What Does Bitcoin Look, Walk, And Quack Like?

What is the best way to think about what Bitcoin is as an investment?

We've already demonstrated what it isn't. Bitcoin isn't "Gold 2.0". We know that's true because Bitcoin doesn't act like gold, which rises in value whenever inflation forces real interest rates to fall. If anything, we found changes in the value of Bitcoin is almost completely independent of inflation-adjusted interest rates. If gold were a duck, Bitcoin wouldn't look, walk or quack anything like it.

Which then raises the question: what does Bitcoin look, walk and quack like?

We think Bitcoin looks, walks, and quacks like a non-dividend paying stock.

The thing that put us onto that line of thought was a recent headline: Bitcoin’s correlation with the Nasdaq 100 index reaches a new all-time high.

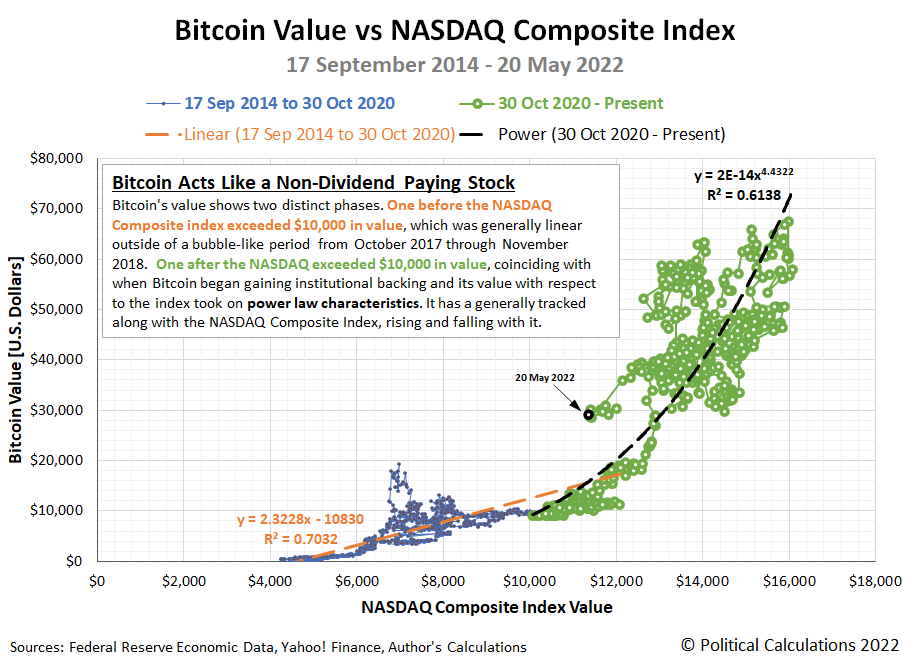

To be highly correlated with something is akin to looking, walking and quacking like it. So we put that proposition to the test, tracking the relationship between Bitcoin and the Nasdaq Composite Index, which is a broader measure of the stocks that trade on the NASDAQ stock exchange. The following chart shows what we found after we mapped the available data we have for the historic value of Bitcoin against the value of the Nasdaq Composite Index over the same period of time, from 17 September 2014 through 20 May 2022.

(Click on image to enlarge)

In the chart, we see that Bitcoin's value has two distinct phases. One before the NASDAQ Composite index exceeded $10,000 in value, which was generally linear outside of a bubble-like period from October 2017 through November 2018. One after the NASDAQ exceeded $10,000 in value, coinciding with when Bitcoin began gaining institutional backing and its value with respect to the index took on power law characteristics. It both cases though, outside short periods where changes in its valuation decoupled from changes in the value of the stock index, Bitcoin has a generally tracked along with the NASDAQ, rising and falling with it in a positive relationship.

That makes it very much like a non-dividend paying stock, especially during the period after it began gaining significant institutional backing. We know that from the exponent of the power law relationship that exists between Bitcoin and the Nasdaq Composite Index during this period, which represents the ratio of the exponential growth rates of Bitcoin and that of the Nasdaq index, which includes dividend-paying stocks.

In doing that, Bitcoin is very much looking, walking, and quacking like a volatile non-dividend paying stock, which shares those characteristics. Unless and until it starts acting differently, that's perhaps the best way for investors to think about Bitcoin's qualities as an investment.

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more