Why I Own Disney For The Long Term

Disney (DIS) stock is being driven by powerful momentum. Disney + is off to a strong start, Frozen 2 is a massive success, and the company delivered better-than-expected earnings and revenue last quarter. In this context, the stock has gained almost 30% in the past year.

Considering this recent performance, it makes sense to be patient when building a position in Disney stock. However, make no mistake, Disney still offers attractive upside potential from these prices over the long term.

A Brilliant Business Model

Disney is a fairly unique company in the entertainment industry. The company builds brands around its characters and its unique intellectual properties, and it owns the rights to many of the most valuable franchises in the world.

A comparative example comes to mind, related to the power of brands and Warren Buffett's decision to invest in Coca-Cola (KO) in the eighties. Buffett asked himself what it would cost to replicate the Coca-Cola brand, and he reached the conclusion that it probably could not be done, even with massive amounts of marketing resources and human brainpower.

Disney is a similar case. The company owns intergenerational brands with deep emotional connections with consumers all over the world, and it would be practically impossible for the competition to replicate the value of those properties.

Launching new movies is always risky, but Disney has the intellectual assets, the human talent, and the financial resources to consistently bring successful new creations to the market. The company has, in fact, built an exceptional track record of consistent success in such a competitive market.

A successful movie means additional business opportunities for Disney in areas such as live shows, toys and merchandises, video games, and entertainment park attractions. Importantly, Disney + is bringing this strategy to a whole new level.

As opposed to selling different products or providing entertainment services for a limited time, Disney + is turning the company into a provider of permanent entertainment services. It's not too hard to imagine the company leveraging on Disney + to add different subscriptions and services such as online games.

Direct distribution allows Disney to eliminate intermediaries, reducing mark-up costs and gaining better control of the user experience. Also, Disney is going to get access to enormously valuable information based on viewership data from consumers, and this will provide another key source of competitive advantage when it comes to content creation in the years and decades ahead.

Disney + is being priced at competitive levels, so management is clearly prioritizing growth above profit margins. This is the right thing to do, since building a large subscriber base tends to have a positive impact on margins over time.

Besides, the subscription-based business model is a great source of recurrent revenue, and Wall Street loves companies with consistently growing sales, so Disney + could be a major positive in terms of providing more visibility about financial performance to investors.

Reasonable Valuation

When you find a world-class business that is also firing on all cylinders, valuation becomes a major factor to consider. After all, even the best company can turn out to be a mediocre investment if the purchase price is too high. Disney stock is not as cheap as it was last year, but it's not overvalued either for such a fundamentally strong company.

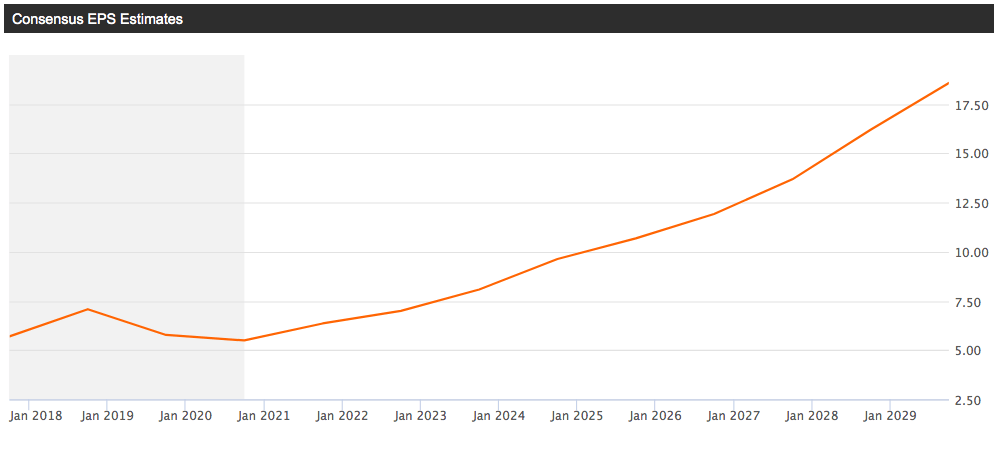

The chart below shows earnings-per-share expectations for Disney over the years ahead.

(Click on image to enlarge)

Source: Seeking Alpha Essential

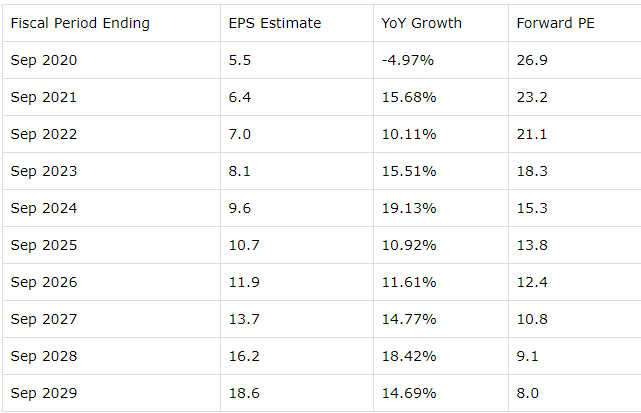

Providing more details, the table shows the average earnings estimate for Disney in the coming years and the implied forward P/E ratio based on those earnings estimates. Disney is arguably the strongest player in the entertainment industry on a global scale, and valuation is not unreasonable for such an exceptional business.

(Click on image to enlarge)

Source: Seeking Alpha Essential

It is important to keep in mind that valuation is always dynamic as opposed to a static concept. This means that the value of the business increases if the company outperforms expectations over time.

Several Wall Street firms have recently increased their price targets for Disney due to the stronger-than-expected traction produced by Disney +. As long as this trend remains in place, better-than-expected performance would mean that the stock is actually more undervalued than what current valuation ratios are indicating.

Risk And Reward Going Forward

Disney is going through some major transitions, and integrating Twenty-first Century Fox is no easy task. Fortunately for investors, the company has an impeccable track record in acquisitions, it not only integrated Pixar, Marvel, Lucasfilm well, but management also did an excellent job at potentiating these properties and creating more value from them. Still, this a relevant challenge for the company in the coming months.

Besides, the competition for building or buying high-quality content is increasingly aggressive, and it will be important to monitor this factor in case it starts hurting profitability at the whole industry level.

Back in July of 2018, I published an article entitled "Disney Looks Undervalued". The main thesis at the time was that the market was overreacting to uncertainty produced by the cord-cutting revolution.

From such an article:

Disney's problems in the networks business are an important risk factor to keep in mind. However, the most likely scenario is that the company will find the right ways to monetize its massively valuable content under new industry dynamics. Besides, other segments such as studios and attraction parks are as strong as ever, and the business remains quite healthy from a big-picture perspective. At current valuation levels, Disney stock looks like an attractive purchase for long-term investors willing to tolerate the short-term uncertainty in Disney stock.

Disney was priced at $106 per share at the time, and the stock has now gained almost 45% from those levels. The investment thesis has clearly evolved in the process. In 2018 Disney was a contrarian and defensive story, and now the business is moving to the offense with the Twenty-first Century Fox acquisition and the launch of Disney +.

The thesis around Disney stock was more about undervaluation in 2018, but in 2020 and beyond it will be more about growth and innovation.

With the stock trading at all-time highs, I wouldn't rush into buying more of Disney stock at current prices, but there is a big difference between not chasing a stock and selling it.

Disney is a high-quality business with an exceptional ability to create value for shareholders over the long term. The stock is not very cheap at current levels, but it's not overvalued either when considering the quality of the business.

A simple and straightforward approach to investing can many times produce superior returns. Disney is a high-quality stock trading at reasonable valuation levels, so it looks like a winning proposition over the long term.

Disclosure: I am/we are long DIS.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more