VET: A 13% Yield Whose Safety Is In The Eye Of The Beholder

Energy stocks are on investors’ radars these days as tensions rise in Iran. So today, we’re looking at an energy producer that we’ve never analyzed before in the Safety Net column.

Vermilion Energy (NYSE: VET) is based in Calgary, but it also has operations in the U.S., the Netherlands, Germany, France, and Australia. The company has paid a monthly dividend for nearly 17 years. It has never cut the dividend and has raised it four times.

Vermilion currently pays a CA$0.23 per share monthly dividend, which comes out to about $0.18 in U.S. dollars. That equates to a 13% annual yield. Impressive. But will that 17-year streak of no cuts remain intact?

It depends on who you ask…

The company reports its cash flow in terms of funds from operations (FFO), which is curious because FFO is usually used by real estate investment trusts (REITs) – not by oil and gas companies.

FFO is a way of looking at cash flow that doesn’t take into account certain items that cash flow does, such as changes in inventory.

You can understand why a REIT may use FFO, as it wouldn’t really have inventory. For a REIT, FFO is a good accounting of the cash that came in the door in a given period.

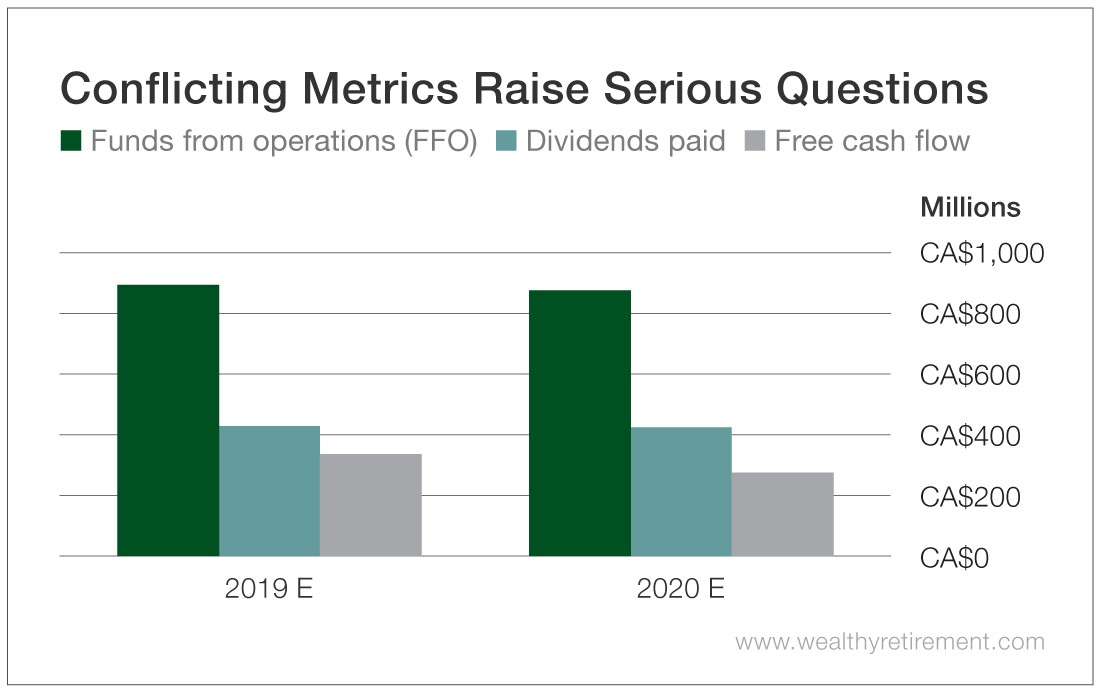

When we look at Vermilion’s FFO, it seems like the company generates plenty of cash to pay the dividend. FFO in 2019 is forecast to be CA$903 million, easily covering the CA$429 million in dividends the company will have paid out in the past year.

But free cash flow tells a different story. Free cash flow, which is the most accurate and conservative accounting of the amount of cash that a company takes in, is projected to be only CA$339 million in 2019. This year, it’s expected to head even lower to CA$277 million. That does not cover the dividend.

So if you look at FFO, which is how the company reports results every quarter, affording the dividend isn’t a problem. But when you consider free cash flow, it is.

(Click on image to enlarge)

(Click on image to enlarge)

When analyzing a company’s dividend safety, I’m conservative, so I’m going with free cash flow on this one. And free cash flow suggests the dividend isn’t safe.

Now, the company does have an excellent dividend-paying history with no cuts, so I’ll give it the benefit of the doubt by not sounding the alarm just yet. But the free cash flow situation does concern me.

If management doesn’t get it straightened out in the next year, a dividend cut could become necessary.

Dividend Safety Rating: D

(Click on image to enlarge)

Disclaimer: Nothing published by Wealthy Retirement should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not ...

more