What Does The Current Stock Market Plunge Tell Lenders?

What Does the Current Stock Market Plunge Tell Lenders?

The global stock markets have been on a vicious decline since the turn of the year. This comes following several indicators which suggested that the rally in the financial markets between the late 2014 and 2015, and especially in the US, was premature and probably driven by unfounded investor optimism.

By illustration, the developed economies and the emerging markets have been struggling for the better part of the last two years. China for instance, which is one of the world’s leading consumers of industrial commodities has experienced some of the worst periods in terms of economic growth in recent times. Analysts are now wondering whether the world should be worried of China’s failings.

The warnings have been present for months now, but investors, for some reason chose to ignore them and now they are paying for their naivety. The picture that is being set is provoking memories of the 2008/2009 global financial crises though analysts are comparing it to the market meltdown experienced in the early 2000s period.

Whichever the case, the financial markets are very unpredictable right now and this triggers the need for precautionary measures especially for lenders. Base interest rates have been in the lower single-digits to a mere fraction for most of the developed economies since the global financial crises of 2008/2009, and this means that people have been able to borrow money at cheaper rates.

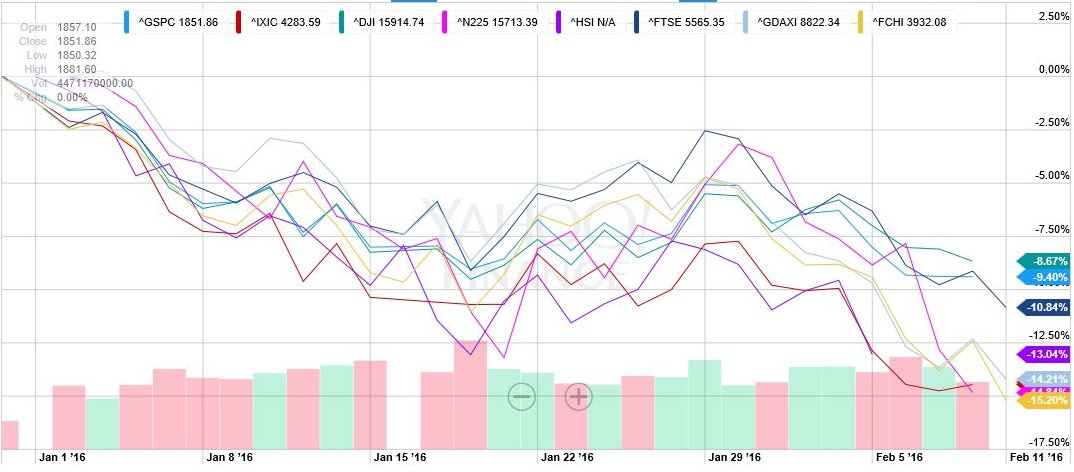

(Click on image to enlarge)

Currently, the uncertainty is only dominant in the stock market as depicted by the whirlwind plunge in the chart above, but the credit market should not turn a blind eye either. The S&P 500 Index, the Dow Jones Industrial Index, the Nasdaq Composite, the FTSE 100 Index, DAX 30, CAC 40, Nikkei 225, and Hang Seng Index are all down between 8% and 15% YTD and this could continue further if the current global economic outlook does not change.

The stock market has never been the best measure of economic progress, especially when in a bullish trend as it is subject to several other forces, among them speculation. However, as the decline begins to occur globally as witnessed in the past two months, it may well suggest that we may be staring at a possibility of another financial crisis. Such a crisis would result in credit defaults and many other perils of the lending industry.

When lending risks are high, lenders tend to focus more on products which have short maturity periods while others also try to increase the frequency of payments. The whole idea is to try to get your money back as quickly as possible. Most credit products have monthly repayment periods, but others like the one offered by elogbookloan have even weekly repayments. The frequency of payments means that the amount paid is easily affordable.

For instance, if you borrow GBP 1,800 worth of logbook loan via elogbookloan, you can expect to pay a weekly amount of just GBP 50, which compares with a monthly payment of more than GBP 200. In tough economic conditions, it is easier to part with GBP 200 in instalments than GBP 200 in a lump sum.

Conclusion

The bottom line is that the stock market is a sensitive measure of the global economic status. Chinese stocks are at new 12-month lows as global correction continues to take shape and there are no signs that the decline could be stopping soon.

Banks in China are also experiencing slowdowns and this illustrates the kind of message that the stock market plunge is sending to lenders and other credit companies.

With lending rates remaining low in most developed economies and uncertainty increasing in the credit market, lenders will need to prepare accordingly by implementing measures to limit the impact of hazards such as credit default.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor ...

more