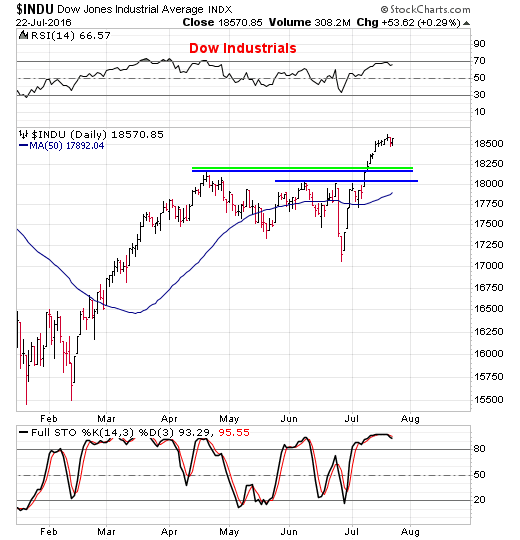

What Is The Risk Of Buying The Dow?

Let's take a look at the Dow.

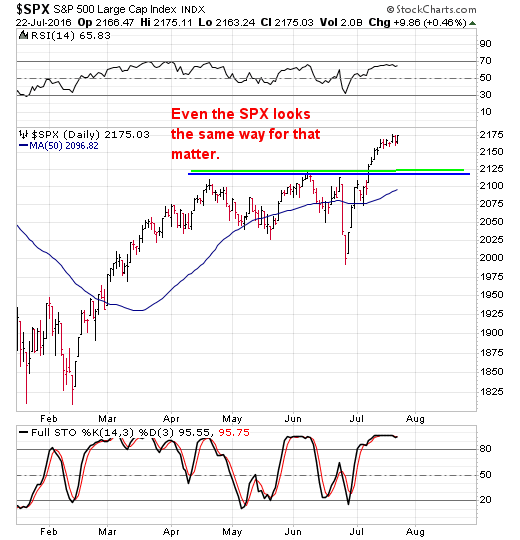

Might as well throw the SPX up here too as its looking the same way.

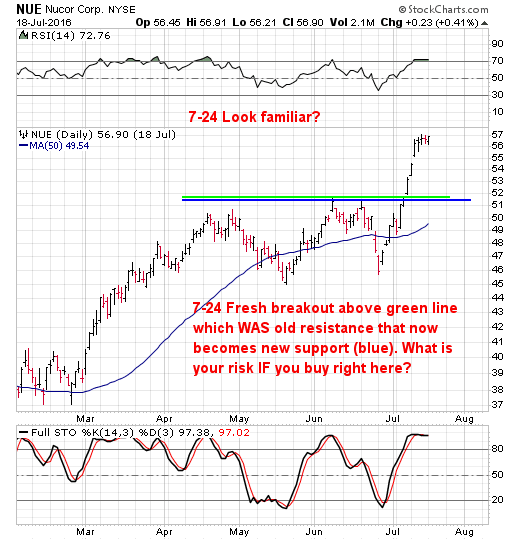

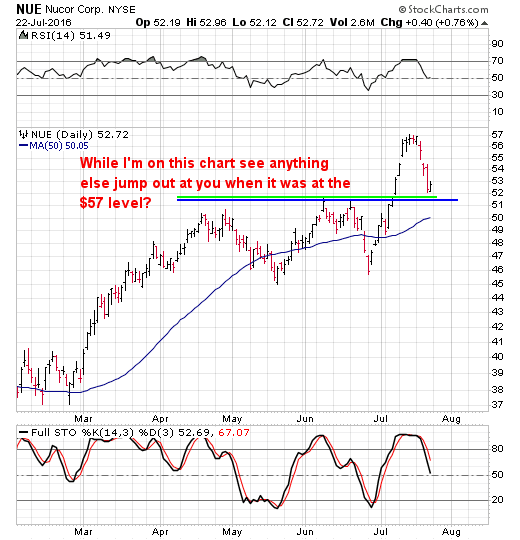

Now take a look at the next chart of Nucor.

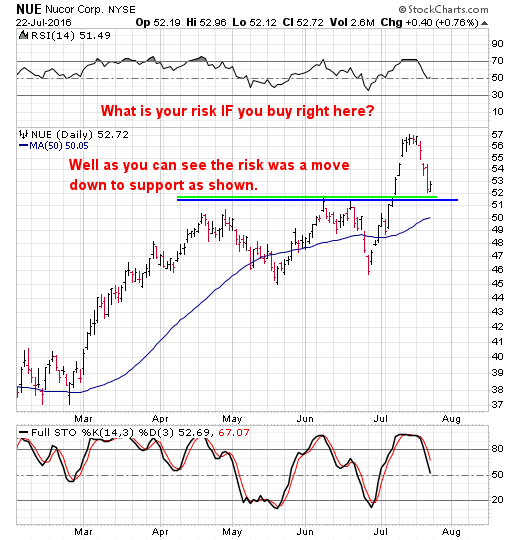

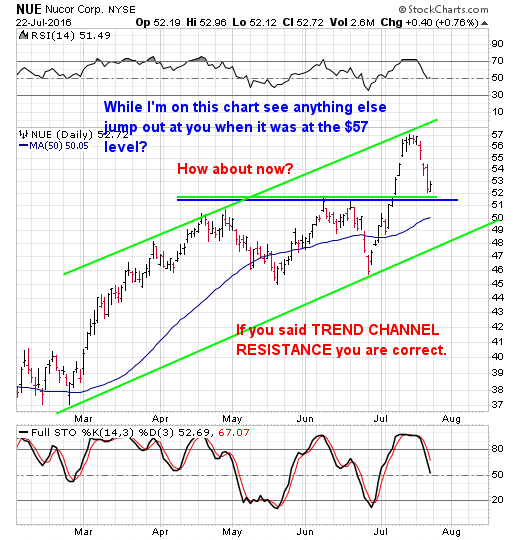

How about now?

Now lets go back to the Dow Industrials for a moment. Now that I just walked you thru "What to Watch Out For" if looking to go long as well as what to be aware of if already long anything that looks like the current DOW, SPX chart. You now know what your risk is in here once the Dow and SPX turn.

So that all being said where are the big low risk technical trades on the long side right now? Simple answer is, NOT here.

In the Dow Industrials' case that old resistance is the green line, now that we've broken thru it to the upside now becomes new support.You've heard me talk time and time again about being prepared in advance vs seeing it scroll across your screen after the fact so this is your heads up to not only be prepared to have this recent bout of strength up and out of the green line in the form of a breakout to stage some sort of pullback.

So that is the first thing to be prepared for. The second thing to be prepared for is the opportunity that that is going to present itself when it occurs.

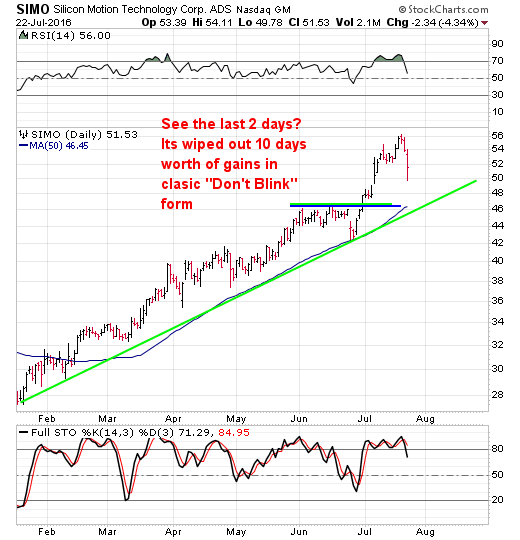

Don't think it can't happen fast because as we've all seen moves take place in the blink of an eye so "Don't Blink" and have to scramble but be prepared in advance. Case in point, see how fast the stock below gave up 10 days worth of gains in the blink of an eye, actually 2 days.

Note: Earnings are due next week.

Disclosure: None.