Visa: Attractive Growth, But This Dow Stock Is Too Expensive Today

Visa (V) is one of the largest companies in the intersection between technology and finance. The payment technology company operates globally, and it has been creating highly compelling earnings-per-share and dividend growth rates since the company’s IPO a little more than a decade ago.

Since its IPO, Visa has grown into one of the largest financial-services stocks in the world. It is also a member of the Dow Jones Industrial Average, a group of 30 of the largest U.S. businesses.

The growth outlook for the coming years is highly favorable as well, as we expect double-digit earnings-per-share growth, but right now Visa is still not a buy, as shares are trading at a valuation that we deem too expensive.

Visa is a leader in its industry, it has very strong fundamentals, including high returns on capital and a superb balance sheet, which is why its overvaluation is the only major negative we are noting.

We believe that Visa would be a strong buy at our price target around $120. However, Visa’s shares should not be bought at the present level, even though Visa has among the strongest growth outlooks in the Dow Jones Industrial Average.

Business Overview

Visa is a payment technology company that transfers information between consumers, merchants, financial corporations, businesses, and other partners. The company, which operates in more than 200 countries around the globe, is the leader in digital payments through its VisaNet processing network.

Visa’s network enables the authorization, clearing, and settlement of payment transactions. Visa offers additional services such as fraud protection to consumers as well as to business customers, and it offers card products itself as well.

Visa was founded in 1970 but had its IPO in 2008. Thanks to its strong growth rates and market leadership position it commands a large market capitalization of $386 billion. Visa is headquartered in San Francisco, CA.

Since its IPO in 2008 Visa has generated highly attractive returns, and vastly outperformed the market. This was also true for the last five years, during which Visa has generated total returns of more than 200% cumulatively.

Growth Prospects

Visa has delivered very strong earnings-per-share growth rates in the past. Over the last decade, its earnings-per-share rose from $0.73 to $4.61, for an average annual growth rate of 22.7%. This makes Visa one of the fastest-growing Dow Jones members.

Earnings-per-share growth will not be this incredibly high going forward, mainly due to the fact that Visa is now growing from a much higher basis, which makes it a lot harder to maintain 20%+ growth rates. Visa’s earnings growth outlook is nevertheless very strong, and we expect an annual earnings-per-share growth rate in the low teens range.

Visa’s earnings-per-share growth rests on several pillars. One of these is revenue growth, which will be easy to achieve for Visa thanks to industry tailwinds.

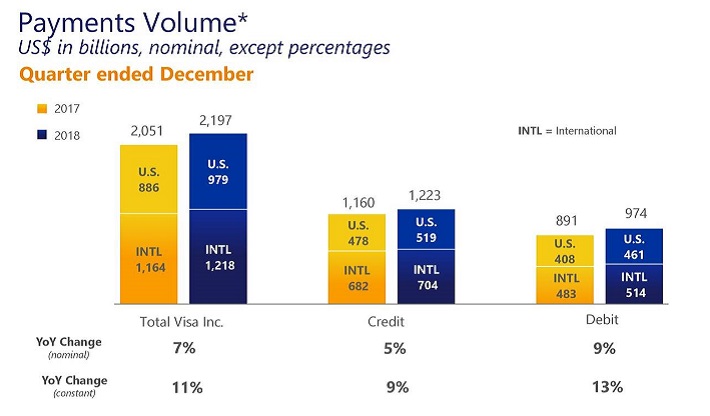

The shift from cash payments to digital payments is a global megatrend, and Visa is one of the key beneficiaries. As societies become more and more cashless, payment volumes on Visa’s network continue to rise at a strong pace:

(Click on image to enlarge)

Source: Visa’s earnings announcement

During the most recent quarter, payment volumes on Visa’s network rose by 7% on a reported basis. Currency rate changes were a headwind during recent quarters, as the USD strengthened versus many other currencies. On a constant currency basis, payment volumes on Visa’s network would have grown at an even better rate of 11%.

We believe that the growth rate of payment volumes will slow down to some degree, but thanks to ongoing growth in both the United States as well as in foreign countries, payment volume growth should still allow for a meaningful revenue growth rate during the coming years.

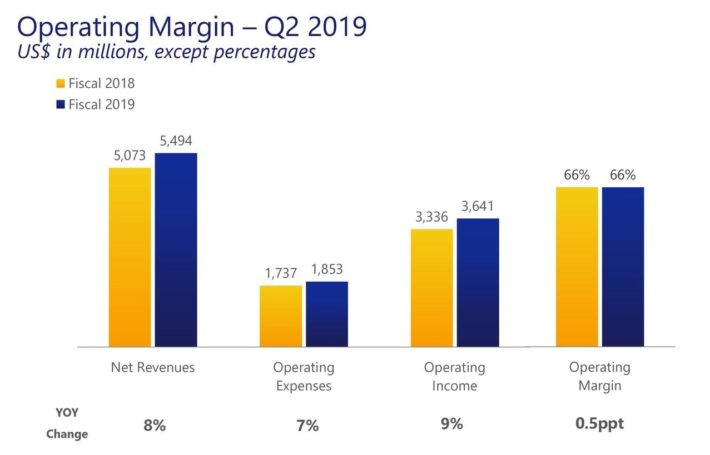

(Click on image to enlarge)

Source: Visa’s earnings announcement

Visa does not have high proportional costs and generates strong margins, which means that each additional dollar in revenues benefits the company’s bottom line to a significant degree. It is thus not surprising to see that Visa’s net profits have been growing a lot faster than its revenues, thanks to operating leverage tailwinds.

During the most recent quarter, for example, Visa’s revenues rose by 7%, whereas net profits grew at twice that rate, at 14%. Going forward, Visa’s net profits should continue to grow at a superior rate compared to Visa’s revenues.

Visa generates significant free cash flows, as there is no need for large capital expenditures. Dividend payments require only a small portion of these cash flows, which is why Visa has ample means to return cash to its owners via share repurchases.

Between 2009 and 2018, Visa’s share count declined from 3.04 billion shares to 2.03 billion shares, for an annual reduction of 4.4%. This has resulted in an additional boost to Visa’s earnings-per-share growth.

We believe that the buyback pace will slow down a bit going forward, but Visa’s earnings-per-share should nevertheless continue to grow at a rate that is faster than Visa’s net profit growth rate, thanks to further declines in the company’s share count.

All in all, we believe that Visa will be able to grow its earnings-per-share by 13% annually through 2024, through revenue growth, operating leverage, and a declining share count.

Recession Performance

As a payment company, Visa is, to some extent, impacted by changes in business and consumer spending. But thanks to the fact that digital payments continue to grow as a percentage of all payments, Visa’s performance during the last financial crisis has not been bad at all.

The company’s profits looked like this during the financial crisis:

- 2008 earnings-per-share of $0.56

- 2009 earnings-per-share of $0.73 (30% increase)

- 2010 earnings-per-share of $0.98 (34% increase)

Note: Due to the fact that Visa was not trading publicly in 2007, there are no profit metrics for that year.

Visa was in its hyper-growth phase back then, and it is not at all guaranteed that the company will not see any headwinds during future recessions, but at least it does not look like Visa will not suffer a lot during future downturns.

Valuation And Expected Total Returns

Visa is an excellent company fundamentally and will continue to generate strong growth rates, but unfortunately, shares are very expensive right now. Based on our forecast for earnings-per-share of $5.32 during the current fiscal year, shares are valued at 33.3 times this year’s net profits right now.

This represents a vast premium relative to how Visa’s shares were valued in the past. Its 10-year average valuation is ~23, which we deem a fair valuation for Visa due to the above-average growth rate. At more than 33 times net profits, shares look substantially overvalued, though.

When we assume that Visa’s shares will trade at 23 times net profits in five years, multiple compression would mean an annual headwind of 7% to Visa’s total returns.

Summing up a 13% earnings-per-share growth rate, a 7% total return headwind from multiple normalizations, and adding Visa’s current dividend yield of 0.6% gets us to forecasted annual total returns of 6%-7% over the coming five years.

This is not bad, but not enough to make us rate the stock a buy right here. We believe that Visa would be an excellent buy at or below our fair value price target of $121, though.

Final Thoughts

Visa has demonstrated very strong growth in the past, and the company should continue to be one of the fastest-growing Dow members. Visa offers strong shareholder returns (mainly through share repurchases) and recession-resilience on top of that.

Everything has its price, however, and Visa is looking too expensive right here. We believe that the company’s shares are a hold right here, whereas buying Visa’s shares at or below our fair value price target should result in highly compelling total returns over the coming five years.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more

The only way $V will ever be 120 dollars again is if it does split like in 2015.

Why do you say that?

I just think that for a major DOW component like $V to drop 35% there would have to be some kind of major fundamental issue, or a severe market correction. Earnings next week could cause a pullback, but I think #Visa will break 200 before EOY.