What Bank Credit And The SOMA Can Tell Us About The Stock Market Today

On the weekend, we outlined a number of technical and sentiment reasons why there could be further downside to the market. Here we look at bank credit for clues to what might be in store.

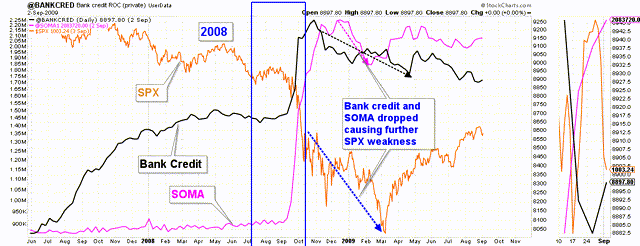

As we all know, bank credit has been making new highs throughout this pullback. In 2008, something similar happened; bank credit and the SOMA soared as the SPX collapsed (blue rectangle). This temporarily arrested the drop in the market, but the moment that bank credit started to fall back because of bankruptcies--mostly by individuals losing their homes--the SPX resumed its decline (blue arrow). It did not help that the SOMA stopped growing before it was safe to do so (chart below).

(Click on image to enlarge)

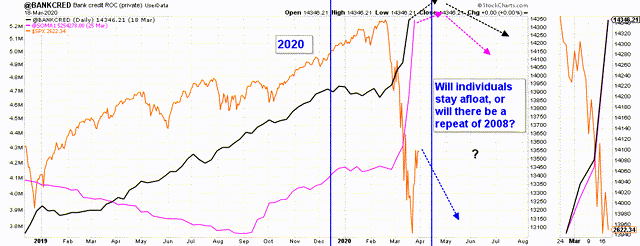

In the present situation, something similar (never exactly the same, however) is taking place; bank credit and the SOMA are making record highs, and the SPX has collapsed but has been stabilized by the stimulus. What is different this time, however, is that there is fiscal support for the individual, and the health of the financial sector is broadly better than it was in 2008.

The question now is, will the support be sufficient to float the individual through this alien invasion and prevent the level of bankruptcies that we saw in 2008? The $1200 one-time payment is, by itself, is not sufficient, but if we are to believe what the government is saying about doing "whatever it takes", then we can look forward to much more support delivered to the individual and the avoidance of the level of bankruptcies we saw in 2008. The market, at this point, seems to be giving the government the benefit of the doubt, but we are not convinced that the government will deliver the support in time to prevent at least some level of financial discomfort, especially if unemployment explodes like we think it will. This is why we think further weakness in the SPX is a very real possibility, but not a sure thing; the market may have already discounted all the damage that is coming our way and the Fed has all our backs (chart below).

(Click on image to enlarge)