Why S&P 500 And DJIA Futures Could Be Useful For Asian Investors During The COVID-19 Selloff

The co-movement of returns that emerged from the interconnection of global markets has important consequences in terms of portfolio hedging and risk management. In our paper, Regional Relevancy of S&P 500® and Dow Jones Industrial Average Futures® in Asia, we highlighted three characteristics of S&P 500 and Dow Jones Industrial Average (DJIA®) futures could potentially be beneficial for Asian investors:

- High Liquidity during Asian Trading Hours:1 About USD 27.4 billion in S&P 500 and DJIA futures were traded daily during Asian hours as of June 23, 2020;

- High Correlation with Asian Markets: Correlations between U.S. and Asian markets tend to be as high as intraregional correlations in Asia, and they tend to increase during periods of high volatility; and

- High Flexibility in Trading: Nearly 24-hour trading and a wide variety of contract sizes allow for precise exposure adjustment at any time.

The high liquidity during Asian trading hours and high correlation with Asian markets could help investors to realize key potential advantages of having U.S. benchmark futures trade during Asian trading hours: being able to react globally to major market news as it happens, hedge against geopolitical uncertainties, and adjust accordingly ahead of economic releases and announcements.

Historically, major market events tend to amplify the liquidity of S&P 500 and DJIA futures, indicating their importance when investors want to react to market news in a timely fashion. On the night of the 2016 U.S. presidential election when U.S. ETF and stock markets were closed, S&P 500 futures traded a notional value of USD 264 billion. This blog provides a recent example of the S&P 500 and DJIA futures during an extreme period by focusing on the COVID-19 selloff.

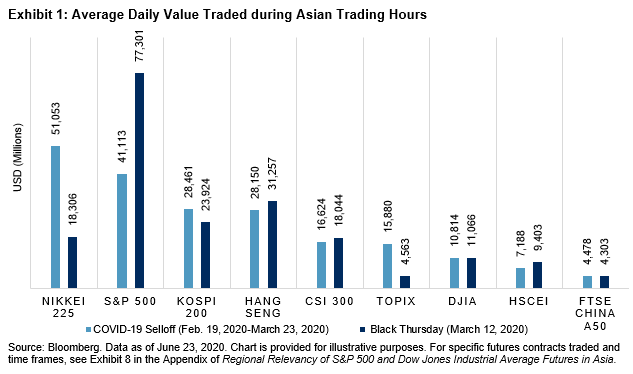

For the whole selloff period from Feb. 19, 2020, to March 23, 2020, the average value traded2 in S&P 500 and DJIA futures was about USD 51.9 billion during Asian trading hours per day (see Exhibit 1). Of note is that on Black Thursday (March 12, 2020), the value traded in S&P 500 futures climbed to USD 77.3 billion during Asian trading hours, which was almost double its average for the selloff period, far exceeding the liquidity traded in the major Asian benchmark futures.

(Click on image to enlarge)

Looking closer at each hour on March 12, 2020 (see Exhibit 2), we can see investors’ immediate reactions to market news through the liquidity of S&P 500 futures. There were two major shocks that largely contributed to Black Thursday. First, when Trump announced a 30-day travel ban against Europe around 9:00 am (Hong Kong/Singapore Time), there was a boost in the value traded of S&P 500 futures. Then later that day, when the ECB made it clear it would not cut interest rates, the value traded in S&P 500 futures increased significantly alongside the effect of the U.S. market open.

(Click on image to enlarge)

The high level and substantial increase in liquidity during major market events suggest the importance of the S&P 500 and DJIA futures as one of the most popular instruments for investors to react timely to market news. Combined with the nearly 24-hour trading and a wide variety of contract sizes, market participants in Asia can potentially hedge and manage risk effectively using a single liquid U.S. index derivative instrument.

1 For the purposes of this paper, Asian trading hours are defined as 8:00 a.m. to 5:00 p.m. Singapore/Hong Kong time.

2 The daily value traded associated with each futures trade is calculated as the number of contracts traded per day times the futures VWAP price per day times the contract size.

Please read our Disclaimers.

Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights ...

more