Wells CEO Is "Extremely Disappointed" With First Quarterly Loss Since 2008; Massive Dividend Cut

While JPMorgan at least had a stellar trading quarter to offset another surge in loan loss reserves (i.e. balance sheet deterioration vs income statement improvement), Wells Fargo (WFC) just had the ugly balance sheet to flaunt and boy was it ugly.

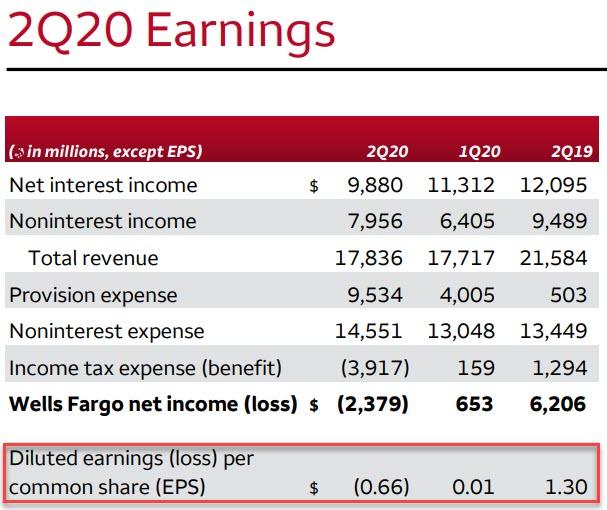

For the second quarter, Warren Buffett's favorite bank reported a Q2 loss per share of 66 cents, down sharply from the $1.30 profit a year ago, and far worse than the 13 cent loss consensus estimate. More importantly, this was the first time Wells posted a quarterly loss since 2008, confirming that this is indeed the biggest crisis since Lehman.

And while it was widely expected that the bank would cut its dividend of 55 cents, with the bank saying last month that it would cut the dividend to comply with the new restrictions the Federal Reserve brought on payouts, consensus expected the cut to be to 20 cents per share. Which is why when Wells unveiled that its new dividend would be just 10 cents (from 55 cents previously), it led to even more disgust with - and selling of - one of the worst-performing stocks of 2020.

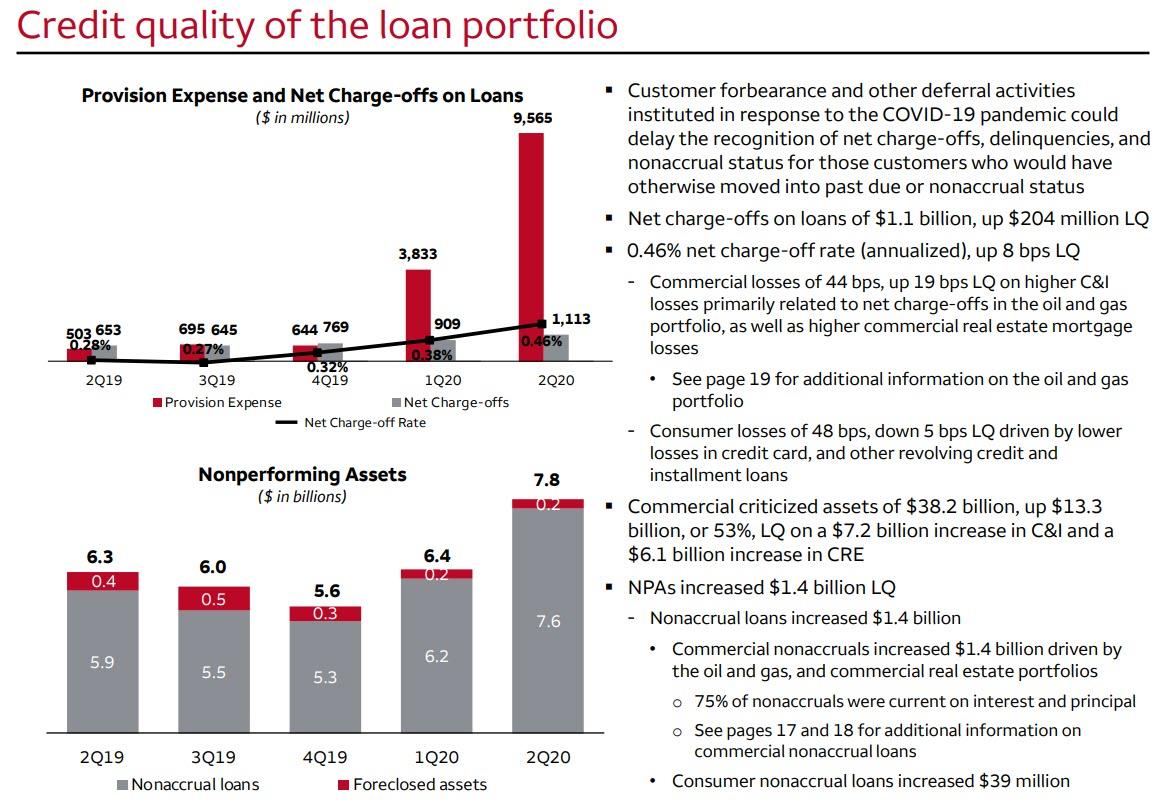

There was more. Consensus also got a kick in the groin after Wells reported that its Q2 provision for credit losses would be a whopping $9.5BN, double the $4.86BN expected, and consisting of $8.4 billion increase in the allowance for credit losses as well as $1.1 billion of net charge-offs for loans.

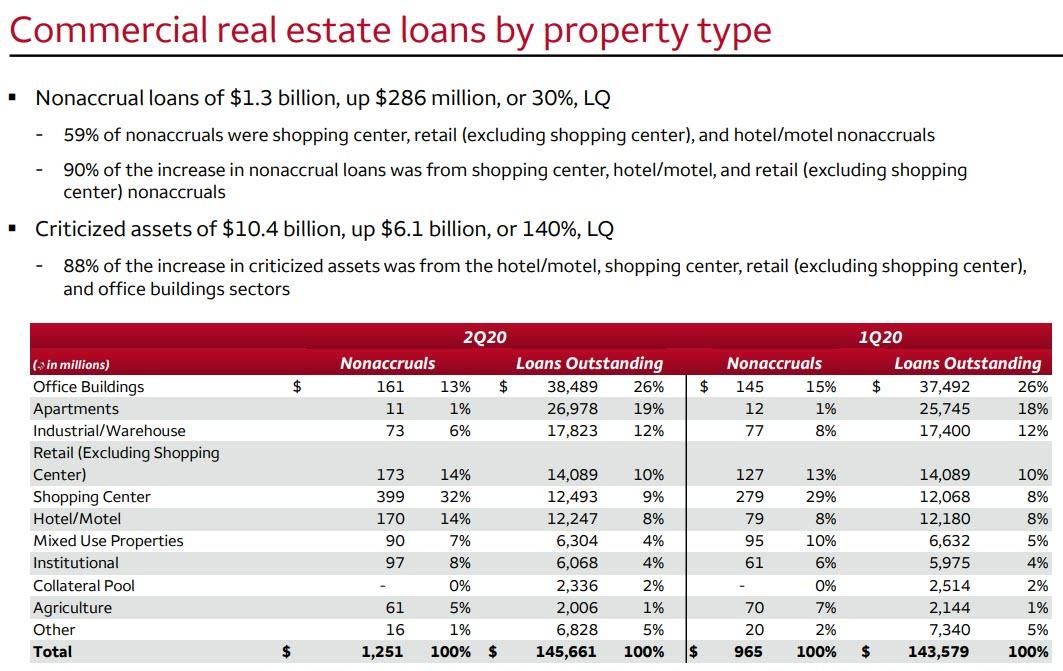

It's about to get much worse, though, because as Wells conveniently highlighted it has some $146BN in commercial real estate loans, most of which will be impaired in the coming months amid record delinquency and default wave.

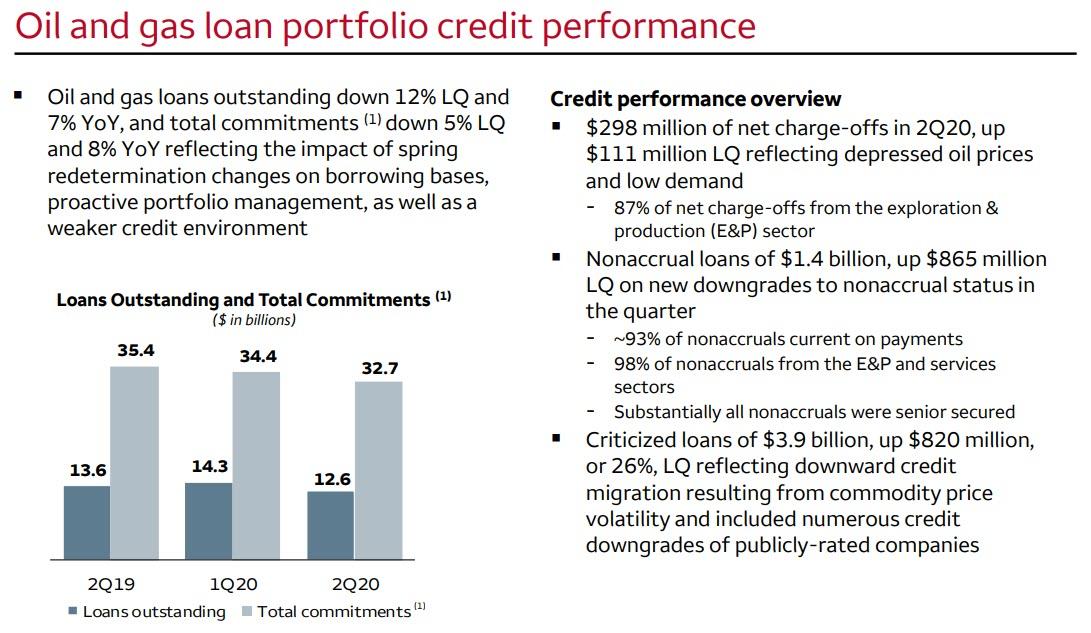

But wait, there's even more, because as of Q2, JPM also has $32.7BN in total oil and gas loan commitments, of which $12.6BN are currently outstanding.

"We are extremely disappointed in both our second quarter results and our intent to reduce our dividend. Our view of the length and severity of the economic downturn has deteriorated considerably from the assumptions used last quarter."

Well, the stock was just as disappointed:

Here is the full Q2 earnings slideshow (pdf link)

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more