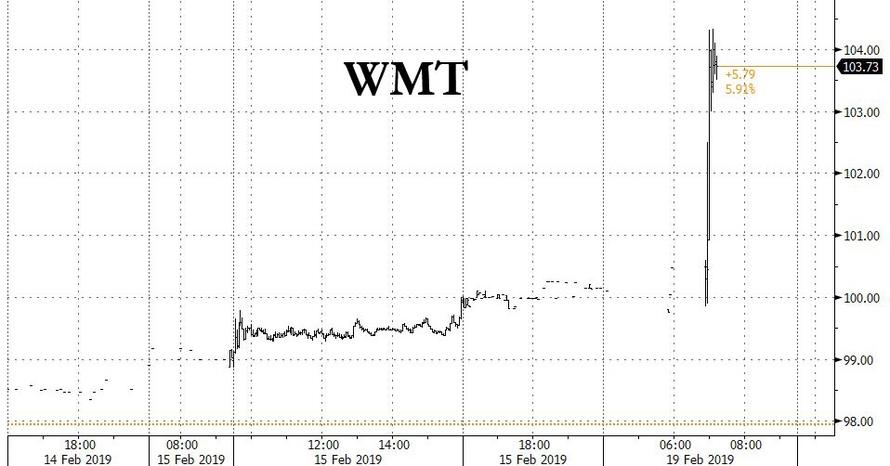

Walmart Soars After Reporting Best Holiday Quarter In A Decade

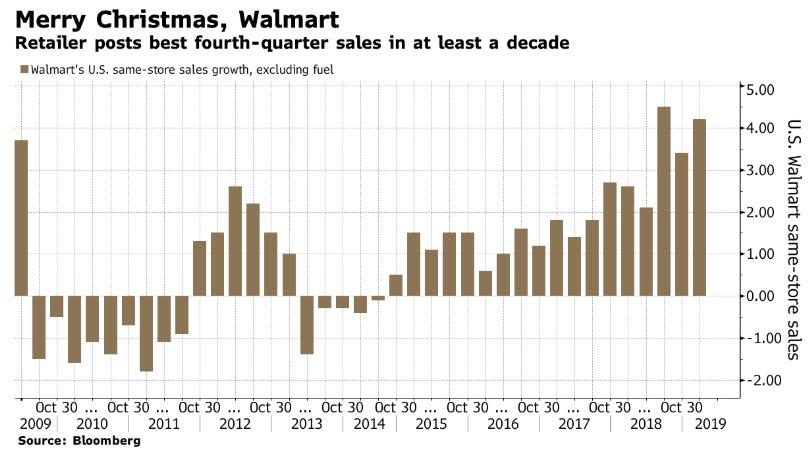

Walmart stock is soaring, brushing off December's dreadful retail sales print, after reporting Q4 revenue and earnings that beat expectations, and same-store sales that not only crushed forecasts, but were the best holiday quarter for Walmart in a decade.

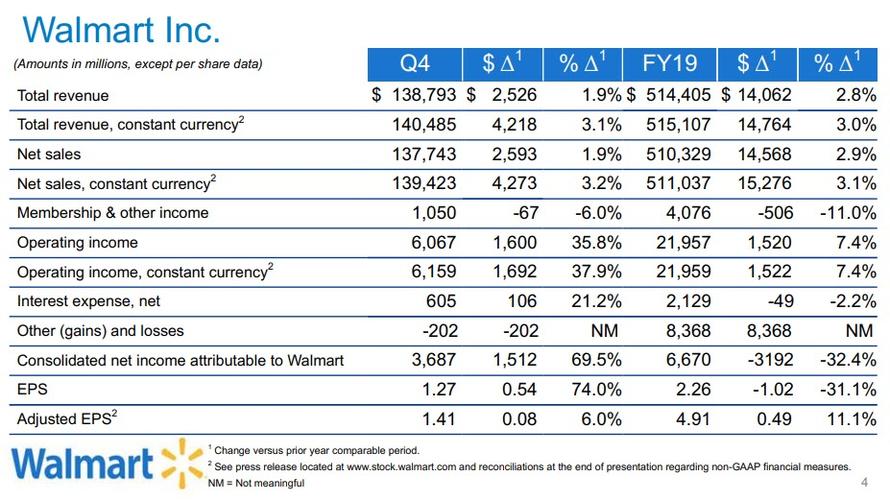

America's largest bricks and mortar retailer reported 4Q adjusted EPS of $1.41 vs est. $1.34 (range $1.29-$1.42), while Q4 revenue of $138.8b also beat estimates of $138.7b (range $135.7b-$140.8b).

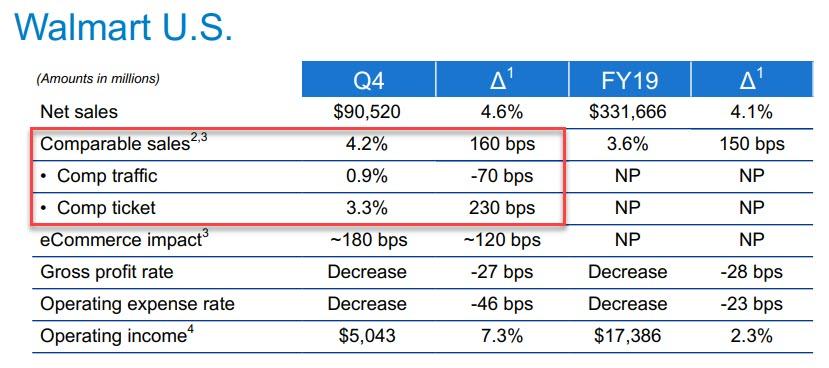

More notably, Walmart reported comparable same-store sales in the US of 4.2% for the fourth quarter which included Christmas, beating analysts’ estimates of 3.2%, by a full percentage point.

Surprisingly, higher prices - more than increased foot traffic - drove the revenue gains, with the average ticket up 2.3% even as traffic dropped 0.7%.

... making Q4 the best holiday quarter in at least a decade, and soothing concerns about the industry’s outlook for 2019.

Some more details:

- 4Q Walmart U.S. comps. ex-fuel rose 4.2%, est. up 3.2%; Walmart U.S. comp sales on a 2-year stack of 6.8% is the strongest growth in 9 years

- Walmart U.S. e-commerce sales up 43% y/y vs up 43% in 3Q

- Walmart U.S. traffic up 0.9% y/y, avg ticket up 3.3%

- Sam’s Club comps. ex-fuel up 3.3%, est. up 2.9% (CM, avg of 15)

- Sam’s Club e-commerce sales up 21% y/y vs up 32% in 3Q

- Sam’s Club traffic up 6.4% y/y, avg ticket down 3.1%

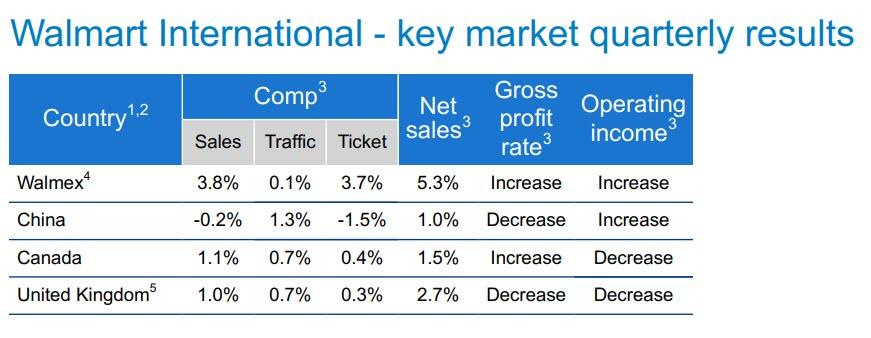

On the international side, WMT was hit hard by the rising dollar, with Q4 reported sales for Walmart international down 2.3% to $32.3BN, however, in constant currency sales would be up 2.7% to $34.0 billion. Curiously, the one place that saw price deflation was China, resulting in a hit to the gross profit.

Some other observations courtesy of Bloomberg:

- Walmart, like rivals, made a big push to grab former Toys “R” Us shoppers during the holiday season, boosting its toy assortment by 40 percent online and holding thousands of in-store events where kids could test out items. The gambit worked, as toys helped fuel the sales beat, Chief Financial Officer Brett Biggs said in a Tuesday morning interview.

- This was the first holiday season for Walmart’s redesigned website, plus its expanded home delivery and curbside pickup options. E-commerce sales in the U.S. rose 43 percent, in line with the gains most analysts had been expecting, helped by a broader assortment of brands and increased online grocery sales.

- The company reiterated the full-year sales and profit guidance it gave in October, including same-store sales growth at U.S. Walmart stores of between 2.5 and 3 percent -- a slight slowdown from the fiscal year that just ended. Retailers are bracing for a pullback in consumer demand this year, especially if the U.S. follows through on its threat to more than double tariffs on many Chinese goods, forcing retailers to raise some prices in response.

Still, before the US retail sales malaise is declared dead, consider that much of the gains in the quarter were more related to timing:, especially as relates to the early release of government food-stamp payments that were supposed to have become available to American shoppers in February, which boosted U.S. same-store sales by 0.4 percentage points in the quarter, the company said.

Finally, the age-old question emerges: are strong sales for Walmart - America's discount retailer - a good thing for the economy (refuting the plunge in retail sales narrative), or a bad thing (as more Americans are forced to buy stuff at lower prices, as discretionary incomes decline).

In any case, the market loves the report, and WMT stock is up over 4%, and pushing Dow futures higher.

Full presentation below (pdf link).