WeWork Targets $20-$30 Billion IPO Valuation, Huge Discount To Latest Private Round

With the WeWork IPO roadshow expected to start as soon as next week as the company's bankers feel a sense of growing urgency to take the company public asap in the aftermath of such recent bombs as Uber, Lyft, Chewy and most recently, Slack, which crashed yesterday wiping out all post-IPO gains, there was one big piece of the puzzle that was still missing: at what valuation would WeWork go public?

Now, according to Bloomberg, we know, with Bloomberg reporting that the New York-based office-rental startup whose lofty mission statement is to "elevate the world's consciousness", is seeking a valuation of about $20 billion to $30 billion in its U.S. initial public offering.

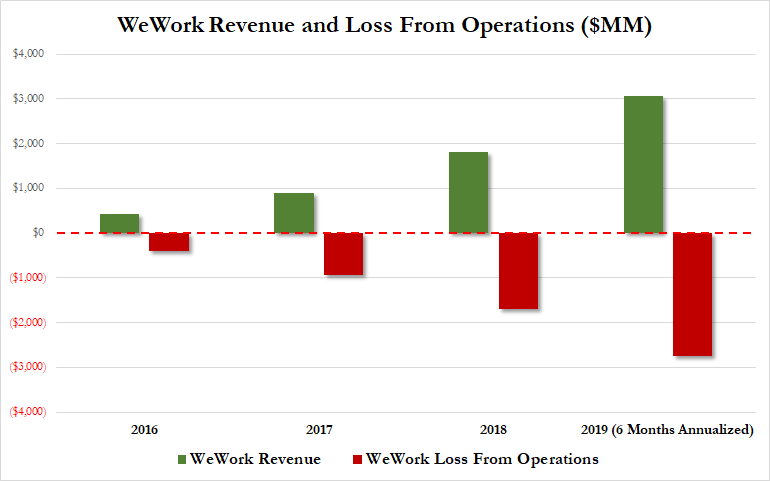

Considering that WeWork generated $1.54 billion in revenue in the first six months of 2019 and posted a net loss of $904 million, while losing an insane $1.4 trillion from operations, that would make the upper end of the range roughly 10x on sales and idiotic on a cash flow, EBITDA, or profit basis.

What is even more remarkable about this valuation is that it represents a massive haircut to the company's latest private founding round: as a reminder, WeWork It started at a $97 million valuation with its Series A in 2009, and by its Series C in 2011, investors had valued the co-working behemoth at $4.8 billion, according to Craft, a website that tracks corporate financial data.

By 2015, WeWork’s valuation had reached $16 billion. Four billion dollars from Softbank last year boosted WeWork into $40 billion territory, and the funding round in January brought it to $47 billion.

In other words, at the $20 billion, low-end valuation, WeWork would be taking an almost 60% discount to the latest idiotic valuation round led by, who else, venture capital's equivalent of "throw shit at the wall and see what sticks while revaluing the shit higher with every toss", SoftBank.

To be sure, terms of the offering will likely still change and will be dependent on the market for the mood of its possible investors. WeWork is still discussing potential terms for the share sale, and the eventual valuation could change depending on investor demand, Bloomberg said citing sources. One thing is certain, however: insiders can't wait to cash out, and none more so than CEO Adam Neumann, who recently sold some of his stock in the company and borrowed against his holdings to generate roughly $700 million, according to the Wall Street Journal - a surprising decision given that founders usually wait at least until after a company goes public before cashing out their shares.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more