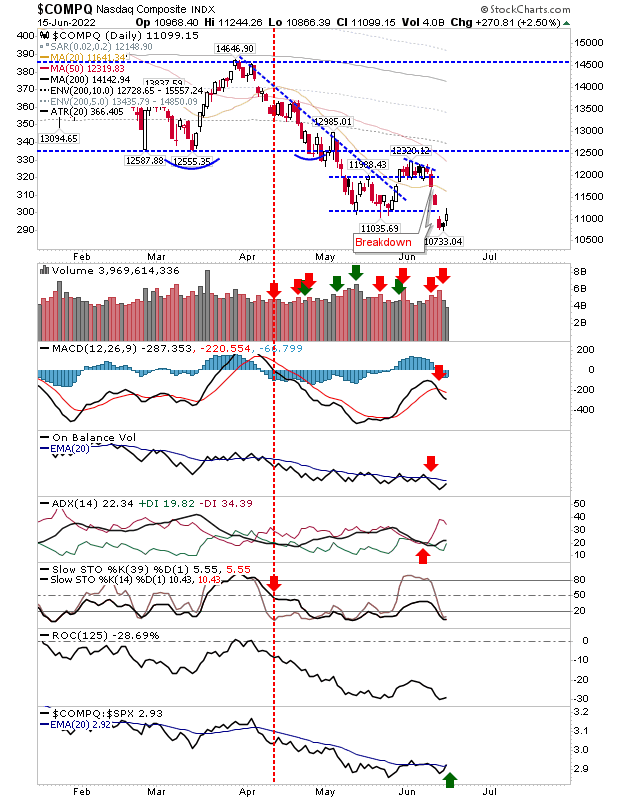

Weak Bounce Does Not A Bottom Make

Buyers step up to the plate and recover some of yesterday's losses, but buying volume was down on Tuesday for some indices - and there were some losses end-of-day to keep the gains in check. I wouldn't expect much from indices tomorrow. but slow, steady gains over coming days would be good.

The S&P did manage to register an accumulation day but technicals are net bearish. If there is going to be a 'bear trap' it will need to do a lot more. Bears hold the advantage in the near term.

The Russell 2000 ($IWM) finished with a 'spinning top', which is a more neutral outlook for the index. With the undercut of the May lows in the S&P and Nasdaq, the likelihood for the same happening here is increased. Today's close also saw a loss in relative performance to the aforementioned indices.

We can't say a whole lot about today. The candlesticks were neutral and volume was on the light side. This has the look of a weak bounce, which means to reverse this we have to see an increase in buying volume and ideally, wide range candlesticks.Lets see what tomorrow brings.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more