Volvo AB Is A Buy Amidst Volvo Electric Car News

Volvo AB (VLVLY) is a manufacturer of trucks, buses, construction equipment and marine and industrial engines. It also develops, manufactures and markets equipment for construction and related industries, including wheel and backhoe loaders, hydraulic wheeled and crawler excavators, articulated and rigid haulers, compactors, pavers, pipe layers, road machinery under the brand names of Volvo, SDLG and Terex Trucks. The Company offers repair and maintenance, lease financing, insurance and financial services. It operates primarily in Europe, North America, South America, Asia, and internationally. Volvo AB is headquartered in Gothenburg, Sweden.

We continue our focus on the auto industry with more big news today from foreign manufacturer VOLVO. While the Trump Administration continues to focus on coal, oil, and other fossil fuels, Volvo made a stunning announcement today. The company has said that all cars produced under the Volvo name will be partially or completely battery-powered by 2019.

Volvo thus becomes the first major auto manufacturers to announced the complete phase-out of conventional internal combustion engines. Volvo CEO Haran Samuelsson told the New York Times that “our customers are asking more and more about electric cars [and noted that while the new strategy posed risks,] a much bigger risk would be to stick with internal combustion engines.”

These vehicles will be made in China, where Volvo owner Geely Holdings is based. They will thus be close to ownership's battery-manufacturing plant. The company expects to then shift some manufacturing of the hybrid and electric vehicles to European and US plants.

This news bolsters the idea that electric cars will soon be a mainstay of the market and follows on the recent revelations that Tesla is now larger than Ford or GM in terms of market cap. It remains to be seen if US companies can/will respond here with viable vehicles of their own. So far, Ford, GM, and Fiat Chrysler all lag the efforts of other major manufacturers across the globe.|

Trump's stated policies--bring back coal, drill baby drill, etc.--do not provide much government support for manufacturers. In addition, low fuel costs and taxes in the US further support the market for larger, inefficient trucks, SUVs, and other vehicles.

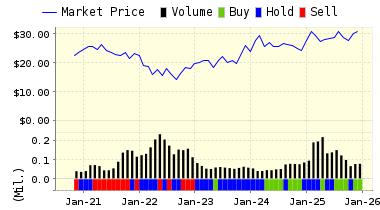

Below is our latest data for Volvo AB (VLVLY):

ValuEngine continues its BUY recommendation on VOLVO AB-B for 2017-07-03. Based on the information we have gathered and our resulting research, we feel that VOLVO AB-B has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Sharpe Ratio and Company Size.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

17.30 | 0.75% |

|

3-Month |

17.03 | -0.83% |

|

6-Month |

17.45 | 1.63% |

|

1-Year |

18.71 | 8.97% |

|

2-Year |

17.35 | 1.07% |

|

3-Year |

16.87 | -1.74% |

|

Valuation & Rankings |

|||

|

Valuation |

n/a |

Valuation Rank(?) |

|

|

1-M Forecast Return |

0.75% |

1-M Forecast Return Rank |

|

|

12-M Return |

71.87% |

Momentum Rank(?) |

|

|

Sharpe Ratio |

1.60 |

Sharpe Ratio Rank(?) |

|

|

5-Y Avg Annual Return |

40.20% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

25.08% |

Volatility Rank(?) |

|

|

Expected EPS Growth |

10.10% |

EPS Growth Rank(?) |

|

|

Market Cap (billions) |

27.87 |

Size Rank |

|

|

Trailing P/E Ratio |

17.34 |

Trailing P/E Rank(?) |

|

|

Forward P/E Ratio |

15.75 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

1.72 |

PEG Ratio Rank |

|

|

Price/Sales |

0.79 |

Price/Sales Rank(?) |

|

|

Market/Book |

3.76 |

Market/Book Rank(?) |

|

|

Beta |

1.29 |

Beta Rank |

|

|

Alpha |

0.38 |

Alpha Rank |

|