform, or SaaS, integrates and automates infrastructure monitoring, application performance monitoring, and log management.

Essentially, Datadog’s platform ensures that developers and administrators’ applications and infrastructure are working correctly. The company’s software is able to track performance running in public clouds and data centers.

Datadog competes head to head with some of the largest names in cloud and software, like Amazon (AMZN), Cisco Systems (CSCO), and Microsoft Corporation (MSFT).

The company should generate approximately $589 million in revenue in 2020. Shares currently trade with a market capitalization of $27 billion.

Growth Prospects

As one might expect with a nearly 140% gain in share price so far this year, investors expect Datadog to have plenty of growth in its future.

Even though the company is smaller than its large cap competitors, going against the biggest names in cloud and software has not hurt its business. Datadog’s revenue grew 61.4% to $154.7 million in the third quarter. Revenue has improved every quarter that Datadog has been a publicly-traded company. That streak is expected to continue in the fourth quarter when revenue is expected to be up more than 43%.

So far, Datadog has been quite successful at winning customers. The company’s platform is adaptable to customers in a variety of industries, such as financial services, gaming, retail, healthcare, and manufacturing. As of September 30, 2020, Datadog has more than 1,100 users with annual revenues of more than $100,000, a 52% improvement from the previous year. Total users grew to 13,100 from 9,500 year-over-year.

Also adding to future growth prospects is that the market for cloud computing is expected to grow at a high rate over the next five years. Estimates peg the global cloud computing market at ~$370 billion for this year. This figure is expected to grow at a rate of almost 18% annually through 2025.

This will create an immense market for Datadog, and others, as customers demands for cloud-related services will surge at a high rate in the coming years. The potential size of this market will also make it likely that Datadog will see its robust growth rate continue.

Competitive Advantages

Datadog’s platform allows for ease of troubleshooting and exploration of customer data.

Source: Datadog.com

The platform automatically collects data from all of the customer’s services, applications and platforms. It is also allows the user to observe logs in real time and archive all logs into a centrally stored space. Datadog makes it easy for customers to unify their on premise network with the cloud, placing all of their data in one unified, secure space.

Customers can also measure traffic by both the source and destination, allowing them to understand the traffic flow in cloud-native environments. This trace can be grouped by data centers, teams or individuals and can report valuable information, like traffic volume. The platform makes troubleshooting and application optimization easily accessible.

Finally, Datadog is compatible with Amazon Web Services, Azure and Google Cloud, three of the most widely used and trusted cloud storage platforms in the market.

Will Datadog Ever Pay a Dividend?

Unlike many technology companies that come public, Datadog is already profitable. The company’s adjusted earnings-per-share have been positive every quarter since its IPO.

In addition, Datadog now possesses a key metric that many other technology companies are missing so early in their publicly-traded existence: positive free cash flow.

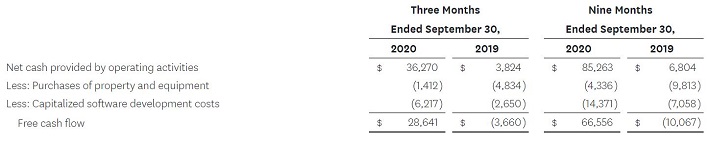

Source: Press Release

The company generated $36.3 million of cash from operating activities and $28.6 million of free cash flow during the third quarter.

This is a remarkable turnaround from the prior year where cash from operating activities was just $3.8 million and free cash flow was a negative $3.7 million. Year-to-date, Datadog has produced cash from operating activities of $85.3 million and free cash flow of $66.6 million.

Extrapolating free cash flow for the first nine months of the year to all of 2020, Datadog would be projected to generate almost $89 million of free cash flow for the year. Let’s suppose that the company chose to appropriate half of the company’s free cash to pay a dividend to the 333 million shares outstanding. In this hypothetical situation, Datadog could theoretically distribute $0.133 per share.

However, shares of the company are extremely expensive as they trade with a 12-month price-to-earnings ratio of 468. Datadog is even expensive on a price-to-sales ratio, which is ~46 currently.

Investors willing to pay this kind of multiple to own the stock likely aren’t concerned about the company’s ability to pay a dividend. These shareholders are in the name for the growth potential, which they likely see as exceptional giving the growth Datadog is already displaying and the expected size of the cloud computing market. A dividend would be seen as a lost opportunity for Datadog to reinvest and grow its business.

Finally, even if the company distributed half of its free cash flow projection for the year, Datadog’s yield would be just 0.15%. This yield is hardly worth using up half of the company’s free cash flow that would be better spent growing the business.

Final Thoughts

Datadog’s growth, both in terms of business and share price performance, has been extraordinary in the short time that the company has traded in the public markets.

While total revenue remains low, the growth rate has been very high. Even better, Datadog has a bright future ahead of itself due to the sheer size and expected growth rate for cloud computing. The company’s platform makes it easy for customers to centralize and monitor their cloud network and data, an appealing aspect of Datadog’s platform.

Datadog is well ahead of many other technology IPOs in that it is already profitable and generating positive free cash flows. These two items make paying a dividend much more plausible.

Given that Datadog remains in its corporate infancy and the total addressable market for cloud computing, we feel it will be quite some time, possibly a decade or more before Datadog shareholders can expect to receive a dividend from the company.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more