What To Expect From Apple's Earnings Report

Apple (AAPL) shares fell 8.7% from the all-time high of $164.94 on September 1, to $150.55 on September 25, due to some disappointment among customers that the much-awaited iPhone X will start shipping only at the beginning of November. Since then Apple shares have regained 4.3% to $156.99 on October 13. As I see it, the deferral of the new revolutionary iPhone does not have any long-term influence on the growth prospects of the company which continues to be bright. Apple Watch is becoming more and more popular, and Apple’s Services business is showing strong momentum growth.

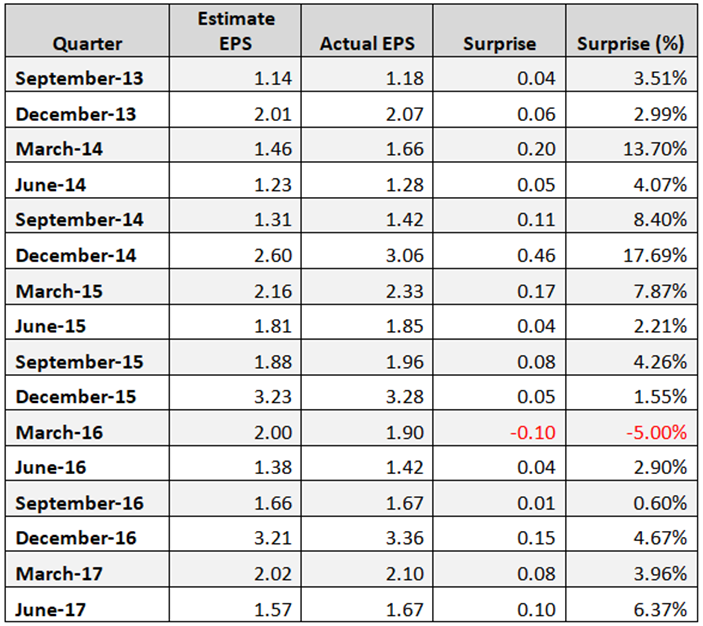

Apple is scheduled to report its fourth-quarter fiscal 2017 financial results on Thursday, November 2, after market close. According to 31 analysts' average estimate, AAPL is expected to post a profit of $1.87 a share, a 24.7% increase from its actual earnings for the same quarter a year ago. The highest estimate is for a profit of $2.01 a share while the lowest is for a profit of $1.79 a share. Revenue for the fourth quarter is expected to increase 8.6% year over year to $50.9 billion, according to 29 analysts' average estimate. There was one up earnings per share revision during the last 30 days. Since AAPL has shown earnings per share surprise in all but one of its last sixteen quarters, as shown in the table below, there is a good chance that the company will beat estimates also in the fourth quarter.

AAPL Stock Performance

Since the beginning of the year, AAPL stock is already up 35.5% while the S&P 500 Index has increased 14%, and the Nasdaq Composite Index has gained 22.7%. Moreover, since the beginning of 2012, AAPL stock has gained 171.3%. In this period, the S&P 500 Index has increased 103%, and the Nasdaq Composite Index has risen 153.6%. According to TipRanks, the average target price of the top analysts is at $176.22, which indicates an upside of 12.3% from its October 13 price, however, in my opinion, shares could go even higher.

AAPL Daily Chart

AAPL Weekly Chart

Chart: TradeStation Group, Inc.

Valuation

According to its valuation metrics, AAPL stock, in my opinion, is pretty attractive. The trailing P/E is at 17.80, and its forward P/E is low at 14.41. The Enterprise Value/EBITDA ratio is also low at 11.28, and the PEG ratio is at 1.47.

Ranking

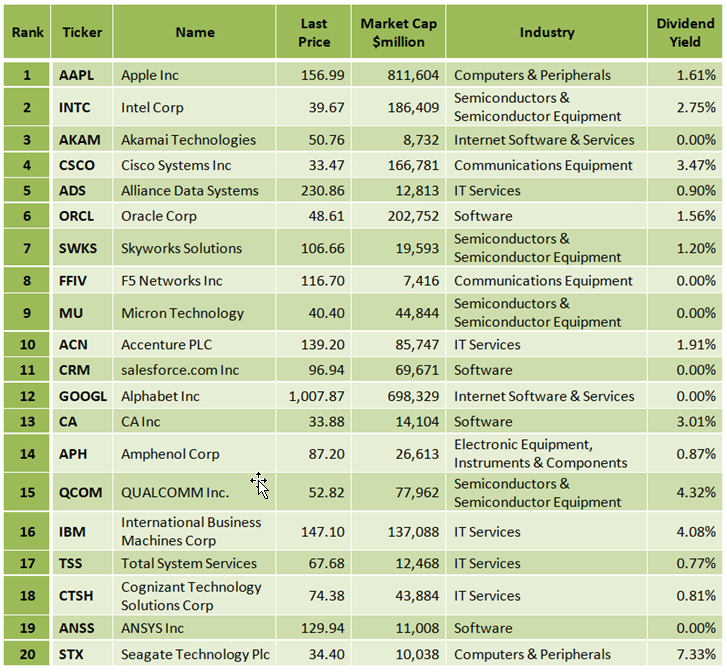

According to Portfolio123’s "All-Stars: Buffett" ranking system, AAPL's stock is ranked first among the 68 S&P 500 tech stocks. The "All-Stars: Buffett " ranking system is based on investing principles of the well-known investor Warren Buffett. The twenty top-ranked S&P 500 companies according to the ranking system are shown in the table below.

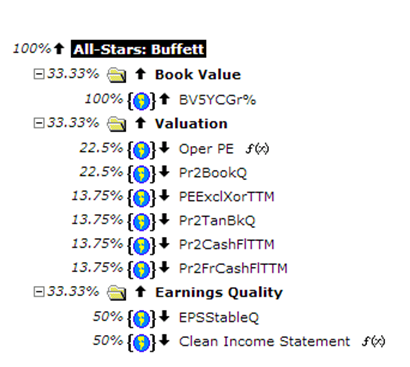

The ranking system is quite complex, and it takes into account many factors like book value growth, operational P/E, price-to-book value, trailing P/E, price-to-tangible book value, price-to-cash flow and EPS stability, as shown in Portfolio123's chart below.

Back-testing over eighteen years has proved that this ranking system is very useful.

Summary

Apple will benefit from big demand to its new revolutionary iPhone X which will start shipping at the beginning of November, and from the increasing success of its Apple Watch and Apple’s Services. Apple is scheduled to report its fourth-quarter fiscal 2017 financial results on Thursday, November 2. According to 31 analysts' average estimate, AAPL is expected to post a profit of $1.87 a share, a 24.7% increase from its actual earnings for the same quarter a year ago. Since AAPL has shown earnings per share surprise in all but one of its last sixteen quarters, there is a good chance that the company will beat estimates also in the fourth quarter. According to its valuation metrics, AAPL stock, in my opinion, is pretty attractive, and it ranks first among the 68 S&P 500 tech stocks. The average target price of the top analysts is at $176.22, which indicates an upside of 12.3% from its October 13th price, however, in my opinion, shares could go even higher.

i am long AAPL stock