Weekly Energy Roundup: Oil And Gas Companies, Jan. 8 - 12

The last week was quite an interesting one for the oil markets, particularly due to the city of New York filing a lawsuit against the industry for “contributing to global warming.” The state of California is also waging a war against the industry for largely the same charge. It is curious to see how this works out and until it is resolved, the industry will certainly have a dark cloud over its head that could easily result in high risks. In addition, the US government’s failure to reach an agreement that would continue funding could result in a US government shutdown, which is likely to result in market turbulence. Thus, we have a lot to report on.

ExxonMobil (XOM)

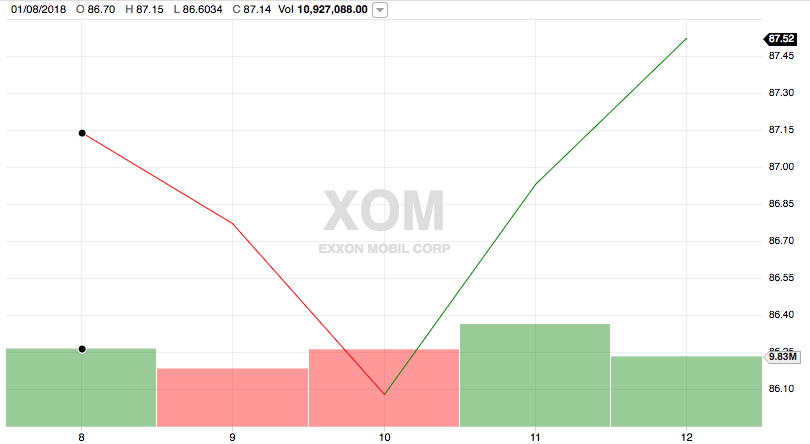

ExxonMobil delivered a gain last week, although it did decline fairly sharply in the first half of the week. On Monday, January 8, 2018, shares of ExxonMobil opened at $86.70 and declined to a low of $85.98 on Wednesday before rebounding and closing out the week at $87.52. This gives the company a return of 0.95% on the week.

Source: Fidelity Investments

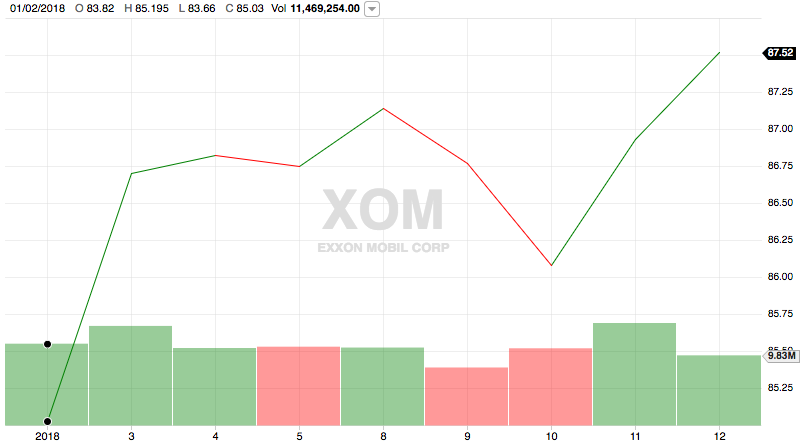

The stock’s two-week performance was quite volatile, although it was also sharply positive and will certainly please long-term investors. On Tuesday, January 2 (the markets were closed on Monday), ExxonMobil opened at $83.82 per share. This gives the stock a two-week gain of 4.41%, fairly respectable for such a large company.

Source: Fidelity Investments

By far the biggest news of the week was the notification that New York City filed suit against ExxonMobil and four other large oil companies, many of which are discussed in these weekly reports, for their role in contributing to global warming. Regardless of your views of the merit of this suit, the possible consequences are very real and could result in significant financial penalties for the companies targeted if the city prevails in this lawsuit. The outcomes of civil suits are notoriously unpredictable and thus this will remain a very real risk to the company’s financial standing until it is ultimately resolved. As another part of this suit, the city’s pension funds have been ordered to withdraw from all fossil fuel investments, representing $5 billion of investment funds.

ExxonMobil also made a sixth oil discovery off of the coast of Guyana, increasing the total amount of recoverable resources in the location to more than 3.2 billion boe. This will certainly prove positive for ExxonMobil’s reserve development and could ultimately contribute to production growth, which is something that the company sorely needs.

Chevron (CVX)

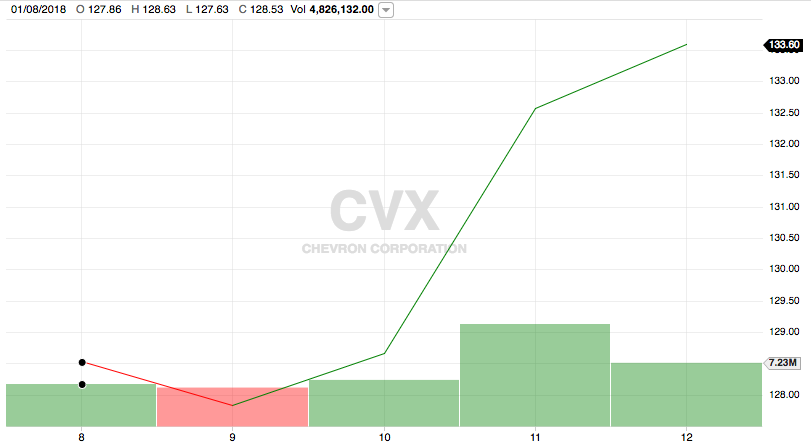

Chevron also delivered a gain to investors last week with much more stability than ExxonMobil saw. The stock opened at $127.86 per share on January 8, 2018 and closed out the week at $133.60 per share. This represents a gain of 4.49% on the week, significantly better than ExxonMobil.

Source: Fidelity Investments

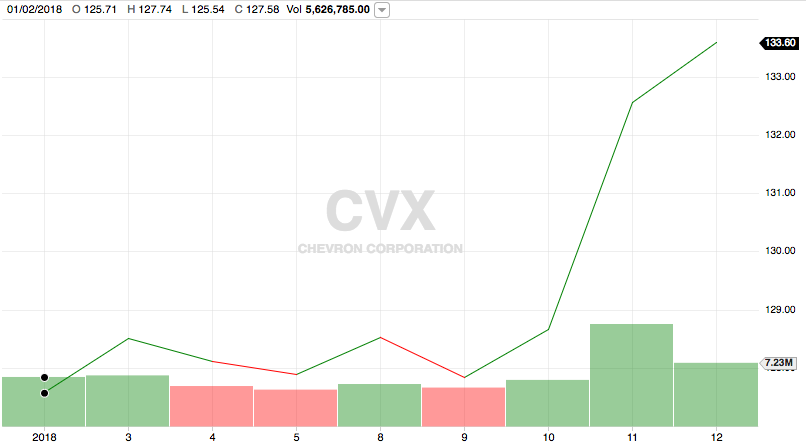

Chevron’s stock price action was fairly impressive over the past two weeks, although the vast majority of its positive performance was delivered in the latter half of the most recent week. Prior to that, Chevron shares were almost completely flat. The stock opened on Tuesday, January 2, 2018 at $125.71. Thus, the shares delivered a positive return of 6.28%. Shareholders should certainly be pleased with this performance.

Source: Fidelity Investments

Chevron was another of the companies that was sued by New York City over global warming, so the same comments apply to it as apply to ExxonMobil. It will also suffer from the loss of a large investor as the city’s pension funds pull out of their fossil fuel investments, although the actual performance hit could be minimal depending on the willingness of other investors to pick up the shares as well as the speed of the divestures.

Chinese oil giant Sinopec (SNP) also committed to purchasing numerous assets in South Africa from Chevron following the approval of the nation’s government. While this deal will result in a significant amount of cash coming into Chevron’s bank account following consummation, it will also result in the latter company no longer having those productive assets in South Africa. The company will thus need to find new investments for the cash as simply returning it to the shareholders will ultimately be self-defeating.

Finally, on Thursday, BMO Capital upgraded Chevron to a “Buy.” The company’s stock proceeded to hit a 52-week high following the upgrade.

BP (BP)

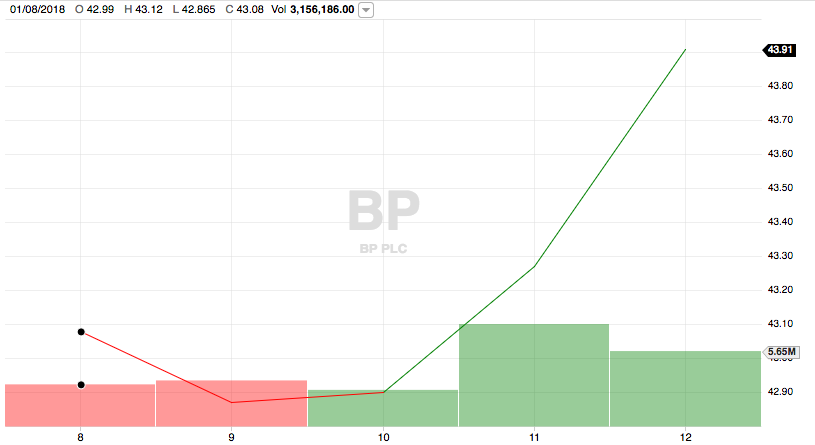

BP also delivered a strong gain over the week to its shareholders. The stock opened on January 8, 2018 at $42.99 per share. It declined slightly early in the week but then reversed course and began to climb on Thursday, ultimately closing the week at $43.91 per share. This represents a gain of 2.14% for the week.

Source: Fidelity Investments

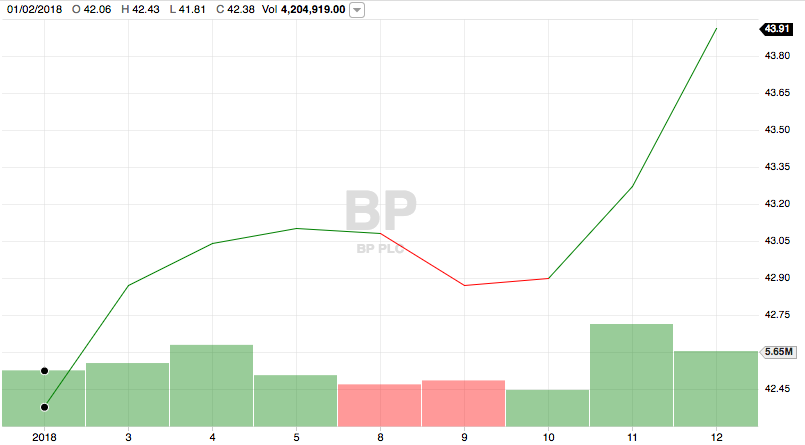

BP shares had surprisingly minimal volatility over the past two weeks, although there were certainly some up days and down days. The shares began trading on January 2 at $42.06 and ultimately closed on January 12 at $43.91. This represents a two-week gain of 4.40%.

Source: Fidelity Investments

BP was yet another company named as a defendant in the lawsuit by New York City, so the comments that were made about ExxonMobil would apply to BP as well. In addition, BP is likely to be one of the companies that is divested by the City’s pension funds, so it could see its stock decline at the time that this happens depending on the willingness of other investors to pick up the shares at an appropriate price and the speed at which the pensions divest their fossil fuel holdings.

BP’s project partner Premier Oil (PMOIY) stated that its Ravenspurn well in the North Sea was a disappointment, although BP might still pursue resources in nearby areas as it continues to search for new sources of natural gas to meet Europe’s high demand.

Royal Dutch Shell (RDS-A, RDS-B)

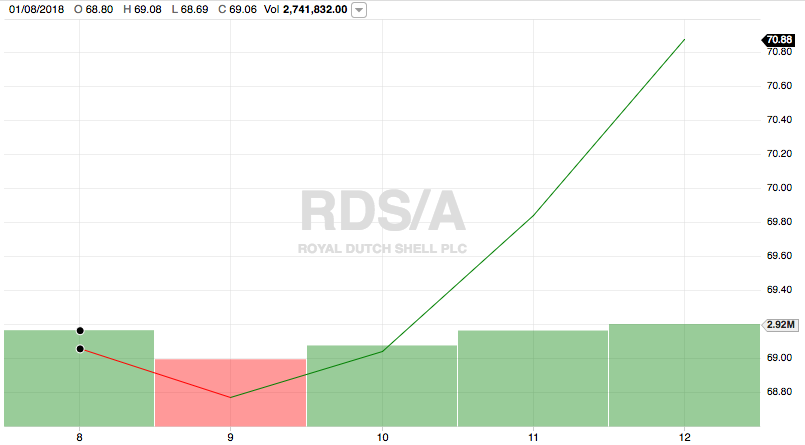

Royal Dutch Shell saw similar price action to that of its peers, showing some weakness early in the week and then quickly recovering to close out the week with a gain. On Monday, January 8, 2018, shares of Royal Dutch Shell opened at $68.80 and closed out the week at $70.88. This represents a gain of 3.02% for the week.

Source: Fidelity Investments

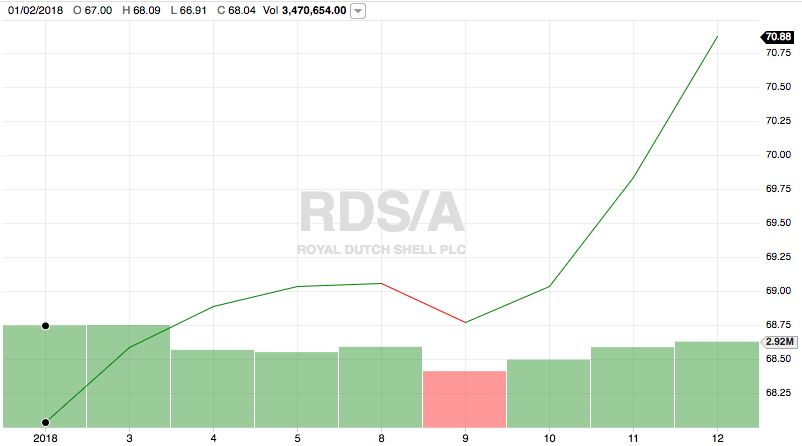

Royal Dutch Shell posted a gain over the past two weeks with surprisingly little volatility. This would make the stock appealing to long-term investors over that period but not so much for traders due to the relative lack of intra-day price fluctuations. On January 2, 2018, the stock opened at $67.00 per share. It thus delivered a two-week gain of 5.79%.

Source: Fidelity Investments

Royal Dutch Shell was yet another company that was named in the New York City global warming lawsuit and as such this will remain a dark cloud hanging over the company until the suit is resolved. Investors should thus remain aware of the risks that the company will not achieve a positive outcome here and suffer large financial penalties.

Royal Dutch Shell also made headlines over the past week with news that it is considering purchasing a Dutch green energy utility. Although no estimate of a price has been released, the owners of the utility state that it is worth at least 3 billion euro. That would be a relatively small acquisition for a company of Shell’s size, but this could also serve as a publicity move to show the company’s commitment to developing green energy solutions going forward.

Eni (E)

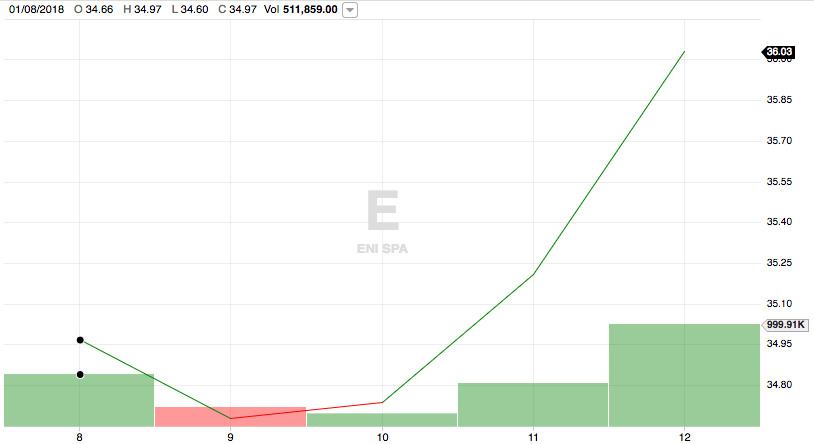

Italian oil giant Eni's stock chart will look quite familiar to those of its peers. The company also saw its stock decline in the early stages of the week only to recover and post a respectable gain. On Monday, January 8, 2018, shares of Eni opened at $34.66 per share. The stock declined at first but then shot upward later in the week to close at $36.03. This gives the company a 3.95% gain over the week.

Source: Fidelity Investments

As was the case with Eni’s other European peers, the stock was not particularly volatile over the trailing two-week period. It also delivered some early gains before losing some ground in the middle of the period and ultimately recovering to deliver a two-week gain. The stock opened on January 2, 2018 at $33.19. Considering that it closed on January 12 at $36.03, it delivered a two-week gain of 8.56%.

Source: Fidelity Investments

Unlike many of the other companies discussed in this series, Eni was not named as a defendant in the New York City lawsuit, which may have to do with the fact that the company does much less business in the United States than any of the others discussed here. While this most likely means that it will not suffer the same financial consequences as the other companies will if the city wins the lawsuit, it may still see its stock impacted by this lawsuit as it is possible that the European Union will attempt to bring a similar lawsuit. I will admit though that I somewhat doubt this outcome, plus the Italian government’s stake in the company insulates it somewhat from this type of threat.

Statoil (STO)

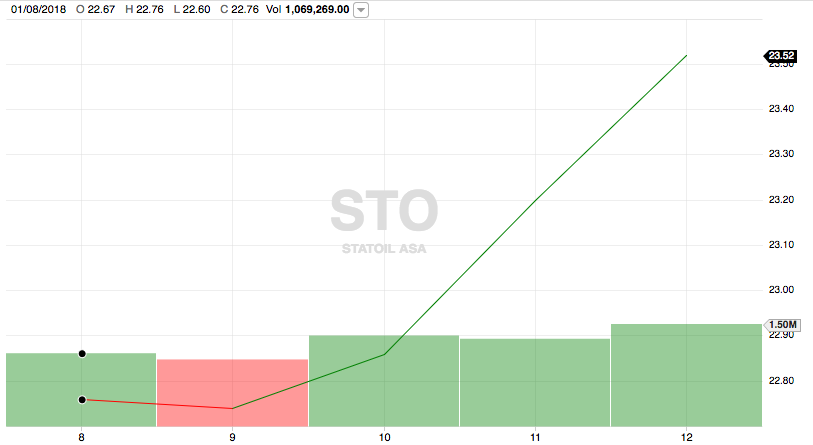

Norway's Statoil is often the most stable entity price-wise in these weekly reports, likely due to the Norwegian government’s substantial ownership stake in the company. This was the case over the past week, although it also saw significant gains in the latter stages of the week along with its peers. ADRs of the company opened the week at $22.67 and closed out the week at $23.52. This gives Statoil a gain of 3.75% on the week.

Source: Fidelity Investments

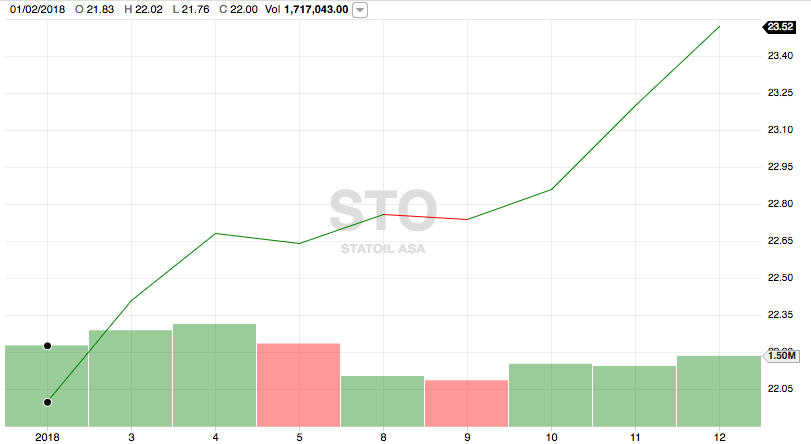

Statoil had much less volatility than any of its peers over the trailing two-week period and delivered almost steady intra-day gains. The stock opened at $21.83 on January 2, 2018. As the stock closed out the two-week period at $23.52 per share, it delivered its investors a respectable 7.74% gain over the period.

Source: Fidelity Investments

As was the case with Eni, Statoil was not named as a defendant in the New York City global warming lawsuit and as such will be quite unlikely to suffer any significant financial penalties if the suit turns out against the industry. The stock will also not likely suffer any real consequences from the suit due to the Norwegian government’s substantial stake in the firm that provides it considerable stability.