Why You Should Pass On Investing In This $3.00 Drug Stock

One of things it takes to be a good analyst is to try to look at a company from every angle before buying any shares, especially in the small cap space. Before I recommend any stock I read not only what analysts are noting about the company but what also other contributors are saying, whether it be here or from other financial sites. Obviously sometimes analysts can be conflicted and it always pays to get several different views on a company and its stock before deciding to pull the trigger on a new investment.

I assigned a staffer recently to look at a small early stage drug company called:

Catalyst Pharmaceuticals (NASDAQ:CPRX)

The stock goes for just over $3.00 a share and has been getting some positive attention from analysts recently. I wanted to get some preliminary research done for this possible new position before I dived in deeper myself before making any decision to recommend this company as a holding.

My staffer did very good job putting together a quick overview of the company as well as what analysts were saying about it. Overall it was a positive review – as you can see from the write up that will follow this summary. However, upon further digging and reading what others are saying about the company I am passing as there seems to be one key thing my staffer and analysts seem to be missing on Catalyst Pharmaceuticals.

This was recently captured in a piece by Adam Feuerstein who writes over at TheStreet and is one of the best in the business in finding potential landmines in the small biotech space. It seems Catalyst’s main drug candidate Firdapse is really just a reformulation of an existing drug that has been given away for free for decades for treatment of a rare condition called LEMS which effects a few thousand people in the U.S.

Catalyst was planning according to reports to price this “new” drug at some $200,000 annually. Obviously given the current political environment and the hot water that

Valeant Pharmaceuticals (NYSE:VRX)

The company found itself in over similar practices — which has cut is stock in half this month — this is a huge risk for investors thinking about investing in Catalyst Pharmaceuticals.

It is also one I might have missed if I would not have dived deeper into different perspectives around this small biotech concern. To my staffer’s defense, Mr. Feuerstein’s piece just hit on Thursday. Maybe Catalyst will be able to implement its plans on Firdapse and/or develop its other earlier stage candidates in its pipeline. Insiders have made some recent small stock buys which I usually view as a positive. However, given the current focus on drug price “gouging”; it is a risk I am not willing to take at this point in time and we are passing on this name.

Sometimes it is the investments one does not make that are just as important to long term portfolio performance as are the holdings one purchases. I offer that thought up for consideration heading into what I hope will be a profitable trading month of November for everyone.

Original write-up in case you still want more about Catalyst.

Catalyst Pharmaceuticals is developing therapies for rare neurological and neuromuscular diseases. Its four primary targets:

- Congenital myasthenic syndrome (NYSE:CMS): a condition characterized by muscle weakness (myasthenia) that gets worse with exertion.

- Lambert-Eaton myasthenic syndrome (LEMS): an autoimmune disease.

- Infantile spasm (IS): a seizure associated with West Syndrome, a form of epilepsy that afflicts infants and children.

- Tourette syndrome (NYSE:TS): a neurological disorder characterized by involuntarily repeated motions and vocal sounds, or tics.

Pipeline Gives the Company Multiple Shots on Goal

Firdapse:

The company’s lead drug candidate is amifampridine phosphate, brand named Firdapse.

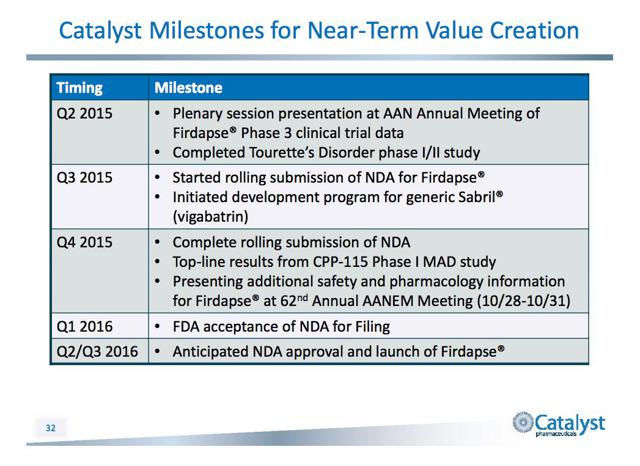

The compound is in a pre-commercial phase. The company is proceeding with a rolling submission of a new drug application (NDA) for Firdapse for the treatment of LEMS, a disease for which the drug has already received Breakthrough Therapy Designation from the FDA. It has also been designated an orphan drug for LEMS and CMS.

Catalyst expects to complete the NDA submission in Q4 2015 and hopes for priority review leading to approval in mid-2016. In the meantime eligible patients have access to Firdapse.

The company is also exploring the potential to treat Myasthenia Gravis patients who are zero positive for MuSK antibodies.

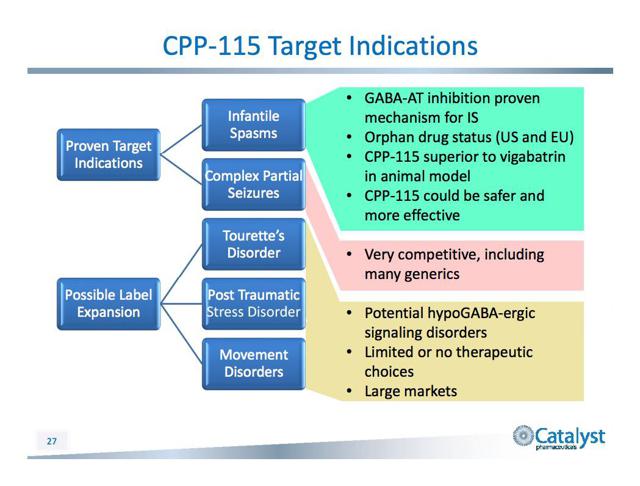

CPP-115:

Last quarter the company announced top line results from an open-label POC trial of CPP-109, or vigabatrin, in the treatment of Tourette’s Disorder. One of the four participants showed a significant reduction in tics, and in two participants tics declined by 25%.

The company was encouraged by the results of the study, which was an effort to demonstrate that the mechanism of action of CPP-109 shows potential for CPP-115 to qualify as a candidate for the treatment of Tourette’s Disorder. It hopes for the drug to replace D2 dopamine receptor blockers, antipsychotic therapies that clinics rarely use because of their severe side effects.

CPP-115 has been designated an orphan drug in both the U.S. and Europe in the treatment of IS. Catalyst is evaluating the drug in a Phase 1b study of multi-dose safety and tolerance.

Addressable Markets:

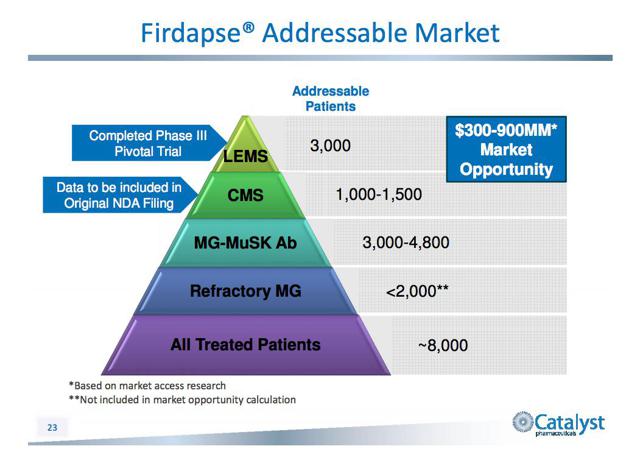

Firdapse has an addressable market of about 8,000 patients in the U.S., 4000-4500 of which suffer from either LEMS or CMS. Its potential revenue ranges between $300 million and $900 million:

Sales of Sabril, the branded version of vigabatrin, grew 35% year over year in 2014 to $120 million. Catalyst has had the generic version CPP-109 in its pipeline for several years. Its management team has experience with generic drugs, and it claims certain competitive advantages over other companies attempting to develop a generic version. It has developed a bioequivalent formulation of the complex high-barrier product, it has both clinical and manufacturing experience with vigabatrin, and it has obtained Sabril.

Infantile spasms affect 5000-10,000 patients in the U.S. and 10,000-20,000 globally.

Catalysts:

Financials and Balance Sheet:

As a developmental stage company, Catalyst has no revenues. Expenses in the most recent quarter included $2.6 million in R&D and $2.3 million in G&A.

The company has $67.4 million in cash and equivalents.

Analyst Expectations:

Piper Jaffrey reiterated its Overweight rating and $7.00 a share price target on August 11 following the Catalyst’s earnings report. The analyst noted that the firm’s cash balance is sufficient to fund the company through a 2016 launch of Firdapse.

An expanded access program brings more commercial awareness to the drug, and regulatory progress generates positive news flow. Piper Jaffrey expects these two forces to cause the market to begin to view Catalyst as a “fully integrated NeuroInnovator focused on high value rare diseases.”

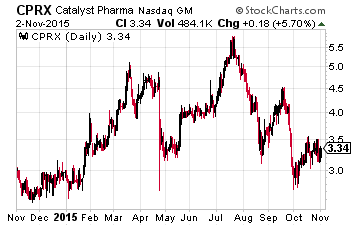

Recent Price Action:

The stock really tumbled on October 29 starting at 11 AM sharp Eastern Time. From an analyst note….”We suspect it is by no coincidence that this was the very time at which Catalyst was scheduled to begin presenting a poster entitled “Vigabatrin in Patients with Treatment-Resistant Tourette’s Disorder: A Proof-of-Concept Study.”

The intent was to present preliminary data from an 8-week trial focused on effectiveness and safety. We have not seen the results yet, nor do we have a reason at this point to believe preliminary data would justify a 10% devaluation of the company.”

The stock had traded up from a low of $2.72 on October 1 to a high on October 28 of $3.50, just under its 50-day moving average. We might expect considerable resistance there even if the preliminary data was exceptionally favorable. The 50-day moving average also coincides with a downward trend line.

Disclosure: more