Wall Street’s Week Ahead: Nike Inc., StemCells Inc., Petroleo Brasileiro SA Petrobras

Product innovation, restructuring plans, falling oil prices, and debt levels color this week’s earnings reports from Nike Inc. (NYSE: NKE), StemCells Inc. (Nasdaq: STEM), Petroleo Brasileiro SA Petrobras (ADR) (NYSE: PBR). Let’s take a closer look at what analysts are looking for from these companies:

Nike Inc

Nike will release its Q3:16 earnings on Tuesday, March 22 after market close. Analysts are expecting the company to post revenues of $8.9 billion and earnings of $0.49 per share, compared to revenues of $7.46 billion and earnings of $0.45 for the same quarter of last year. These estimates mark narrow growth deceleration, an estimated 9%, compared to double digit growth the past 6 quarters.

For this quarter, analysts will be watching for future orders. While the company guided 20% growth, analysts predict only 13% growth due to FX headwinds. Still, this number reflects healthy future order levels and indicates demand growth. Related, future orders are expected to include Olympic products. Despite rising competition from the likes of Under Armour and Adidas, Nike still has over 60% U.S. market share in athletic footwear.

Although SG&A is expected to grow due to investments in digital commerce and major events including the Super Bowl and NBA All-Star game, management’s cost cutting measures combined with efficient pricing should lead to favorable gross margin for the quarter. Other factors to watch for in this report are online sales growth and focus on innovation.

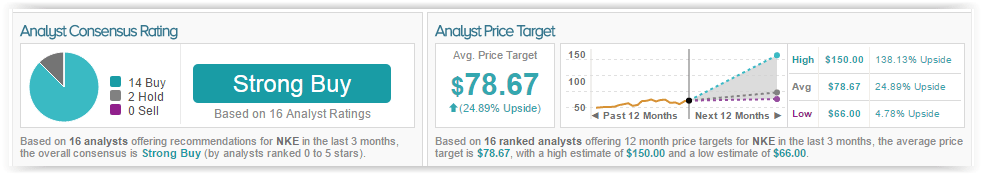

According to TipRanks, out of the 16 analysts who have rated the company in the last 3 months, 14 gave a Buy rating while 2 remain on the sidelines. The average 12-month price target for the stock is $78.67, marking a 25% upside from where shares last closed.

StemCells Inc

StemCells is expected to report Q4:15 earnings on March 15 after market close. For this quarter, analysts are expecting the stem cell-based therapeutic product maker to post revenues of $30,000 and a loss of $(0.06) per share, compared to revenues of $21,000 and a loss of $(0.14) per share for the same quarter of last year. Analysts will be looking for the effects of the company’s restructuring plan, announced in December, which includes the suspension of the company’s Phase 2 Radiant™ study, a treatment of age-related macular degeneration, in order to find a suitable partner for additional funding. Instead, the company is choosing to focus all of its resources on its HuCNS-SC® platform technology to treat chronic spinal cord injury. The shift is expected to reduce $20 million in costs over the next two years. Additional elements of the plan include a 25% cut in the company’s workforce.

Analyst Keay Nakae of Chardan Capital weighed in on the company following the announcement with a Buy rating on December 24, 2016 reducing his price target to $1. He expects this move to negatively impact sales, stating,“We agree that this decision to conserve capital is pragmatic, even at the cost of pushing out the AMD opportunity, as we view the nearer term data from the PATHWAY study, if positive, as more leveragable. Our 12-month price target is reduced to $1.00 to reflect the negative impact of the delay in potential future revenue from AMD.”

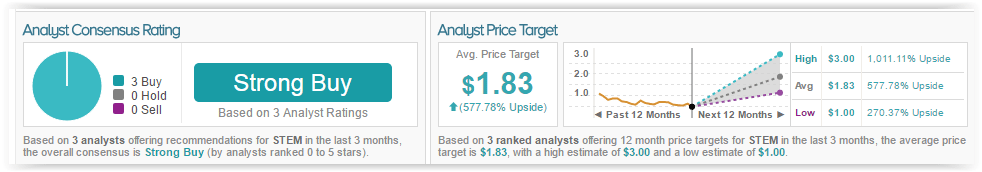

According to TipRanks’ statistics, all 3 analysts who have rated the company in the last 3 months gave a Buy rating. The average 12-month price target for the stock is $1.83, marking a 588% upside from where shares last closed.

Petroleo Brasileiro SA Petrobras (ADR)

Petroleo Brasileiro is expected to release Q4:15 earnings on March 21 after market close. Analysts expect revenues of $25.5 billion and a loss of $(0.06) per share, compared to revenue of $34 billion and earnings of $0.24 for the same quarter of last year. For this quarter, analysts will be mainly focused on the effects of falling crude oil prices, which dipped to below $40 a barrel recently. As a result, analysts are anticipating a weak fourth quarter, further emphasized by falling fundamentals such as its debt-to-capitalization ratio, which was 58% in the third quarter.

In early November, union workers of the company went on strike demanding policy changes and the cease of asset sales as the company has been desperate to generate cash to offset some of its debt, which stands at a whopping $170 billion. Other concerns include limited access to additional debt, currency fluctuations, 2016 capex cut, and corruption scandals.

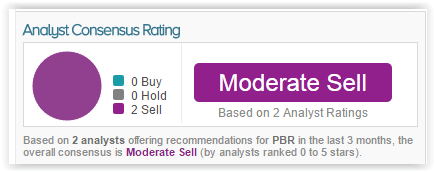

According to TipRanks, both of the analysts who have rated the company in the last 3 months gave a Sell rating and no price target.

Disclaimer: Tip more