Wells Slides After Another Dismal Quarter With Misses Across The Board

There are three certainties in life: Death, taxes, and Wells Fargo bungling up its quarter.

Moments after JPM reported its latest stellar quarter, which saw a record $12.1BN in adjusted earnings (boosted by $2.9BN in reserve releases), Wells Fargo once again proved it is the black sheep of US banks with earnings that missed on the top and bottom line.

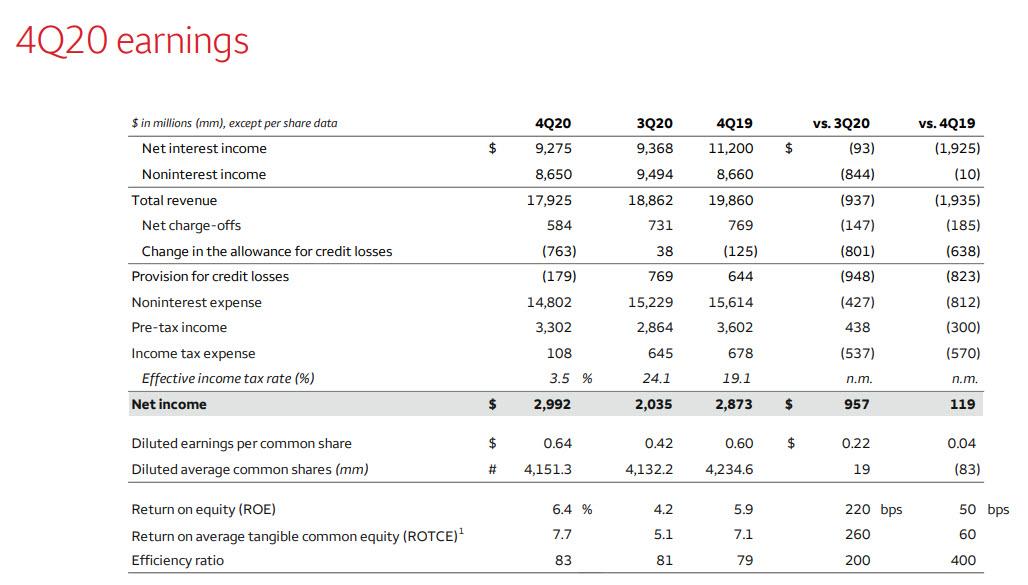

For Q4 Wells reported:

- EPS 64c, missing estimates of 60c y/y

- Revenue of $17.93 billion, missing the estimate of $18.09 billion

Wells' results would have been even worse had the bank not sharply cut its credit loss provision, which dropped by $823 million to a negative $179 million (meaning a benefit). The bank also announced total net charge offs of $584MM, well below the $921.6MM expected. This is odd considering even JPM saw its credit loss provisions increase sharply in the quarter.

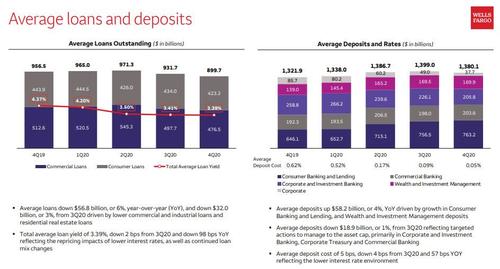

The bank also announced loans of $899.7 billion, below the estimate of $917.92 billion, while deposits dipped from $1.399 trillion to $1.380 trillion.

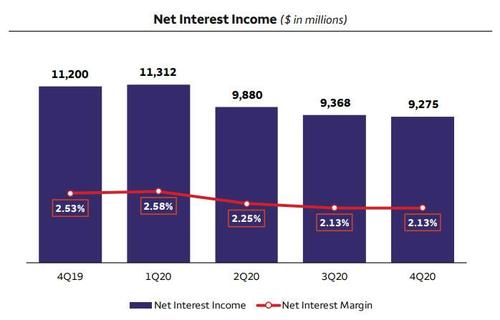

As usual, net interest income for the mortgage-heavy bank continued to slide, and dropped to $9.28 billion, missing the estimate of $9.43 billion, and the lowest on record. In percentage terms, net interest margin was 2.13%, just beating the estimate of 2.12%. This is what the bank said:

- Net interest income decreased $1.9 billion, or 17%, YoY reflecting the impact of lower interest rates, which drove a repricing of the balance sheet, lower loans primarily due to weak customer demand and elevated prepayments, lower investment securities, as well as higher mortgage-backed securities (MBS) premium amortization (4Q20 MBS premium amortization was $646 million vs. $445 million in 4Q19)

- Net interest income decreased $93 million, or 1%, from 3Q20 reflecting lower loan balances on lower customer demand and elevated prepayments, and the impact of lower interest rates, which drove a repricing of the balance sheet

And visually:

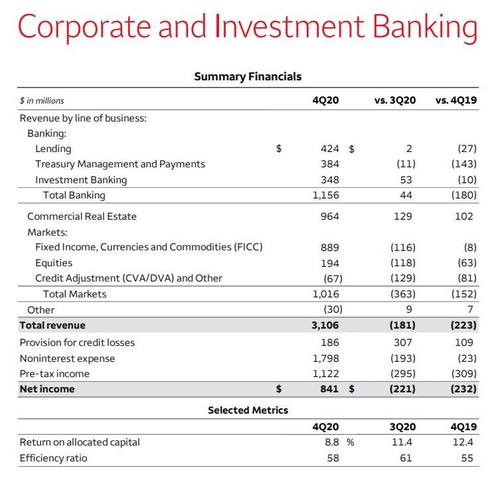

On the corporate and investment banking side, total revenues were down 7% YoY and 6% from 3Q20, with markets revenue down 26% from 3Q20 on lower trading volumes across FICC and Equities, as well as lower Credit Adjustment and Other revenue

Banking revenue down 13% YoY primarily due to lower Treasury Management and Payments revenue predominantly driven by the impact of lower interest rates and lower deposit balances, and up 4% from 3Q20 on higher Investment Banking revenue driven by higher advisory fees and equities origination

Commercial Real Estate revenue up 15% from 3Q20 on higher CMBS volumes and improved gain on sale margins, as well as an increase in low-income housing tax credit income

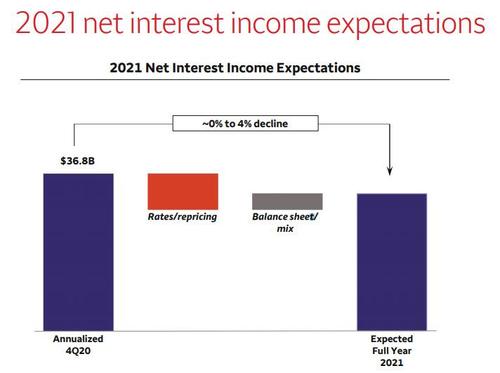

There was no good news looking ahead either with the bank expecting 2021 net interest income to be flat to down 4% from the annualized 4Q20 level of $36.8 billion. The expectations "reflect the announced sale of our student loan portfolio which accounts for approximately 1% of the decline. Expectations influenced by interest rate environment that remains below levels at which the majority of the portfolio was originated. Expectations assume the asset cap will remain in place for 2021."

As a result of these ugly results, the stock is not happy, sliding over 2%.

Full results below (pdf link)

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more