Why Mr. Market’s Earnings Expectations May Still Be Far Too High

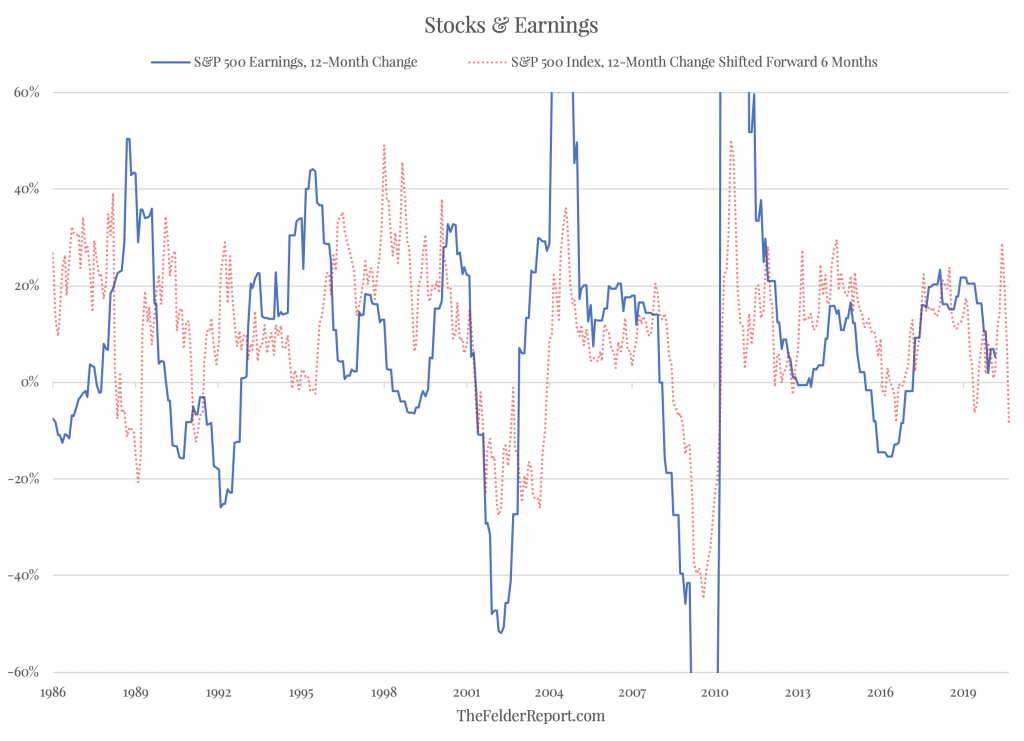

One reason for the record-setting stock market crash we witnessed in the first quarter was a rapid reappraisal of the earnings situation for the S&P 500. As I noted here back in January, stocks were discounting about a 30% jump in earnings growth over the coming six months, a pretty herculean assumption. When COVID-19 destroyed the prospect of earnings growth for the first half and introduced the distinct probability of a major earnings decline, the S&P 500 was forced to adjust and in dramatic fashion.

However, it appears that the index is now discounting just a 9% decline in earnings going forward. With many businesses shut down completely at present and for at least the rest of the month, this could still prove to be a very optimistic assumption. Earnings growth could easily turn much more deeply negative than that.

(Click on image to enlarge)

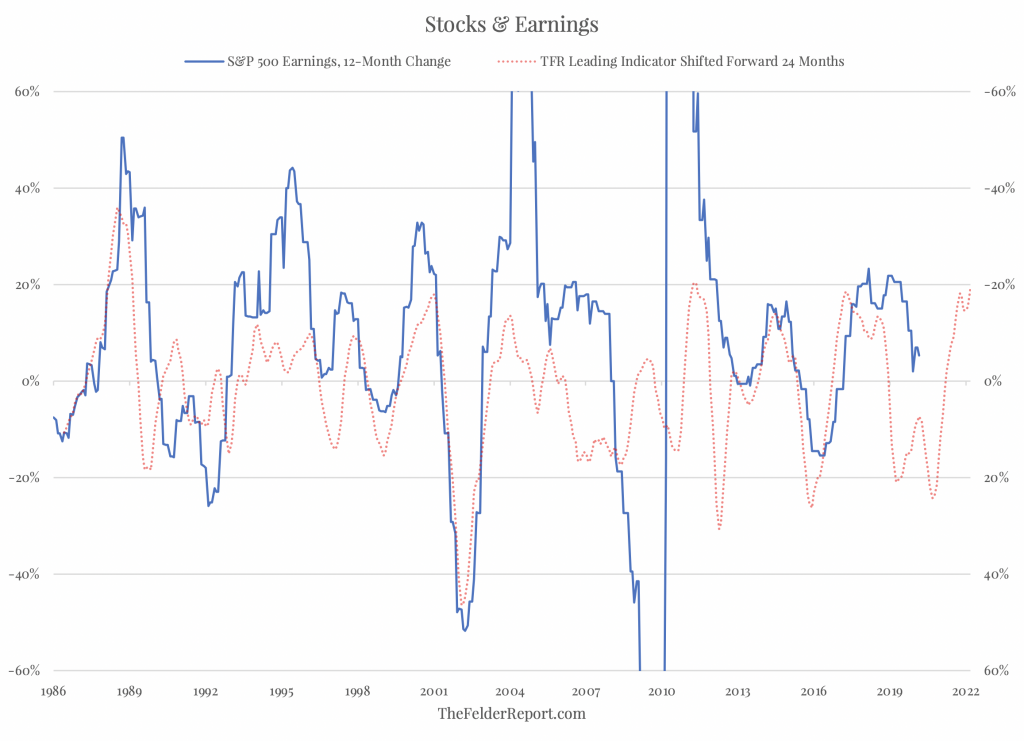

Then again, stocks don’t always have to match the decline in earnings. Obviously, if earnings fall 90%, as they did during the Great Financial Crisis, the stock market doesn’t need to fall 90%, as well (although it did fall 45% year-over-year at its nadir back then). And there is some evidence to suggest that this earnings recession will be relatively brief. My macro earnings model suggests that earnings growth could hit bottom in September or October of this year before rebounding and returning to positive numbers in the first half of 2021.

(Click on image to enlarge)

If stock prices do discount earnings growth by six months in advance and our model is accurate, that September/October bottom in earnings growth would suggest a stock price bottom in March/April, in other words, right about now. This would seem to support the idea that the recent low in the S&P 500 was a sustainable bottom, at least for the next several months.

However, there are a couple of major longer-term issues to consider, as well. For one, stocks are still very expensive. The Buffett Yardstick remains much closer to its all-time highs than its lows or even its historical average, for that matter. Second, earnings in recent years could be dramatically overstated and vulnerable to a more sustained decline than our model would suggest. For these reasons, it probably makes a good deal of sense to maintain a defensive posture, especially if you have a longer-term time horizon and are invested primarily in the index.

Disclosure: Information in “The Felder Report” (TFR), including all the information on the Felder Report website, comes from independent sources believed reliable but accuracy is not ...

more