Weatherford Might Need $1.4 Billion To Avoid Bankruptcy

I recently outlined my major issues with Weatherford International WFT. I believe the company's goodwill and inventory could be overstated by over $2 billion. Asset write-downs of that size could cause Weatherford to breach its debt covenants. This article outlines [i] the potential write-offs and [ii] the capital Weatherford may need to raise to avoid a breach of its debt covenants and/or bankruptcy.

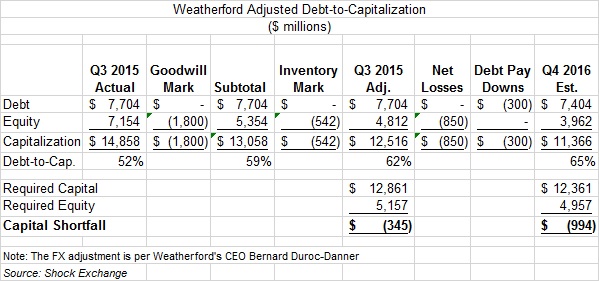

Scenario 1

The following scenarios project [i] potential asset impairments and [ii] the capital required for Weatherford to remain in compliance with its debt-to-capitalization of 60% pursuant to its debt covenants with JP MorganChase JPM.

Q3 2015 Actual Capitalization

At Q3 2015 the company's capitalization (debt and equity) was $14.9 billion. The $7.2 billion equity includes [i] actual equity of $5.8 billion plus [ii] an add-back of $1.4 billion for foreign exchange currency translation adjustments. According to management this add-back is allowed.

$1.8 Billion Goodwill Mark

At Q3 Weatherford had $2.8 billion of goodwill and $400 million in intangible assets primarily related to acquisitions. Many of those acquisitions were made when oil prices were much higher. $1.8 billion of the goodwill is attributable to the company's North American operations. Through YTD September 30, 2015 ("September YTD") North America had revenue of $2.8 billion, EBITDA of $133 million, and a pretax loss of $156 million.

These figures do not include allocations for corporate costs and R&D which were a combined $326 million for September YTD. If corporate allocations were based on percentage of revenue, North America's percentage would be about 38% or $124 million; September YTD EBITDA and pretax loss would be $9 million and $280 million, respectively. That said, the case could be made to write off the entire $1.8 billion goodwill associated with North America.

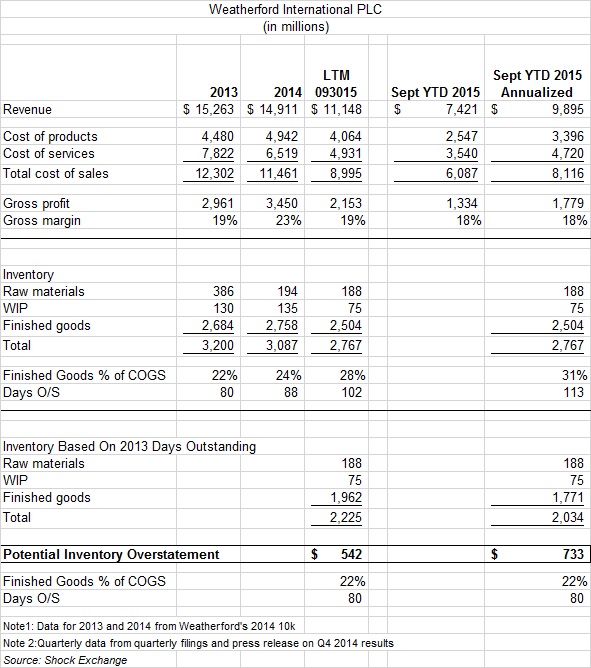

$542 Million Inventory Mark

Weatherford's $2.8 billion inventory at Q3 2015 appears to be slow moving; inventory was 10% less than the $3.1 billion inventory balance at year-end 2014 and only 14% less than the $3.2 billion balance at year-end 2013. It has declined much less than revenue or cost of sales over those periods.

By my estimation, Weatherford's inventory days outstanding for finished goods was 80 days at year-end 2013; it increased to 88 days at year-end 2014 and 102 days at Q3 2015. Had finished goods remained at the same 22% of cost of sales (80 days) for the last 12 months through September 2015, total inventory would have been lower by $542. Applying the same metric to the company's annualized results for September YTD, total inventory would be lower by approximately $733 million.

The inventory mark of $542 million represents the amount that goodwill could potentially be overstated.

Subtotal Q3 2015

The inventory mark and goodwill mark would have bring Weatherford's debt-to-capitalization to 62% at Q3 2015. The company would need $345 million to bring the ratio under 60%. It had a reported $519 million of cash on hand. However, it may be hard-pressed to pay down debt of $345 million at Q3 and still have enough cash to make a $350 million principal payment due in Q1 2016.

$850 Million In Losses

Weatherford had a net loss of $170 million in Q3 2015. I assumed it would lose this amount each of the next five quarters -- Q4 2015 to Q4 2016. Given continued cut backs in oil & gas E&P, this assumption could be optimistic.

$300 Million In Debt Pay Downs

Weatherford has $519 million in cash on hand; however, some of this amount could have been eroded by foreign exchange currency effects that have been reflected in "other comprehensive income." Secondly, through September YTD Weatherford's cash flow from operations, less capex, was negative. Its cash flow from operations was $383 million, while capex was $542 million. I expect cash flow to be flat to negative going forward. Sans incurring additional debt, I assumed the company would have enough liquidity to repay $300 million in debt over the next five quarters.

Q4 2015 Estimate

I assumed Q4 2016 debt would be lower by $300 million and equity lower by $850 million in net losses. Debt-to-capitalization would rise to 65%. Capital of $994 million would be required to bring the ratio below 60%. Ironically, Weatherford attempted to raise $1 billion in capital in September in order to "pre-fund acquisitions."

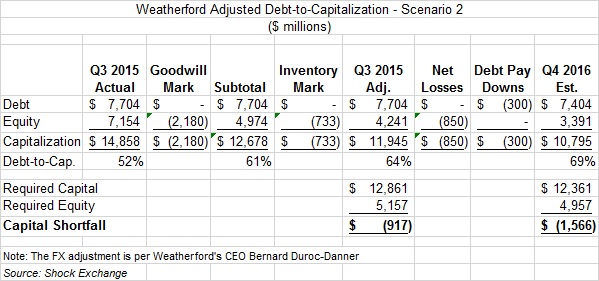

Scenario 2

The following scenario assumes higher write-offs for goodwill and intangibles, and inventory.

$2.2 Billion Goodwill Mark

This assumes that $1.8 billion of goodwill associated with North America, and $380 million of intangible assets are written off. At the low end of my valuation range (5x EBITDA), WFT would be worthless. A case could be made that the entire $3.2 billion of goodwill and intangibles should be written off.

$773 Million Inventory Mark

The $773 million inventory mark assumes [i] finished goods inventory at 80 days outstanding and [ii] cost of sales based on annualized results through September YTD.

Capital Shortfall

Based on the Q3 2015 balance sheet the company's adjusted debt-to-capitalization would be 64%; Weatherford would need a capital infusion of about $917 million to keep from breaching its debt covenants. After net losses of $850 million over the next five quarters and debt repayments of $300 million, Weatherford would need a capital infusion of about $1.6 billion to keep from breaching its debt covenants before the end of 2016.

Conclusion

Based on estimates of goodwill and inventory impairment charges, Weatherford could potentially need to raise $1 billion (or more) of new capital. A capital raise of this magnitude could be highly-dilutive. WFT sold off about 17% when Weatherford attempted a $1 billion capital raise in September; the company subsequently canceled it due to poor pricing.

Sans a capital raise, Weatherford's could breach its debt covenants, prompting lenders to accelerate its $1.7 billion short-term debt. This could potentially force the company to file chapter 11 bankruptcy. Avoid WFT as either scenario could cause the stock to sell off.

Disclosure: I am short WFT

Best Buy: Weatherford, National Oilwell Varco, or Helix...

Are you asking which one of those stocks the Shock Exchange would buy? He wouldn't buy any stocks at this juncture.