Where Analysts Are Most Optimistic And Pessimistic On Company Ratings For 2021

With the end of the year just days away, Factset looked at where sell-side analysts are most optimistic and pessimistic in their ratings for S&P 500 stocks for 2021, and also how have their views changed since the start of the COVID-19 pandemic.

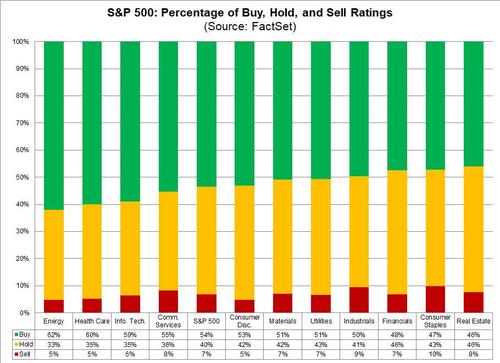

As Factset's John Butters summarizes, there are a total of 10,361 ratings on stocks in the S&P 500. Of these 10,361 ratings, 53.6% are Buy ratings, 39.6% are Hold ratings, and 6.8% are Sell ratings.

Curiously, at the sector level, analysts are most optimistic on the one sector that has been most beaten down in 2020 - Energy (62%) - followed by Health Care (60%), and Information Technology (59%) as these three sectors have highest percentages of Buy ratings. On the other hand, analysts are most pessimistic about the Real Estate (46%), Consumer Staples (47%), and Financials (48%) sectors, as these three sectors have the lowest percentages of Buy ratings. The Real Estate (46%) and Financials (46%) sectors also have the highest percentages of Hold ratings, while the Consumer Staples (10%) sector also have the highest percentage of Sell ratings.

(Click on image to enlarge)

At the company level, the 10 stocks in the S&P 500 with the highest percentages of Buy ratings and the highest percentages of Sell ratings are listed in the tables below.

(Click on image to enlarge)

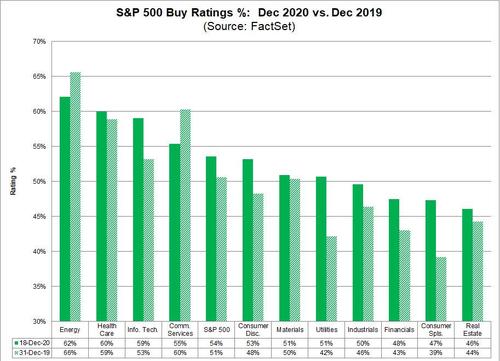

Based on the percentage of Buy ratings on S&P 500 stocks, it is interesting to note that analysts are more optimistic on S&P 500 stocks today compared to the start of the 2020 (before the impact of COVID-19), and with the S&P500 trading above 3,700 - an all-time high. On December 31, 50.6% of ratings on S&P 500 stocks were Buy ratings, compared to 53.6% today. Nine sectors have a higher percentage of Buy ratings today compared to the start of the year, led by the Utilities (to 51% from 42%) and Consumer Staples (to 47% from 39%) sectors. On the other hand, just two sectors have a lower percentage of Buy ratings today compared to the start of the year: Communication Services (to 55% from 60%) and Energy (to 62% from 66%).

(Click on image to enlarge)

However, there has been little change at the sector level in terms of ranking by Buy ratings. The same four sectors (Energy, Communication Services, Health Care, and Information Technology) that had the highest percentages of Buy ratings at the start of the year (before COVID-19) also have the highest percentages of Buy ratings today. Three of the four sectors (Consumer Staples, Financials, and Real Estate) that had the lowest percentages of Buy ratings at the start of the year also have the lowest percentages of Buy ratings today.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more