Was Black Friday Selling Meaningful?

Holiday trading rarely marks the start of a major trend change as junior traders look after desks until their bosses return from the holiday. But bosses won't be happy with the shift their minions have put in over the Thanksgiving weekend. Last Wednesday's gains truly do feel like a long time ago.

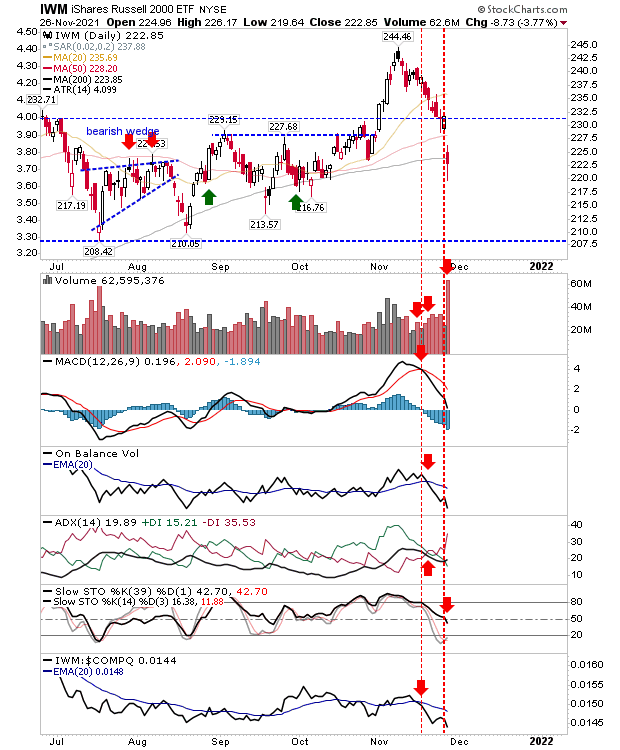

The Russell 2000 is the barometer for the broader market. It really has no more room for maneuver as the index gapped down to its 200-day MA with technicals net bearish. Relative performance has also moved sharply against it relative to the Nasdaq and S&P 500.

Volume climbed to register as distribution, adding to the misery. After waiting so long for the breakout in 2021, the index now finds itself looking in the other direction.

Losses in the Nasdaq weren't as dramatic as for the Russell 2000. Technicals are more mixed, with 'sell' triggers in the MACD and ADX offset by continued bullishness in On-Balance-Volume and Stochastics. The index is underperforming against the S&P 500, but it has spent the past six months moving back and forth on this. Unlike for the Russell 2000, it hasn't lost its breakout.

The S&P 500 experienced losses of over 2%, which leaves the chart with a large, ugly scar after weeks of small gains. While the price bar left an impression, there wasn't too much damage done to supporting technicals with only the MACD on a 'sell' trigger. The October breakout still has some wiggle room with the 50-day MA nearby. I suspect we will be looking at a test of the latter moving average over the coming week.

Funnily enough, the Dow Industrial Average has a chart which looks closer to the Russell 2000. The index has lost its breakout and undercut its 50-day MA. The Dow Jones Industrials is looking at a test of the 200-day MA as its next support play.

Heading into next week, the Russell 2000 is the index to watch. It took so long for it to participate in the rally, only for the breakout to collapse in on itself. If losses continue, it will only go on to pull the other indices lower. Will junior traders be getting their Christmas bonus? We will see if their actions placed them on the right side of the trend.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more