What Do Hostilities With Iran Mean For Investors?

The financial world is still reeling from the aftershocks of the U.S. military’s strike on Qasem Soleimani. In the near-term, stocks dropped, and oil surged. That’s to be expected.

I must caution investors to resist the urge to invest with their emotions, especially fear. I won’t venture a prediction of what will happen, and I’m wary of anyone who tries.

Let me be clear: There’s no reason to sell out of this market due to Iran. As long as you have a diversified portfolio of sound stocks, then you should keep your wits about you. Remember that the fundamentals of the U.S. economy are still sound. Unemployment and inflation are low.

Never Invest by Fear

I will, however, touch on a few truths about the markets and investing. The first reaction is almost always wrong. In fact, stock prices have already stabilized.

The second is that dire predictions often get the most attention, and they’re almost always wrong. (Note that I said almost always.)

I even have evidence. Jeffrey Kleintop, the Chief Global Investment Strategist at Charles Schwab, posted a fascinating chart (see here). It details the market’s near-term reaction following U.S. military strikes going back more than 25 years. (I had forgotten there had been so many.)

Except for a bump up in the price of oil, the market largely takes these actions in stride, although I recognize that this latest strike could be more consequential.

We also have to remember that the stock market is not a barometer of world political stability. Stocks are focused on earnings. International events hold more sway over bond and currency markets, plus selected commodities.

We should keep in mind that the U.S. is no longer in the grip of the oil-producing nations like it used to be. A few decades ago, OPEC could easily trip us up by making production cuts. That’s not true anymore. Even Saudi Arabia is trying to diversify its economy. I’ll add that since its post-IPO peak, Saudi Aramco has lost $200 billion.

Raytheon: “Light of the Gods”

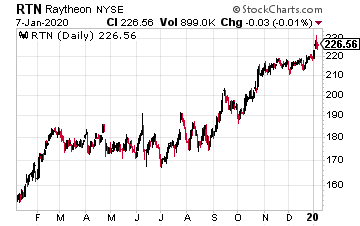

The heightened tensions do present us with some opportunities in the defense sector. Fortunately, the United States has many outstanding defense and aerospace stocks. One that I’ve long been an admirer of is Raytheon (RTN), which means “light of the gods.”

Raytheon is in the upper pantheon of U.S. military contractors. The company regularly places among the Pentagon’s top 10 contractors. Its air/land/sea/space/cyber defense offerings include reconnaissance, targeting, and navigation systems, as well as missile systems (Patriot, Sidewinder, and Tomahawk), unmanned ground and aerial systems, sensing technologies, and radars.

Raytheon also makes systems for communications (satellite) and intelligence, radios, cybersecurity, and air traffic control. It offers commercial electronics products and services, as well as food safety processing technologies. The U.S. government accounts for a large portion of sales. It’s nice to have your major customer to be someone with very deep pockets.

While I like Raytheon, there’s a major near-term issue that causes me concern. That’s why my support for the stock is conditional. Let me explain. The biggest news for Raytheon came last June.

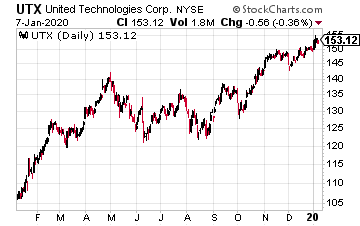

That’s when the company announced that it is merging with United Technologies (UTX). The deal is all cash. Raytheon shareholders will get 2.3348 shares of the new company for every one they own now. The combined company will be called Raytheon Technologies.

Once the merger is done, United Technologies shareowners will own approximately 57%, and Raytheon shareowners will own about 43% of the combined company on a fully diluted basis.

That sounds good, but there’s the fine print. United Technologies is also in the process of spinning off two companies, Otis and Carrier. As a result, it’s not entirely clear what Raytheon will be merging with.

Those spinoffs are projected to happen in the first half of this year. So is the Raytheon/United Technologies merger, but shareholders of Raytheon will not get spinoff shares of Otis and Carrier. This is frustrating and not the way shareholders should be treated.

I like Raytheon, the company—and the shares just touched a new 52-week high. However, I caution investors of adding it before the next earnings report.

Raytheon should report Q4 earnings at the end of the month. Wall Street current expects earnings of $3.12 per share. If Raytheon tops expectations, then I think it’s a safe stock to build a position even with the spinoffs issue.

If Raytheon doesn’t beat earnings, then back away, and we’ll have to reevaluate until the United Technologies deal is complete.

Disclosure: None.