Veeva Systems - All-Time High

Summary

- 88% technical buy signals.

- 12 new highs and up 20.87% in the last month.

- 36.49% gain in the last year.

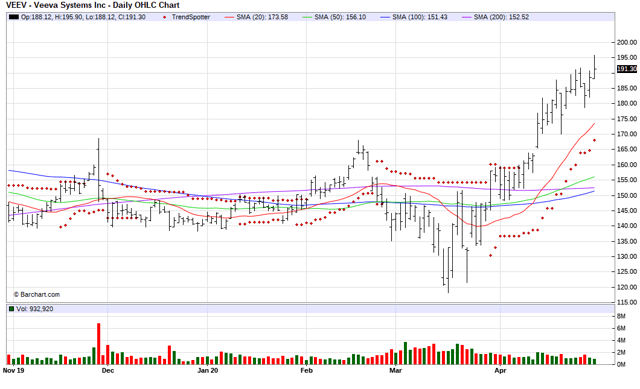

The Barchart Chart of the Day belongs to the life science software company Veeva Systems (VEEV).I found the stock by sorting Barchart's New All-Time High list first by the most frequent number of new highs in the last month, then used the Flipchart feature to review the charts for consistent price appreciation.Since the Trend Spotter signaled a buy on 4/8 the stock gained 18.95%.

Veeva Systems Inc. operates as a provider of industry-specific, cloud-based software solutions for the life sciences industry. It offers enterprise applications, a multichannel platform, customer relationship management, and content management solutions. The Company provides its solutions to pharmaceutical, animal health, and biotechnology companies. Veeva Systems Inc. is headquartered in Pleasanton, California.

(Click on image to enlarge)

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can, therefore, change during the day as the market fluctuates. The indicator numbers shown below, therefore, may not match what you see live on the Barchart.com website when you read this report.

Barchart technical indicators:

- 88% technical buy signals

- 42.06+ Weighted Alpha

- 36.49$ gain in the last year

- TrendSpotter buy signal

- Above its 20, 50 and 100 day moving averages

- 12 new highs and up 20.87% in the last month

- Relative Strength Index 67.15%

- Technical support level at 183.57

- Recently traded at 192.13 with a 50 day moving average of 156.09

Fundamental factors: (These numbers are not accurate as many analysts have not updated their projections yet)

- Market Cap $28.14 billion

- P/E 117.14

- Revenue expected to grow 24.60% this year and another 28.80% next year

- Earnings estimated to increase 12.80% this year, an additional 20.60% next year and compound at an annual rate of 19.46% for the next 5 years

- Wall Street analysts have 9 strong buy, 2 buy and 4 hold recommendations in place on the stock

- The individual investors following the stock on Motley Fool voted 557 to 10 that the stock will beat the market

- 27,594 investors are monitoring the stock on Seeking Alpha

Disclosure: None.