Wells Fargo Reports Another Disappointing Quarter: Interest Income Tumbles Again As Expenses Mount

After the stellar results from both JPM and Goldman, we got the now traditional disappointment from Wells Fargo which reported Q1 earnings that were mixed at best.

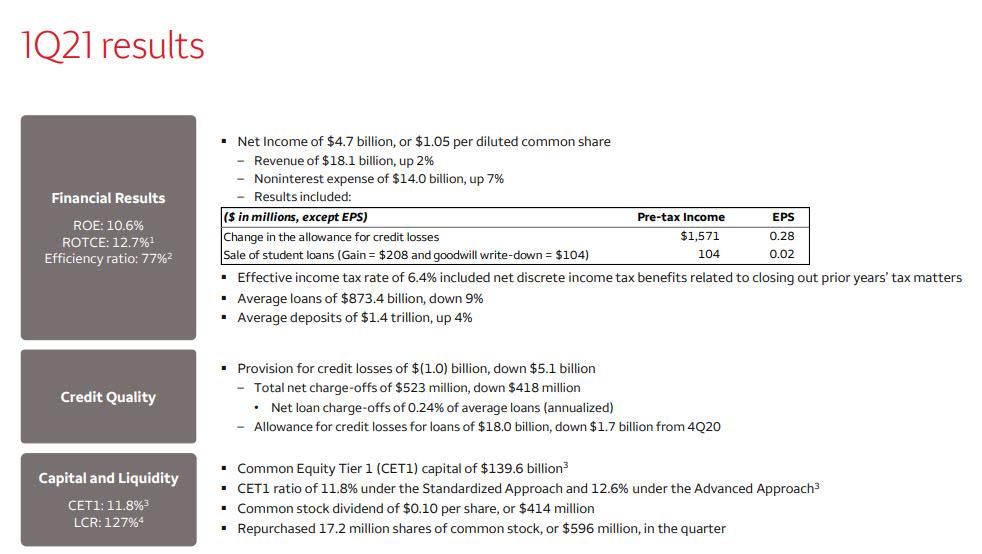

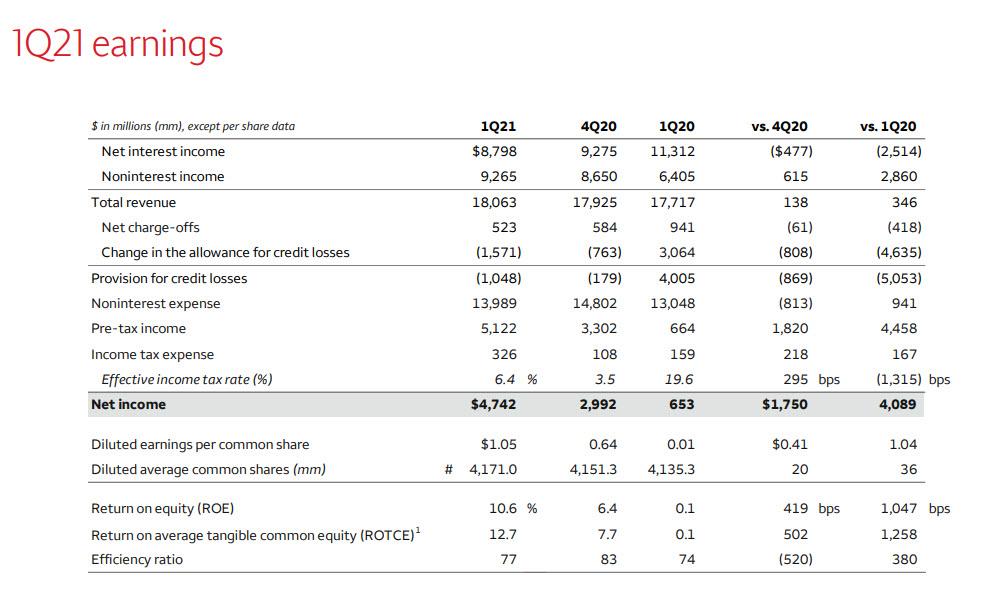

The bank reported Q1 total revenue of $18.063BN, beating estimates of $17.5BN, with EPS of $1.05 also stronger than the 0.70 expected, and while CEO Charlie Scharf said that “Charge-offs are at historic lows and we are making changes to improve our operations and efficiency" he cautioned that "low-interest rates and tepid loan demand continued to be a headwind.”

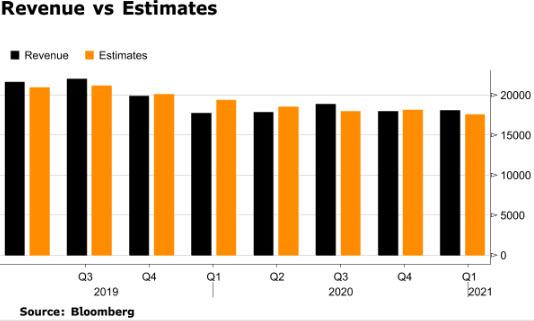

The good news: at least Wells revenues beat expectations, not something it can say for its previous quarters:

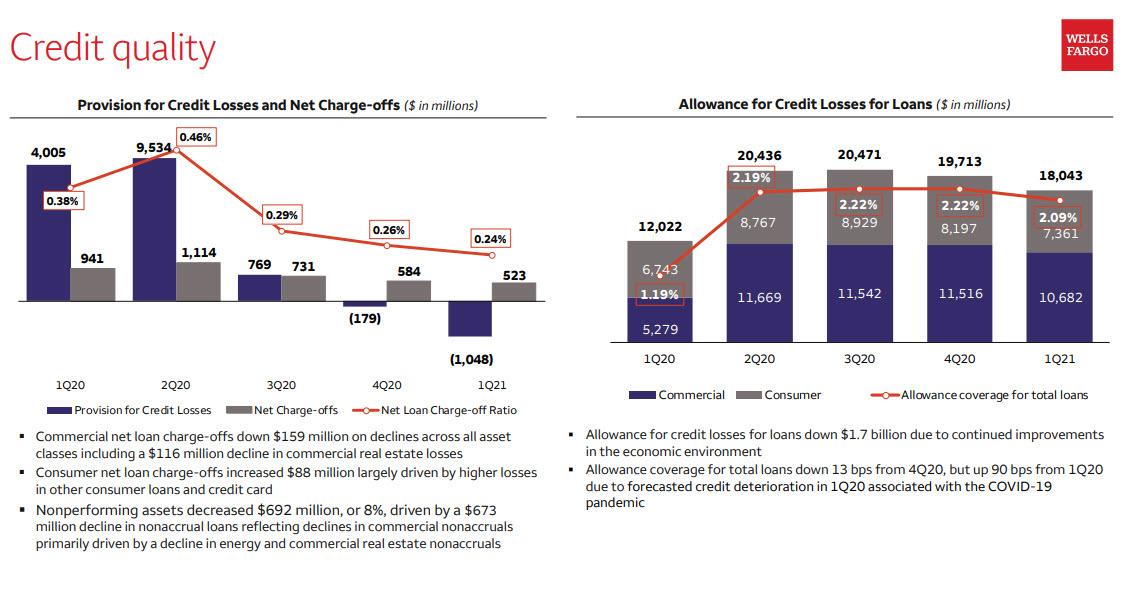

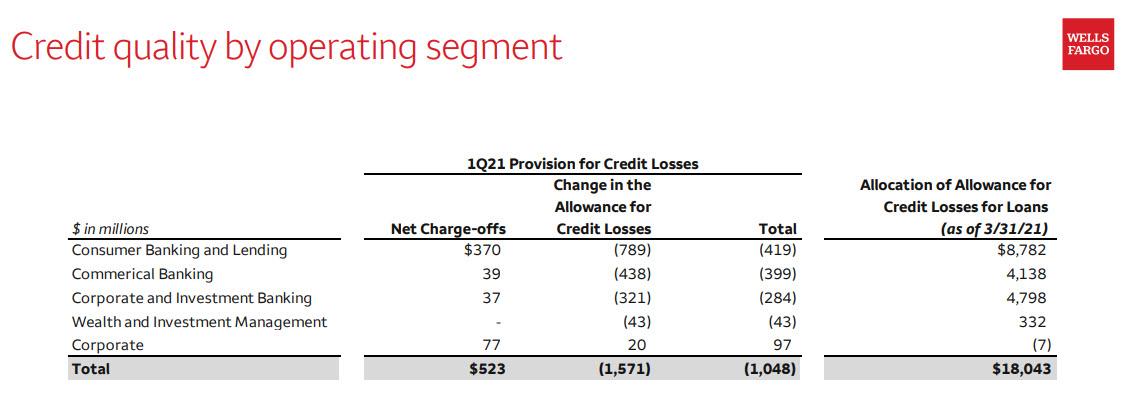

Sure enough, as with JPM, there were a number of asterisks here: the bank's net income of $4.74 billion was boosted by a larger-than-expected release of loan-loss reserves. To wit, the $1.6 billion reduction in the allowance for loan losses “reflected an improving U.S. economy," and “due to continued improvements in the economic environment and lower net charge-offs,” the bank said.

Also of note, net of $523MM in charge offs (a 0.24% charge off ratio), Wells loan loss provision declined by $1.048BN, a huge boost compared to the $121MM estimate.

Additionally, the bank's effective income tax rate was just 6.4%, which "included net discrete income tax benefits related to closing out prior years’ tax matters."

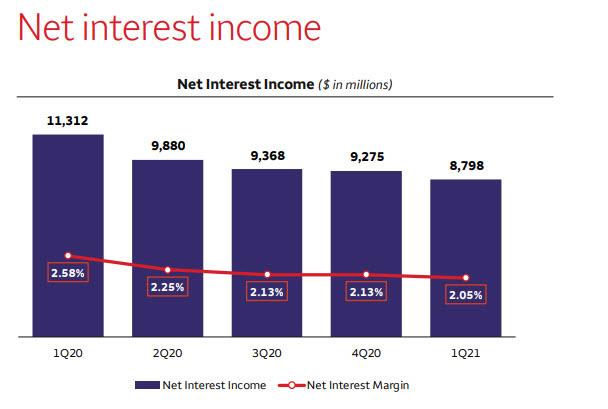

Things were especially ugly in net interest income, which tumbled a whopping 22% to $8.8BN from $11.3BN as "interest rates were a drag" and the impact was felt across the company’s businesses: consumer, commercial and corporate, and investment banking.

Commenting on this ongoing decline in Net Interest Income, the bank blamed it on lower rates even though rates actually jumped substantially in Q1.

- Net interest income decreased $2.5 billion, or 22%, YoY reflecting the impact of lower interest rates, which drove a repricing of the balance sheet, lower loan balances due to soft demand and elevated prepayments, as well as unfavorable hedge ineffectiveness accounting results, and higher mortgage-backed securities (MBS) premium amortization; 1Q21 MBS premium amortization was $616 million vs. $361 million in 1Q20 and $646 million in 4Q20

- Net interest income decreased $477 million, or 5%, from 4Q20 reflecting 2 fewer days in the quarter, unfavorable hedge ineffectiveness accounting results, continued repricing of the balance sheet, and lower loan balances

And while consumer-bank earnings dropped 6% because of lower interest rates, home lending was a bright spot, with earnings rising 19% on higher retail mortgage originations and a higher gain on sale margin. Wells Fargo is the biggest mortgage lender in the U.S.

Like JPM, Wells reported a decline in loans while deposits increased thanks to the ongoing QE.

Some more details, first on loans:

- Average loans down $91.6 billion, or 9%, year-over-year (YoY), and down $26.3 billion, or 3%, from 4Q20 on lower consumer loans predominantly driven by a $23.0 billion decline in consumer real estate loans

- Total average loan yield of 3.33%, down 6 bps from 4Q20 and down 87 bps YoY reflecting the repricing impacts of lower interest rates, as well as lower consumer real estate loans

... and deposits:

- Average deposits up $55.5 billion, or 4%, YoY, and up $13.4 billion, or 1%, from 4Q20 as growth in Consumer Banking and Lending, Wealth and Investment Management, and Commercial Banking deposits was partially offset by targeted actions to manage to the asset cap, primarily in Corporate and Investment Banking, and Corporate Treasury

- Average deposit cost of 3 bps, down 2 bps from 4Q20 and 49 bps YoY reflecting the lower interest rate environment

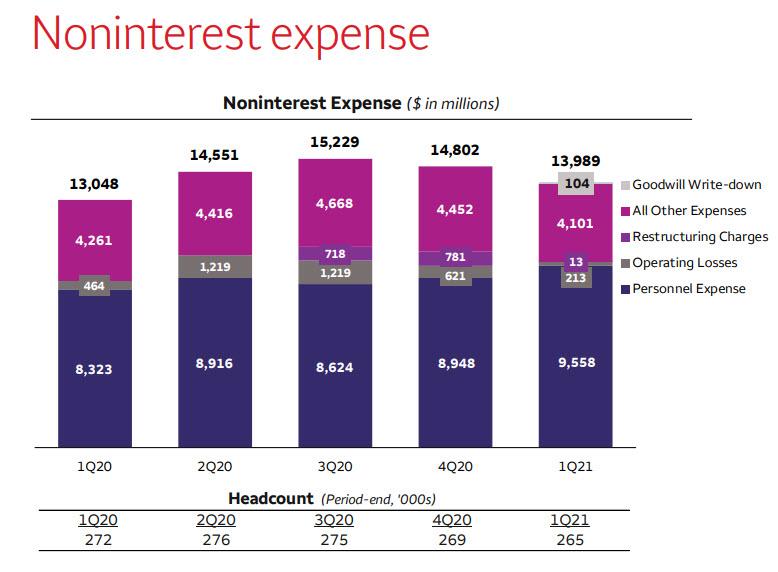

While interest income missed expectations, expenses jumped $1BN Y/Y and at $14 billion, were a touch higher than analysts forecast, showing the company still has a long road ahead to rein in costs, and primarily the impact of a lower deferred compensation plan expense.

This is what Wells said:

- Noninterest expense up 7% from 1Q20

- Personnel expense up 15%

- Higher incentives and revenue-related compensation, including the impact of higher market valuations on stock-based compensation

- 1Q21 deferred compensation expense was $5 million vs. $(598) million in 1Q20

- Partially offset by a decline in salaries expense on lower headcount

- 1Q21 included a $104 million goodwill write-down related to the sale of student loans

- All other expense down 4% on lower professional services expense largely driven by efficiency initiatives, as well as lower advertising and promotion expense

- Personnel expense up 15%

Moving on to Wells Fargo’s corporate and investment bank, which was also a mixed picture:

- Markets earnings jumped 19% on increased client demand for asset-backed finance products, other credit products, and municipal bonds.

- Banking results fell 6% because of lower interest rates (again) and lower deposit balances.

- Commercial real estate gained 5%, driven by higher sale margins and better results in the low-income housing business.

Commenting on the results, Wells Fargo CEO Charlie Scharf’s said "our results for the quarter, which included a $1.6 billion pre-tax reduction in the allowance for credit losses, reflected an improving U.S. economy, continued focus on our strategic priorities, and ongoing support for our customers and our communities. Charge-offs are at historic lows and we are making changes to improve our operations and efficiency, but low-interest rates and tepid loan demand continued to be a headwind.”

Scharf also said the bank was working to “build the appropriate risk and control environment remains our top priority. This is a multi-year effort and there is still much to do, but I am confident we are making progress.”

In response to the earnings, Wells Fargo initially fell more than 1% but then swung to a gain of about 0.4% as investors assessed first-quarter results that included a revenue beat, a miss in net interest income, and CEO Charlie Scharf calling low-interest rates and loan demand headwinds.

Finally, here is the company's Q1 presentation (pdf link)

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more