Will Amazon Ever Pay A Dividend?

In the years since the bursting of the “Dot Com” bubble in 2000, a major shift took place in the technology sector. After share prices across the technology sector crashed, investors began to demand the stability of dividends, rather than relying solely on a rising share price for capital appreciation.

Over the past decade, many technology companies such as Apple, Inc. (AAPL), Cisco Systems (CSCO) and others have initiated dividend payments to shareholders. There are now over 300 dividend-paying technology stocks that are every bit as profitable as dividend-paying companies in other market sectors.

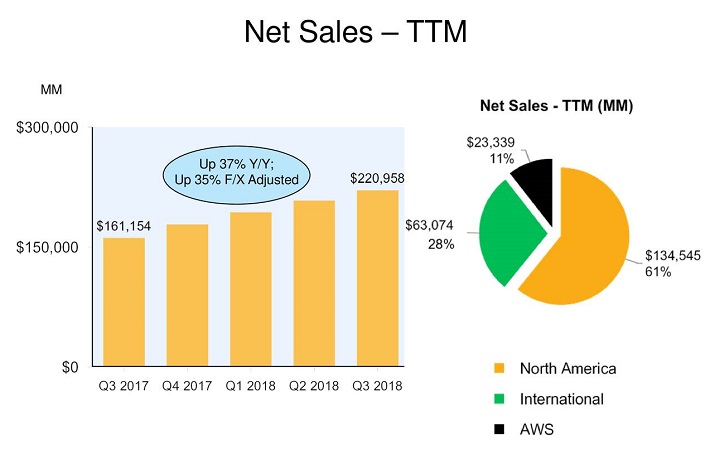

One tech company that has not initiated a dividend policy is e-commerce giant Amazon.com Inc. (AMZN). Despite climbing to a market capitalization above $800 billion, with over $220 billion in annual revenue, Amazon still does not pay a dividend to shareholders. This article will discuss the chances of Amazon ever paying a dividend.

Business Overview

Amazon is an online retailer that operates a massive e-commerce platform where consumers can buy virtually anything with their computers or smartphones. It operates through the following segments:

- North America

- International

- Amazon Web Services (AWS)

The North America and International segments include the global retail platform of consumer products through the company’s websites. The Amazon Web Services segment sells subscriptions for cloud computing and storage services to consumers, start-ups, enterprises, government agencies, and academic institutions.

Amazon’s e-commerce operations fueled its massive revenue growth over the past decade. Consider that in 2008, Amazon generated revenue of $14.84 billion. Last year, Amazon brought in revenue of $177.87 billion, for a compound annual growth rate of 28%.

Amazon has continued to generate strong growth to start 2018. Third-quarter sales increased 29% to $56.6 billion.

Source: Earnings Slides, page 7

The company generated earnings-per-share of $14.10 through the first three quarters, which means earnings for the full year are set to grow at a high rate from 2017. Of course, Amazon’s huge revenue growth did not come easy (or cheap). Amazon had to spend huge amounts of money to build its retail operation. As a result, Amazon had razor-thin profit margins for many years of its growth phase.

That said, the company was profitable in every year over the past decade except 2014. Last year, Amazon generated diluted earnings-per-share of $6.15, compared with just $1.12 per share in 2007. One of the biggest drivers of Amazon’s strong earnings growth is its high-margin Amazon Web Services. While the retail business continues to operate at very low gross margins, the AWS segment is highly profitable, which improves Amazon’s chances of paying a dividend at some point in the future. That said, the company still plans to invest heavily in growth.

Growth Prospects

As is typical with many technology companies, Amazon continues to invest heavily in growth. This is partly a necessity. Things move extremely fast in technology, a highly competitive and cyclical industry. Technology firms need to invest large amounts to stay ahead of the pack. Amazon is no different—it is making major investments to continue building its online retail platform. Last year, Amazon acquired natural and organic grocer Whole Foods for nearly $14 billion. This gave Amazon the brick-and-mortar footprint it desired to further expand its reach in groceries.

Amazon isn’t stopping there. In addition to the retail industry, it aims to spread its tentacles into other industries as well, including media and healthcare. Amazon has built a sizable media platform in which it distributes content to its Amazon Prime members. Making original content is a highly capital-intensive endeavor, which will require huge sums in order for Amazon to compete with the likes of streaming giants Netflix (NFLX) and Hulu, as well as other television and movie studios.

Separately, earlier this year Amazon acquired online pharmacy PillPack for just under $1 billion, likely a precursor to a bigger move into healthcare distribution. Last but not least, Amazon is set to invest $5 billion to build two new headquarters in New York City and Virginia.

These investments will fuel Amazon’s growth, which is what the company’s investors are primarily concerned with. Nevertheless, such aggressive spending will limit Amazon’s ability to pay dividends to shareholders, at least for some time.

Will Amazon Ever Pay A Dividend?

Amazon has joined the ranks of highly-profitable tech companies like Apple and Cisco, both of which pay dividends to shareholders. In this way, Amazon has climbed ahead of other similar tech stocks like Netflix (NFLX), which does not currently pay a dividend (and might never) due to a lack of consistent profits. However, Amazon still has a way to go before anyone should realistically expect it to begin paying dividends.

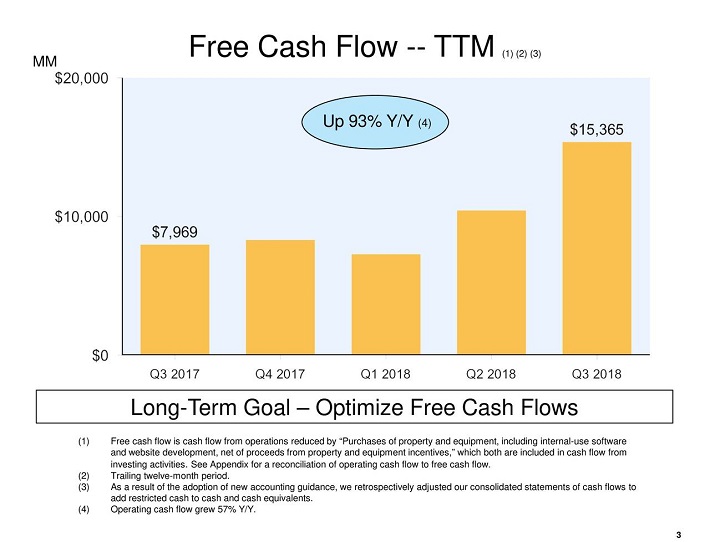

On one hand, Amazon is cash flow-positive, meaning it generates free cash flow that could be used to pay dividends. In the trailing 12-month period through the most recent quarter, Amazon generated free cash flow above $8 billion. Its free cash flow more than doubled from the same period the previous year.

Source: Earnings Slides, page 3

If Amazon chose to, it could distribute a dividend to shareholders, although it would not be easy. Amazon currently has 501 million shares outstanding. Amazon could target a modest dividend payout ratio of $2 billion—approximately 25% of its trailing 12-month free cash flow—which would amount to approximately $3.99 per share. At a recent share price of $1,657, an annual dividend payout of $3.99 per share would represent a dividend yield of just 0.2%, which would be virtually meaningless for income investors. The company could pay out a greater percentage of its free cash flow, but this would hinder its ability to invest in growth, which is critical for technology companies.

Final Thoughts

There is no debating the fact that Amazon has been one of the most impressive growth stories in history. From its humble beginnings as an online book seller, Amazon now dominates the online retail industry. It is also a massive cloud services provider, a movie studio and content streaming giant, and could soon become a major player in healthcare.

Amazon is still in its growth stage. Consequently, Amazon does not yet appear to be in a suitable position to initiate a dividend program. But there is hope for the company to pay a dividend at some point in the future, if its growth needs wind down, and cash flow continues to grow. Still, it will likely be several years at least before Amazon declares a dividend.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more