Will Adobe Ever Pay A Dividend?

Income investors tend to focus their attention on dividend stocks. This is largely due to the fact that these stocks provide income to shareholders regardless of the economic conditions. Some companies cut their dividends when times get tough, but many, including the Dividend Aristocrats tend to continue to distribute dividends even during recessions.

The downside of this focus is that income investors can often miss out on companies with incredibly high growth rates simply due to the lack of a dividend.

One company that doesn’t pay a dividend, but has seen its business and share price grow at an exceptionally high rate is Adobe Inc. (ADBE). Shares of the company have generated annualized returns of 32% over the last decade. A $10,000 investment in Adobe in 2010 would be worth almost $168,000 today.

While there is no doubting Adobe’s growth over the last decade, income investors interested in the company likely want to know if the company will ever pay a dividend. This article will review Adobe’s business model, its prospects for growth, and competitive advantages to determine if shareholders can expect a dividend any time soon.

Business Overview

Adobe offers a wide variety of computer software products that allow users to create, transfer and print electronic documents. The company is composed of three business segments. The Digital Media segment provides tools and solutions for users to create, publish, promote and monetize digital content.

The Digital Experience segment provides products and solutions for the creation, management, measuring and optimizing of customer experiences in a variety of areas. The Publishing segment’s portfolio of products and services includes technical document publishing, web application development and high-end printing.

The company was founded in 1982 and changed its name from Adobe Systems Incorporated in 2018. Adobe trades with a market capitalization in excess of $225 billion and generated more than $11.2 billion in revenue last year.

The company’s leading software products include Photoshop, Illustrator, Acrobat and InDesign. Adobe also offers a subscriptions service, called the Creative Cloud, that allows for access to the latest version of all of its creative products.

Growth Prospects

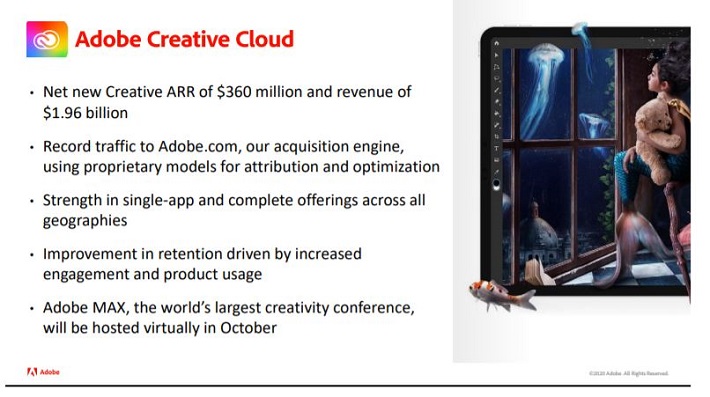

Adobe’s bundling of its content creation software into the Creative Cloud has made a one-stop-shop for customers.

Source: Investor Presentation

Making these products available by subscription has broad appeal among customers. For as low as $10 a month, customers can access and use Adobe’s products. The subscription model helps to even out revenue results as customers make monthly payments instead of a one-time fee.

The Creative Cloud is popular among both professional and amateurs and appeals to customers in many different professions, such as publishing, animation, and photography. The Creative Cloud also makes cross-selling quite easy as customers can pick and choose which products this wish to pay for.

In addition, Adobe continues to see strong sales numbers for even its older products. For example, Acrobat, and its PDF file format, now bring in annual revenue of ~$1 billion. Though there are several PDF editors on the market, Adobe’s Acrobat Pro DC is tops on the market.

Also fueling growth in this area is the need for documents to be viewable on any device that a customer might have, such as laptop, smartphone, and tablets. This trend has only been amplified by the coronavirus pandemic as business and employees had to transition to a stay-at-home workforce in a very short time for large portions of the economy.

Adobe also augments its core business with bolt-on additions, especially in the area of digital experience. For example, the company acquired Marketo, a leader in business-to-business marketing engagement, for $4.8 billion in 2018. The Marketo Engagement Platform offers advanced analytics that allow for the handling of a large amount of data and more complex marketing processes.

In total, Adobe has multiple growth levers to pull, making it likely that the company will continue to be a major player in its industry.

Competitive Advantages

Adobe has stated that it sees its total addressable market for application software of almost $128 billion. The company currently holds a little less than 10% of this market, giving it plenty of room to capture additional share. With a leadership position in its industry, due both to organic growth and acquisitions, the company is primed for future growth as well.

One key competitive advantage that the company enjoys is the high costs of switching from the Creative Cloud. With all the features available that a customer needs, the regular updating of applications and the widespread acceptance of the products, the likelihood that customers would switch to a different platform is quite low. And with so many different disciplines using the products, Adobe’s customer pool is very deep.

This should allow Adobe to continue to grow at a high clip even after the growth that the company has experienced over the last decade.

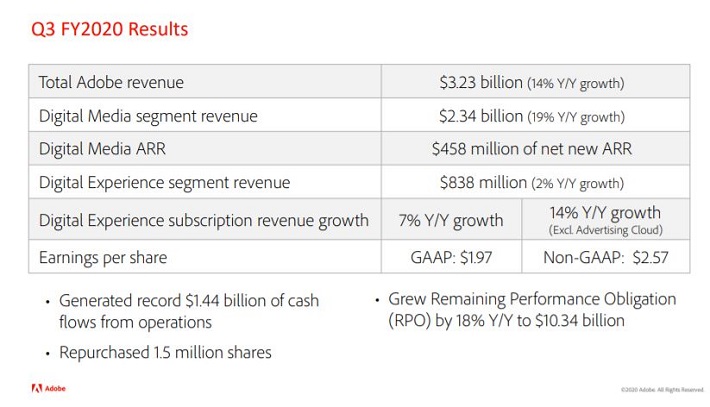

A good example of this are the company’s most recent earnings results.

Source: Investor Presentation

Adobe reported third-quarter earnings results on September 15th, 2020. Adjusted earnings-per-share increased more than 25% to $2.57. Revenue grew almost 14% to record $3.2 billion. Digital Media, which is the largest component within Adobe, grew 19% with subscription revenue growing a high single-digit figure.

Adobe has had a long history of high growth rates and that looks to continue this year as well. On average, analysts expect adjusted earnings-per-share to grow 30% from 2019 with revenue projected to increase 15% to $12.8 billion.

Will Adobe Ever Pay A Dividend?

Adobe has two of the most important items necessary for dividend growth: profitability and free cash flow growth. The company has seen impressive earnings growth over the last decade as adjusted earnings-per-share have increased with a compound annual growth rate of nearly 14% from 2010 through 2019. As discussed previously, adjusted earnings-per-share is expected to be higher by twice its CAGR in 2020.

Analysts believe that adjusted earnings-per-share growth will be 12% in 2021, which is more in-line with the company’s long-term average. Even so, double-digit growth compared to this year would be an excellent result considering what analysts expect the company to produce.

Adobe also has seen a massive increase in free cash flow in just the past few years alone. For 2019, the company produced free cash flow was just over $4 billion, which was more than twice its total in 2016. Extrapolating what Adobe has generated through the first nine months of the year to the rest of the year, free cash flow is on pace to reach $4.8 billion in 2020. This would be a 20% increase from last year’s total.

Let’s assume that Adobe wanted to set aside one-third of its annual cash flow to be used to distribute dividends to shareholders. Using estimates for 2020 and the most recent share count of 485 million shares, the annual dividend would be $3.30. Based on Wednesday, November 25th closing price of $470, shares of Adobe would offer a dividend yield of 0.7%.

The yield, though low, matches Apple’s (AAPL) yield exactly and isn’t too far off Microsoft’s (MSFT) 1% yield. Investors desiring a high yield wouldn’t find Adobe’s yield that attractive, but given the company’s ability to grow its free cash flow, the dividend growth rate could be quite high.

The best part is that this projected yield stems from using just one-third of free cash flow to pay the dividend. If the company targeted a larger percentage of free cash flow then the yield would be slightly higher. In fact, using 50% of free cash flow would give the stock the same exact yield as Microsoft.

That said, Adobe is still in the growth stage of its business life even after more than a decade of exceptional returns. Adobe continues to make acquisitions to support its core businesses, which require the use of cash to do so.

As such, we don’t expect Adobe to pay a dividend in the very near-term, but if free cash flow growth continues at an elevated rate then a payment in the future could definitely be in the cards. Were this to occur, Adobe would likely be able to grow its business while also paying a dividend.

This would give income investors an almost “best of both worlds” situation where Adobe continues to grow while also throwing off some income. In our estimate, it would probably be several years from now before Adobe would start distributing a dividend.

Final Thoughts

Adobe has been one of the best-performing stocks over the last decade. Even better, the company looks poised for continued growth due to demand for its products and acquisitions that add to Adobe’s product offerings.

Adobe is also a highly profitable company that has demonstrated tremendous free cash flow growth. While the company does not currently pay a dividend, Adobe shareholders could eventually see one if free cash flow continues to improve at a high rate. Income investors with a longer time horizon might find Adobe interesting enough right now to purchase even without the guarantee of a dividend.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more