Why “Passive” Investing Is Now Riskier Than Ever

Over the last 25-30 years, we have seen a massive shift by investors away from “actively managed” mutual funds (and more recently Exchange Traded Funds) in favor of so-called “passively managed” funds and ETFs. This huge shift is primarily because passive funds have significantly lower annual management fees.

The main risk with passive funds, as everyone reading this knows, is if the stock market has a major downward correction or a bear market. In that case, these passive funds – which are largely invested in so-called “index” funds — will lose just as much (or more) as the market. Fortunately for passive investors, the stock markets have gone up, up, and up in the record bull market since the last bear market low in March 2009.

In fact, the S&P 500 Index has soared a record 518% since the 2009 lows. As a result of this success, more and more investors have plowed their money into passive funds in recent years as the market hit new record high after record high. It’s as if no one thinks the market can go down. But we all know this won’t be the case indefinitely.

Yet while the market risk is largely ignored, there is another risk that has developed in recent years. While this newer risk is referred to with various terms, I’ll just call it: “technology concentration.” Over the last decade or so, passive index funds have increasingly loaded their portfolios with more and more technology company stocks.

The problem, of course, is when we get the next major downward correction in tech stocks (which are seriously overvalued), passive index funds will almost certainly get hammered!

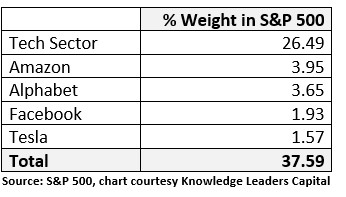

So, the question is, just how concentrated are these passive index funds in tech stocks?

Let’s take a look at the bellwether S&P 500 Index. As we can see at left, the S&P has nearly 38% exposure to tech stocks this year. This includes stocks from the tech sector in general, plus the “FAANG” stocks – Facebook, Amazon, Apple, Netflix (not shown at left), and Google — plus Tesla. This allocation to tech stocks in the S&P 500 has been growing steadily in recent years. Much the same is true in other major stock indexes and large tech mutual funds and ETFs.

The next question, of course, is how much tech concentration is too much? I think we can all agree the tech stocks above, plus others such as Microsoft, Apple, etc. (not shown above), are highly correlated simply due to the fact they are, well, tech stocks. But does this mean they will likely all go down at the same time in the next market correction?

We do know that tech stocks, as a group, went down together in the recessions of 2000 and 2008. So, it would not be a stretch to assume they’ll get hit again in the next recession. If correct, this will mean a lot of damage to funds that are loaded up with 35-40% exposure.

Keep in mind that companies in the table above, plus Apple, Microsoft, and a handful of others are among the largest companies in the world. Several of these companies have market caps of $2 trillion or more. Apple is the most widely held stock in the world. If some or most of these companies experience a serious downturn, which they will at some point, they will likely take the whole market down with them.

In addition to the large index funds, these same companies are also among the largest holdings of most large cap mutual funds and ETFs, not to mention large pension funds, large 401(k)s, and other retirement funds. In short, they are everywhere. And keep in mind, this trend is happening all across the developed world.

So, you should take a serious look at your portfolio and determine if you have an oversized exposure to these large tech stocks. If you do, you might consider reallocating some of your assets to mid-cap or small-cap mutual funds or ETFs. Chances are you would have even more real diversification with these mid-and-smaller cap funds which don’t have such a large allocation to the giant tech stocks. Something to think about.